Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

Dentex India Limited is a rapidly growing player in the Indian food and beverage industry, known for its premium fine-dining restaurants. The company owns and operates multiple high-end dining establishments, including Eve Worli, Eve Powai, Que Sera Sera, and Tat. These restaurants focus on delivering exquisite dining experiences, offering gourmet menus crafted by renowned chefs, and catering to an elite clientele ranging from High-Net-Worth Individuals (HNIs) to Millennials and Gen Z consumers.

The Indian restaurant industry is on a strong growth trajectory, with the market projected to grow at a CAGR of 11.7%, reaching $59 billion by 2029. Dentex India is strategically expanding its footprint by opening new outlets, reinforcing its position in the premium dining segment. Let's dive into understanding its business model and financials.

Business Model Of Dentex India

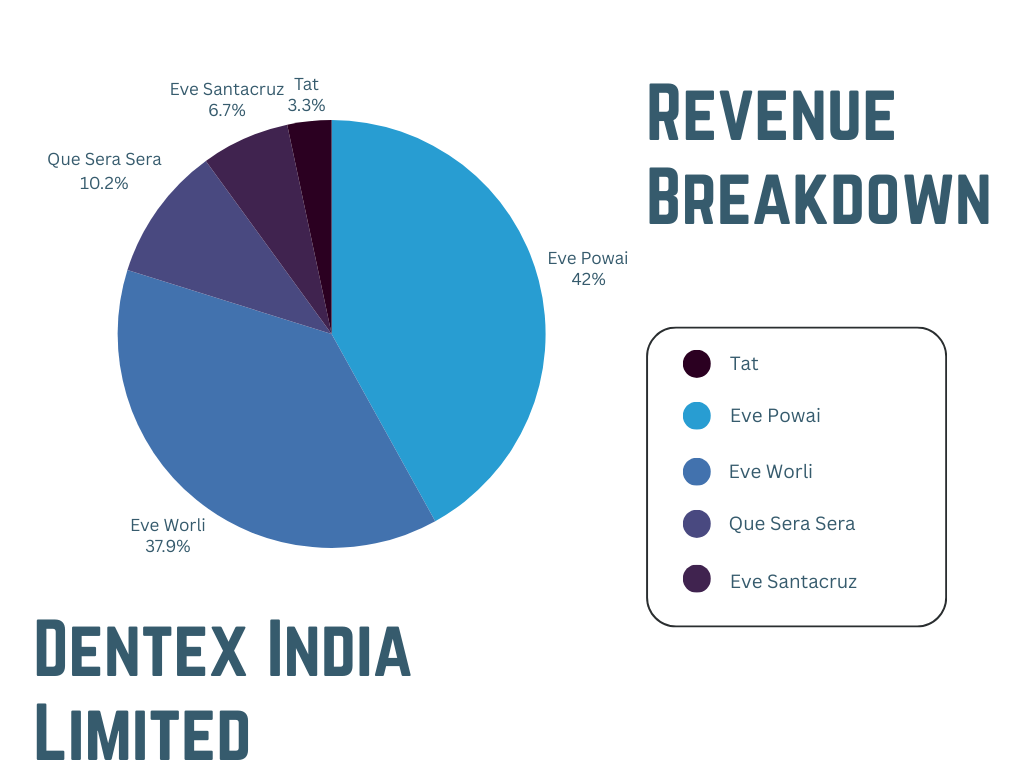

Dentex India's business model revolves around dine-in sales, which form the primary source of revenue. The company's revenue streams are broken down as follows:

