Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

Hero Fincorp, the financial arm of Hero Motors, is preparing to launch its IPO. The NBFC has filed a DRHP (Draft Red Herring Prospectus) with SEBI. The Hero Group is well in the motor services market, and Hero Fincorp has built its position in the financial services market.

Let’s explore various aspects of the Hero Fincorp IPO from an investor’s point of view.

About The Company

Incorporated in 1991, Hero Fincorp is the financial arm of Hero Motor Corp. It offers leasing, financing, bill discounting, and related services. The NBFC is involved in commercial lending and consumer finance.

Here are some types of loan Hero Fincorp offers:

Home Loan.

Loyalty Loan.

Personal Loan.

Business Loan.

Used Car Loan.

Two-Wheeler Loan.

Loan Against Property.

To know more about their products, check out their website.

Objective Of Raising Hero Fincorp IPO

Expansion through Capital—Hero Fincorp aims to strategically expand its business by addressing the significant credit gap within the rapidly growing Aspiring India and MSME customer segments.

Diversifying the loan portfolio: To lower their cost of funds, they seek to reduce their dependence on relatively expensive term loans from banks and financial institutions.

Leverage technology for operations—They intend to further enhance technology and AI integration across all our business operations to support our growth, optimise operating expenses, and provide an enhanced customer experience.

Strategic expansion of distribution network- To further increase our market penetration across our existing two-wheeler distribution network, focusing on customers with better credit scores and customers that showcase a higher potential for future cross-sell opportunities.

Details About Hero Fincorp IPO

IPO Size: Hero Fincorp aims to raise Rs 3,668 crore. This includes Rs 2,100 crore for the issue of new shares and Rs 1,568 crore as an offer for sale.

Price Band: Expected to be announced near the IPO date.

Lead Managers: JM Financial Ltd, BofA Securities India Ltd, HSBC Securities and Capital Markets (India) Private Ltd, ICICI Securities Ltd, Jefferies India Private Ltd, and SBI Capital Markets Ltd.

