Table of Contents

The CSK has dominated the cricket field with 12 playoff appearances in 14 seasons, 10 finals, and 5 IPL titles. But even off the field, CSK Unlisted Shares has given impressive financial success to its investors, like the Life Insurance Corporation of India (LIC) got 500% from their investment in CSK.

LIC And CSK Shares Story

When IPL began in 2008, CSK was owned by India Cements, a cement-based manufacturing company. But in 2014, the IPL governing council ordered all franchises to operate as separate identities.

This means CSK will have to become a separate identity from India Cements. Back then, LIC held 1.8 crore shares in India Cements. After this separation, LIC got a 6.04% stake in Chennai Super Kings Limited and has held it since then.

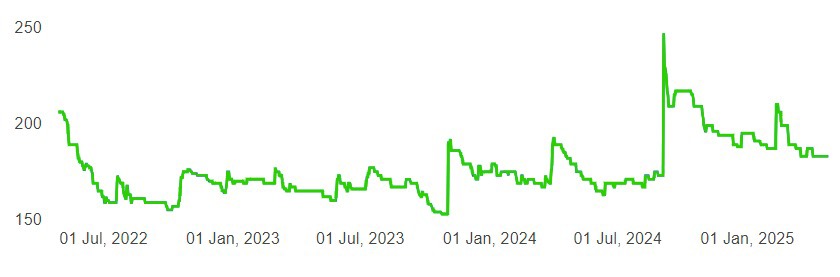

Unexpected Returns from CSK Unlisted Shares

In the last few years, CSK has given a jaw-dropping 529% return to LIC's Investment since 2019, turning the heads of investors globally. In 2019, CSK Unlisted Shares were valued at Rs 31 per share. By 2024, the shares reached around 190-195 per share, peaking at Rs 235 on September 24. The 529 % return (from Rs 31 to Rs 195), turned LIC Investment into a 6x Investment value of Rs 1,000 crores in 5 years.

Growth Drivers Behind CSK Shares Price Growth

Some of the key drivers which influence CSK's growth were:

A) 2x Revenue Growth in FY 23-24

The central pool of revenue (broadcasting rights and sponsorships) jumped by 150 % YoY to Rs 479 crore. Profit After Tax (PAT) grew by almost 15x in just 1 year from 12.8 crores to Rs 201 crores in a single year.

B) Broadcasting Deals Growth

In 2023, the sale of IPL rights was the defining moment for investors in how teams associated with the PL, including CSK. The IPL sold its media rights for the next 4 seasons for US$6.4 billion to Viacom18 and Star Sports, meaning each IPL match was valued at $13.4 million, thus injecting a lot of inflow.

C) Brand Loyalty

CSK has one of the most loyal fan bases. Although the Dhoni factor reduced in the latest IPL 2025, his presence has still given a lot of sponsorships and limelight to CSK. Leading to a revenue boost through sponsorships with giants like Muthoot Group.

Should You Buy CSK Unlisted Shares?

With current financial growth, share price trends, and a 500% investor return, CSK looks like a promising investment any investor will dare to miss. However, investors need to research and weigh all the risk and return factors of a company before investing.

If you plan to buycsk share, Stockify, the online brokerage platform, is an ideal place to buy and sell unlisted shares. Our team of experts can provide you with relevant information about stocks like EBITDA, EPS growth, revenue reports, etc.

Apart from CSK unlisted shares, Stockify also has a list oftop pre-IPO companies in Indiafor investors to choose from and earn high ROI by investing in unlisted shares. We will guide you throughout the trading process to make an easy deal for you.

Join ourWhatsAppgroup for regular updates on trending unlisted shares.