Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

The Indian Energy Exchange Ltd (IEX) shares have crashed 26% in a day after the Central Electricity Regulatory Commission (CERC) approved the implementation of market coupling in electric power trading from January 26. This news has sent shockwaves among the shareholders due to the potential end of the long pricing domination by IEX. But other players like PXIL can gain from this update.

Let's understand what was happening and how this move can impact the power trading industry.

A) Current Landscape of Power Exchange Platforms In India

There are 3 major power exchanges in India, namely:-

1. Indian Energy Exchange Ltd (IEX)

2. Power Exchange Limited (PXIL)

3. Hindustan Power Exchange(HPX)

IEX has been dominating this space since 2008, with more than 85% share, as the platform has been a primary price setter for the electricity market. IEX follows a profit-driven model, operating as a continuous trading exchange where buyers and sellers are automatically matched based on market dynamics.

The other major player, PXIL, which has less than 10% market share, is more institutionally backed and focuses on an auction-based model, resulting in lower liquidity.

B) Market Coupling A Level Playing Field, IEX Can Lose Dominance

After the CERC's implementation of Marketing Coupling, all three exchanges will need to submit their buy/sell orders to a common market coupler, which will then determine a uniform market clearing price for the day.

1. Here Is The Big Change

IEX was the primary price setter in the market. With Market Coupling, the prices will be decided centrally and not by IEX. Thus, IEX will become a pass-through platform and not a price maker, losing its moat of liquidity and price discovery.

Now, Electric Power Buyers/Sellers can trade through any exchange, since the prices on all exchanges will be the same.

2. Impact On IEX

IEX charges higher transaction fees than PXIL/HPX. Without a pricing advantage, people may shift from IEX to cheaper platforms. This will squeeze IEX's margins and slow its profit growth.

This change will have a negative effect on IEX's valuation as the exchange already trades at a PE due to its market domination. Directly reflected in the share price falling, affecting shareholder expectations.

C) PXIL The Unexpected Beneficiary

As the power price market becomes a level playing field, this can be a huge win for PXIL due to the following factors:

1. End of Pricing Disadvantage

Earlier, low liquidity led to worse prices, running traders away.

Now, PXIL can offer the same prices as IEX to buyers/sellers.

All previous pricing barriers are levelled now.

2. PXIL read to compete on its strengths

PXIL offers lower fees than IEX.

With a level playing field, PXIL can play on cost to attract more deals.

PXIL will need to level up in their UI/UX for a better trade experience.

3. Huge Potential for growth volume

Now, traders and brokers have less incentive to stay with IEX

Even if PXIL attracts just 5-10% market share, it will still be a huge revenue leap.

PXIL currently trades in the unlisted market, this update can generate a lot of strategic investments.

D) Potential Impact On PXIL Share Price?

If PXIL executes well during this phase, the exchange can rapidly increase its market share, revenue and give an outsized return to investors backing it.

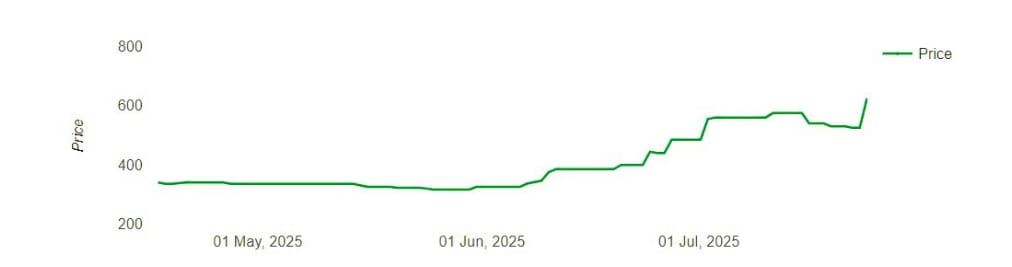

The share price has almost doubled in the last two months, from trading at Rs 325 in May 25 to Rs 610 in July 25. With this update, the PXIL share price has the potential to go up in the next few weeks. You can also buy Power Exchange India Unlisted Shares online for great returns on your investment.