Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

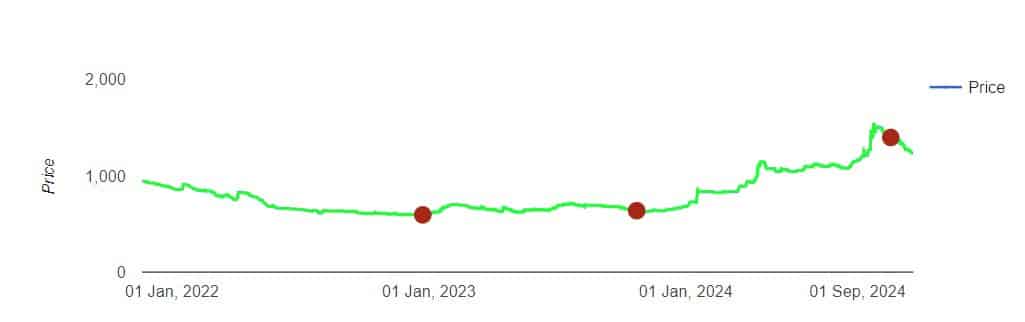

HDB shares have remained one of the most actively traded stocks in the unlisted share market. After the IPO was announced, the HDB unlisted share price suddenly surged to Rs 1400 per share. It is currently trading at Rs 1,250 a piece.

While the prices have stabilized, HDB Shares have generated continued investor interest.

HDFC Following RBI’s IPO Mandate

HDFC’s decision to list HDB came after the Reserve Bank of India (RBI)’s 2022 mandate requiring all upper-layer Non-Banking Finance Companies(NBFCs) to list on the stock exchange in 3 years.

Although HDB will be listing for its IPO, the financial services company will remain an HDFC subsidiary and ensure all legal compliances.

HDB IPO Plan

The financial arm of HDFC plans to raise Rs 12,500 from the primary market. Out of these Rs 10,000 crore will be sold by the current shareholders and Rs 2,500 crore will be raised fresh from the market.

This raise will be used for strengthening the Tier 1 Capital Base, thus supporting future needs. HDB may soon file its Draft Red Herring Prospectus (DRHP).

Is HDB Valuation justified?

If we look at the above graph, hdb share price was trading around Rs 800-900 in 2024 1st quarter. Within a 7-month span, the share price almost doubled reaching Rs 1400 per share in Oct 24.

This jumped the Price To Earning (P/E) Ratio to around 46X, while the average P/E in this industry is 25X. Thus HDB shares can be overvalued.

HDB’s FY 23-24 Financial Performance

A) Revenue of HDB

The NBFC earns majorly through the interest earned from loans given and other income. In FY24 the NBFC earned 11,157 crores through interest income, a significant increase of 25% from Rs 8,928 crore the previous year.

B) Profit After Tax

Despite fluctuations in other income, HDB’s overall profitability still increased by 25.6 % as the PAT soared to Rs 2,461 crores in FY24 as compared to Rs 1,959 crores in the previous years. The Net Profit Margin also increased by 15.8% to 17.36%.

C) Loan Disbursement

TheLoan Book of HDB Financial Serviceshad a significant annual growth of 30.63%, with respect to the loans given by HDB as the FY 23 & FY 24 loan book increased from Rs 66,382.7 crore to Rs 86721.3 crore.

This suggests an assertive growth in the lending operations of HDB Financial Services and a potential upward demand for their products and services.

D) Earnings Per Share

The EPSshowed a significant growth from Rs 24.78 in FY 23 to Rs 31.08 per share in FY 24, an approximate 25% increase. This indicates a growth in shareholder wealth and also impacts thehdb share price.

E) Gross Non-Performing Assets

The Gross NPAhas improved significantly in the last 3 years.

| Year | Gross NPA % |

| Mar-21 | 4.99% |

| Mar-22 | 2.73% |

| Mar-23 | 1.90% |

On March 22, the gross NPA reached 4.99% which caused concern among investors as the asset quality was deteriorating. On March 23, the asset quality improved to 2.73%. By the end of FY 23-24, the Gross NPA reduced to 1.9%.

To know more about HDB Unlisted Shares visit our Share Page. At Stockify, we help our clients uncover the best unlisted shares and increase their wealth with our in-depth research and insights. Our platform serves all your unlisted share needs with the best offerings.

Connectwith our experts to know more and gain more.