Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

In recent months, we have seen a sudden upsurge in the share price & valuations of significant unlisted companies. While the hype exists, investors must stay cautious as many companies can be overpriced.

Let's have a look at some key players:

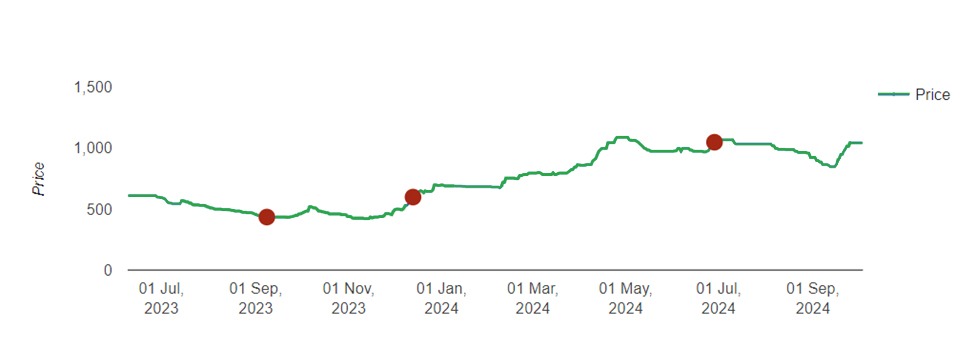

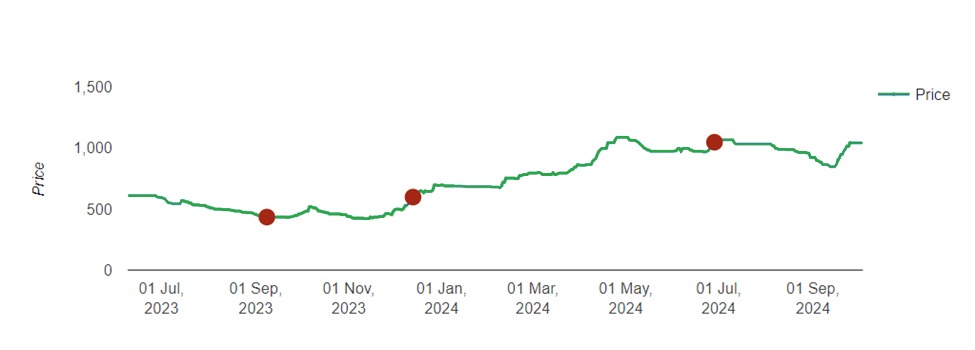

1. Tata Capital

- The tata capital share price rose by 120% in the last 1 year, from Rs 500 per share in 2023 to Rs 1,100 per share in 2024.

- Currently, Tata Capital Trading is around Rs 1075 per share.

- Generally, stocks trade around a P/B Ratio of 5x, Tata Capital has a P/B Ratio of 20.9 indicating a potential overvaluation.

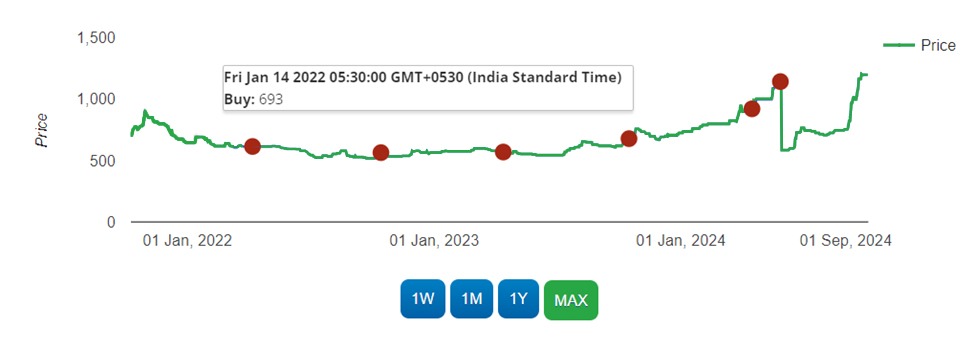

2. Hexaware Technologies

- The global digital and technology services company has filed its DRHP & planning to launch an IPO.

- The stock price currently trades around Rs 1100 per share with a P/E Ratio of 125.

- This starkly contrasts an average IT Sector P/E ratio of 25-35, making the current share price potentially overvalued.