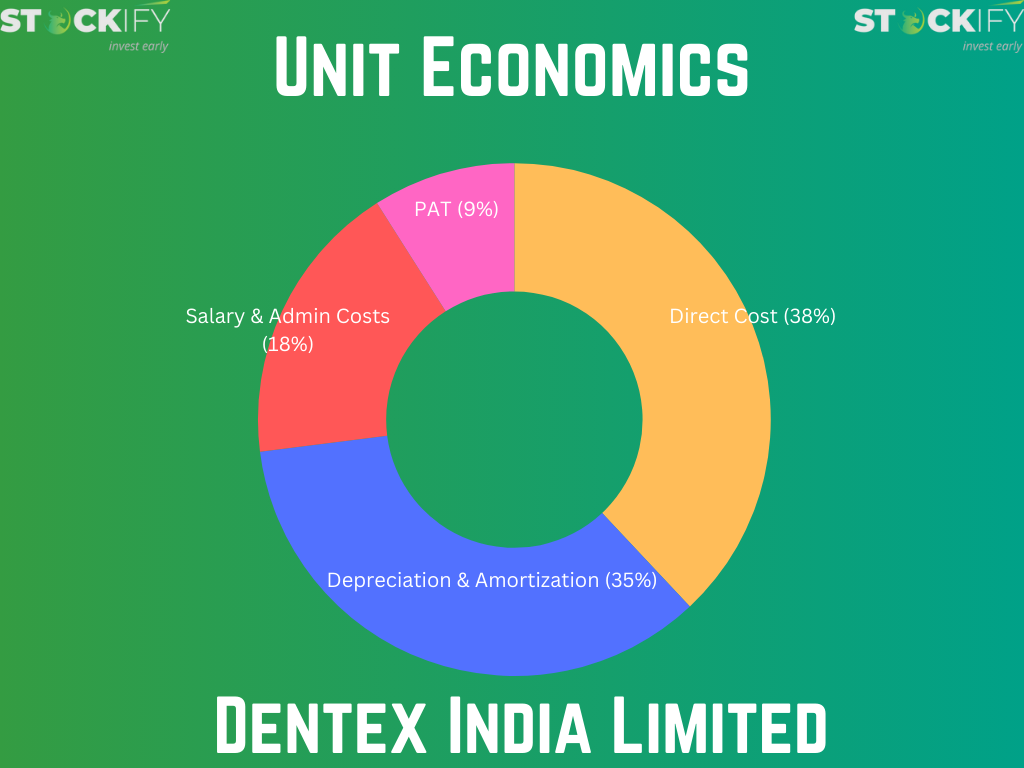

The company’s cost structure is categorized as follows:

Dentex India Valuation

The company is currently valued at ₹200 crores and is planning to dilute 10% of its equity in a pre-IPO round. The funds raised are to be allocated as follows:

- Restaurant Construction: ₹1.35 crores

- Restaurant Capital Expenditure: ₹0.9 crores

- Security Deposits & Brokerage: ₹0.36 crores

- Marketing: ₹0.15 crores

- Miscellaneous: ₹0.15 crores

- Inventory & Operations: ₹0.09 crores

Dentex Financial Analysis

| Particulars | FY 2023 (In Rs crores) | FY 2024 (In Rs crores) | FY 2025 Projected (In Rs crores) |

| Total Income | Rs 9.76 cr | Rs 21.76 cr | Rs 45.8 cr |

| Operating Expenses | Rs 8.38 cr | Rs 18.84 cr | Rs 32.52 cr |

| EBITDA | Rs 1.38 cr | Rs 2.92 cr | Rs 13.28 cr |

| Depreciation & Amortisation | Rs 0.28 cr | Rs 1.10 cr | Rs 2.31 cr |

| EBIT | Rs 1.11 cr | Rs 1.82 cr | Rs 10.97 cr |

| EBT (Earnings Before Tax) | Rs 1.06 cr | Rs 1.73 cr | Rs 10.77 cr |

| PAT (Profit After Tax) | Rs 0.80 cr | Rs 1.30 cr | Rs 8.08 cr |

- Revenue Growth: The company’s revenue of has grown from Rs 9.76 cr in FY 2023 to Rs 21.54 cr in FY 2024, demonstrating strong growth.

- Profitability: EBITDA margin has significantly improved, indicating operational efficiency.

- Expansion Strategy: Investments in new restaurant openings are expected to further drive revenue growth.

Future Outlook

The future of Dentex India looks promising, given its strategic expansion and the overall growth in India’s restaurant sector. The key growth drivers include:

- Industry Growth: The Indian restaurant market is expected to reach $59 billion by 2029.

- Premium Dining Demand: A rising affluent class and urbanization trends are fueling demand for high-end dining experiences.

- First-Mover Advantage: Dentex is capturing market share in an underserved premium dining segment.

- Diversified Cuisine Portfolio: The company’s focus on European, Asian, and regional Indian cuisines appeals to a broad consumer base.