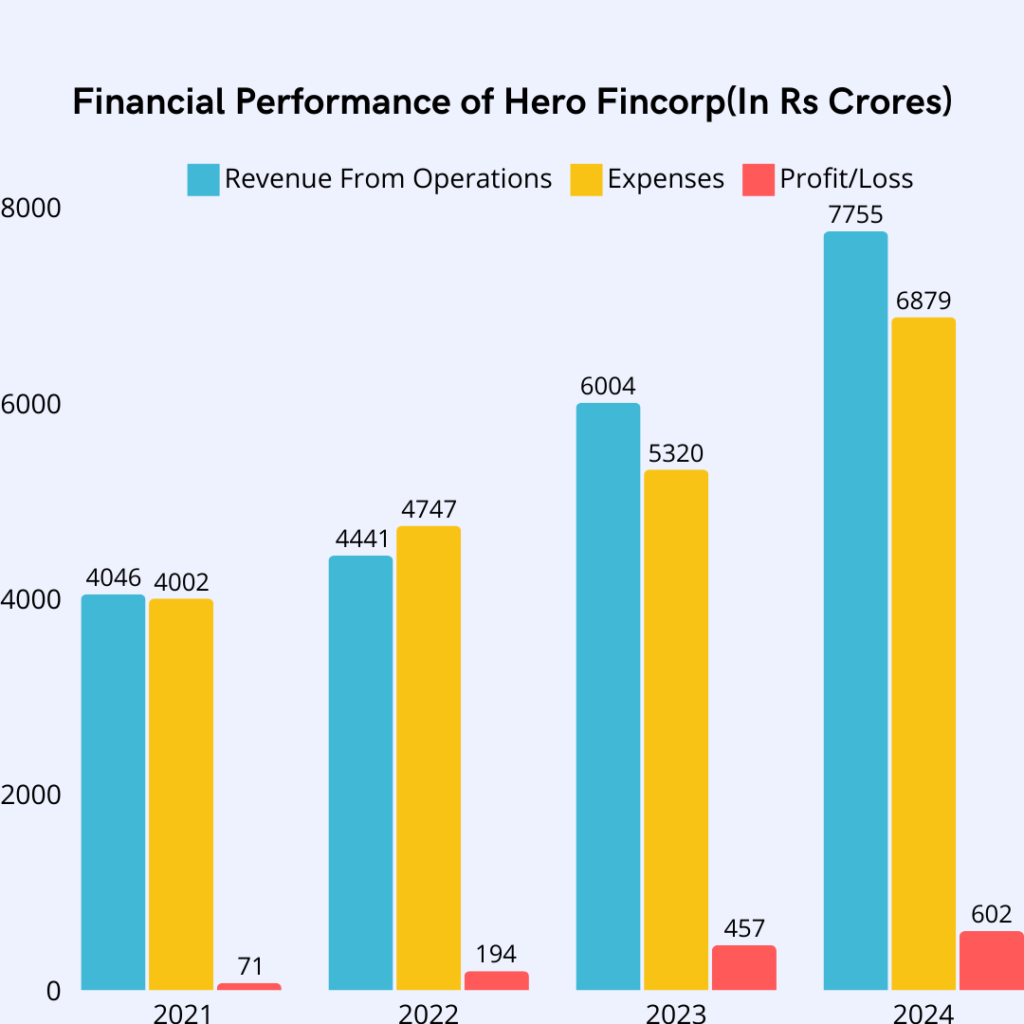

Hero Fincorp Financial Performance

Key Financial Highlights

The interest income for FY 24 was Rs 6,977.3 crore, which is a 23% increase from the previous year’s interest income of Rs 5,663.69 crore.

The Profit After Tax (PAT) has grown by 24% from Rs 457.3 crore in FY23 to Rs 601.92 crore in FY24, indicating significant profitable growth in operations for Hero Fincorp.

Their basic EPS has also grown at the same rate of 24% from Rs 35.92 per share in FY 23 to Rs 47.28 per share in FY 24.

The loan book of Hero Fincorp grew by 19.34% from Rs 36,213 crore in FY 23 to Rs 44,929 crore in FY 24.

Risk Factors

1. High Dependence on Promoters- They source 99% of our two-wheeler loans from our promoter, Hero MotoCorp Limited’s two-wheeler dealership. Any decline in demand for Hero two-wheelers may adversely affect us;

2. Stage 3 Loans Provisioning – These loans amounted to 4.02%, 5.11%, and 7.54% of total gross loans as of March 31, 2024, 2023, and 2022, respectively. Non-payment or default by our customers and our inability to provide any adequate provisioning coverage may adversely affect our business.

3. New Credit Risk- The Company’s retail business depends on new-to-credit borrowers. We may not be able to properly assess the credit of new-to-credit borrowers, and loans extended to such new-to-credit borrowers may have a higher risk of non-performance or default.

4. Reduced Retail Demand – Retail finance, comprising vehicle loans, personal loans, and mortgage loans, and MSME finance constitute around 80% of assets under management. Any adverse event can reduce demand for our loans amongst retail and MSME customers.

5. Regulatory issues- Certain promoters have been and are currently subject to certain regulatory proceedings initiated by authorities. Any adverse outcome in such proceedings may lead to reputational risks.

6. Interest Rate Changes – Changes in interest rates may affect our treasury operations, causing our net interest income to decline.

Is it possible to get Hero Fin Corp pre-IPO shares?

Hero Fincorp Ltd is not a listed company; however, it is actively traded in the unlisted share market. With the increased operations and credit quality, investors have a gainful opportunity to invest in the current Hero Fincorp share price before its IPO.

Trading in unlisted shares can be tricky due to a lack of information. At Stockify we give investors insights about top trending pre-IPO shares and help them trade in such unlisted shares. Increase shareholder wealth by identifying the right companies at the right time.

Connect here to learn more.