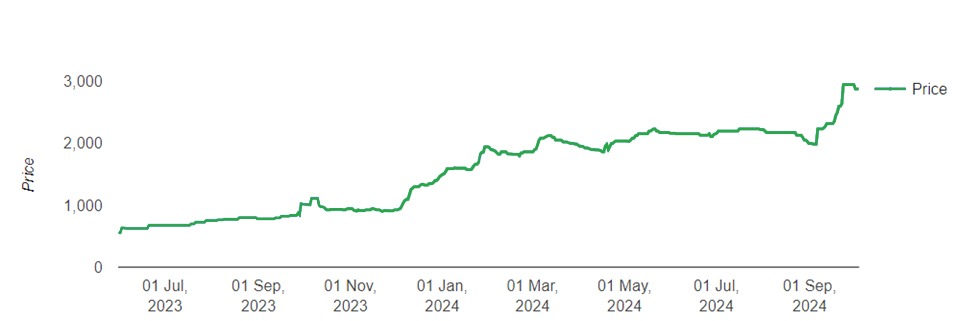

3. Waaree Energies

- Valuation wise Waaree has given a decent growth.

- But the current share price moving between Rs 2800-3000 per share.While the PE is 62. The P/B Ratio is 19 times.

- The solar industry is in a growth phase with low penetration of new players & government support for renewable resource initiatives.

- With a valuation of Rs 78600 crore and Profit to-sales ratio of 7 times, the hype around the solar industry is good, but investors need to be cautious.

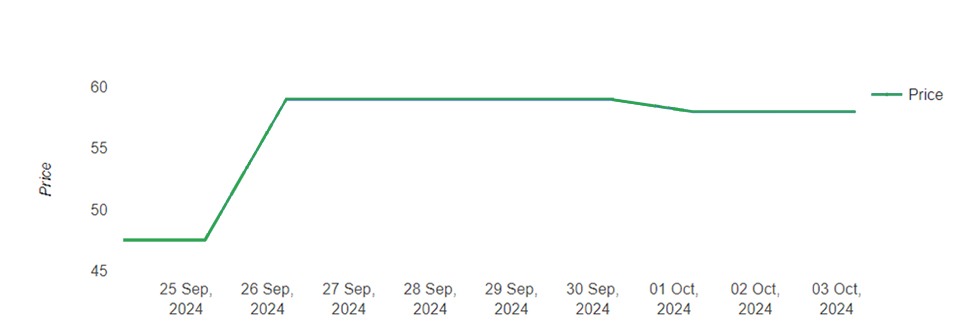

4. Oyo

- After raising money at a 76% valuation cut, oyo has expanded its operations in the Middle East, Europe & US.

- Oyo raised money at Rs 30 per share but currently trades around Rs 60.Per share

- While the company aims for a profit of Rs 750 crore, the valuation comes to around Rs 39000 crore.

5. CIAL

- CIAL gave a 1:4 right issue in Jan 2023 priced at Rs 50 per share.

- Since then the stock price has grown from Rs 200 per share to now Rs 465 per share.

- The PE is standing at almost 49 times with a market valuation of with a market cap of Rs 22,257 crore

- CIAL share looks fully priced at this moment.

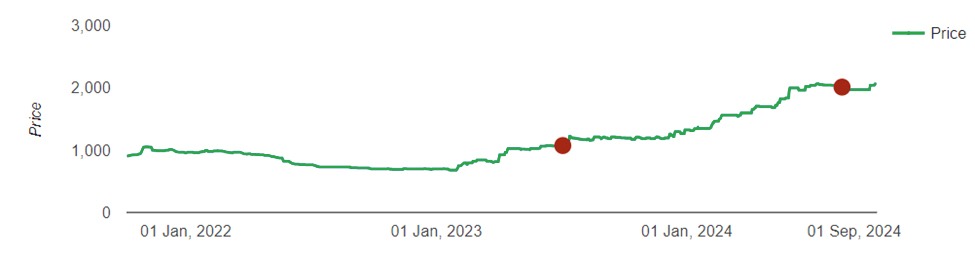

6. Hero Fincorp

- Hero's financial segment is currently trading at around Rs 2200 per share, with a P/B Ratio of Rs 4.8. The company filed papers to raise Rs 3368 crore this year.

- The normal P/B ratio in the NBFC Sector goes around 1-1.5.

- Therefore the company has a 3X premium, which can be overpriced.

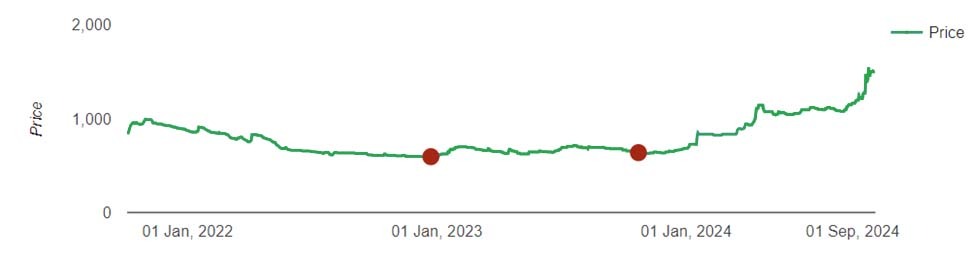

7. HDB Financial

- The current price of HDB is in the range of Rs 1490 - Rs 1545, which is an all-time high for the company.

- With the current market cap of Rs 1,21,214 crore. The IPO estimation has been a lower range of Rs 800.

- Thus HDB can be overvalued at the moment.

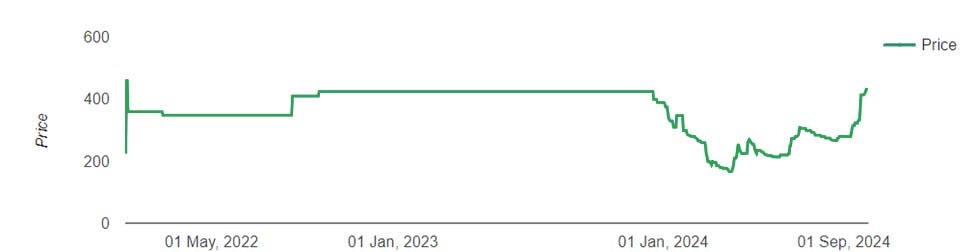

8. Vikram Solar

- On June 24, Vikram Solar issued shares through a private placement for Rs 122 per share.

- Then the market cap was Rs 3,700 crore. Currently, the share is trading at Rs 446 with a market cap of 11,005 crore.

- With no major development & expected profit of Rs 250 crore, the P/E Ratio stands at 138.1 which seems abnormally high for unlisted shares.

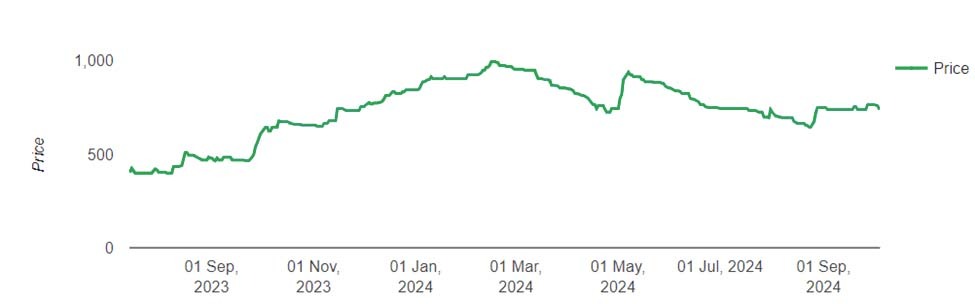

9. Polymatech

- For semiconductor industries globally, the general P/B ratio ranges between 1.5-4x. For Polymatech the P/B ratio is hovering around 17.5x.

- The share grew from Rs 425 on July 23 to now trading at Rs 777 which is almost 2X growth.

- SEBI rejected its IPO on March 24. While the company is saying to bring the IPO back, we need to be cautious while investing.

- The share seems to be already trading around its maximum price.

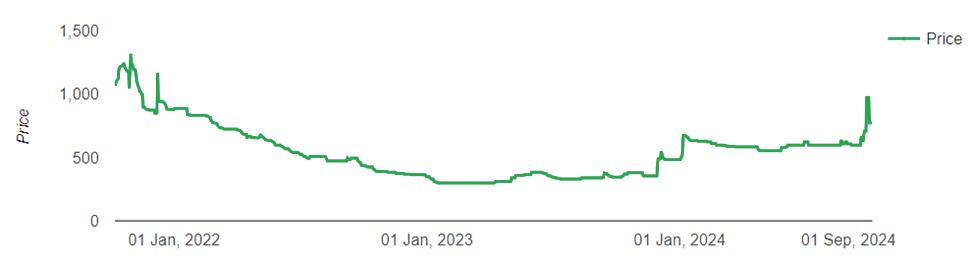

10. Mobikwik

- A typical P/E ratio of 20-30x is considered a fair value range.

- Mobikwik’s P/E ratio is 311.6. This is unexpected with a 2023 loss of Rs 83.4 crores and a 2024 profit of Rs 14.8 crore.

- The current share price of Rs 761 seems high.

In A Nutshell

In today's dynamic market, thorough research is more critical than ever. Whether listed or unlisted shares, it's crucial to carefully assess each opportunity, especially when valuations seem optimistic.

Smart investing requires a balanced approach - identifying potential while managing risk. We encourage you to gather and analyze all available information before making decisions.

Connect with our experts to know more.