Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

The National Stock Exchange(NSE), India’s largest stock exchange saw an increase in market valuation by Rs 85,000 crore to Rs 3.21 trillion. This was after declaring a 4:1 Bonus issue and 90 Rs per share dividend in the first week of May 24, causing a 30% jump in nse stock price .

This distribution of profits came after NSE's outstanding quarterly and annual results. Let’s compare NSE’s yearly performance for FY 23-24 and price journey comparison with its competitors like BSE.

(I)FY 23 vs FY 24 Performance analysis.

- Basis 1: Revenue Growth: In FY 23, NSE reported a consolidated revenue of Rs.12,765.36 cr. which grew to Rs Rs.16,433.61cr. in FY 24 i.e. a 28 % increase.

- Basis 2:Profit After Tax: PAT increased by 12.06% Year on Year to Rs 7501.88 cr. in FY 24 from Rs 8406.48 cr. in FY 23.

- Basis 3: Expenses: The consolidated total expenses increased for FY 24 to Rs 5350 cr. We can see the same pattern for standalone total expense which is Rs 6139 cr. for FY 24. A major reason for this increase was due to SEBI-mandated contributions to Core SGF.

- Basis 4:Earning Per Share: The Consolidated EPS saw a 30% growth from Rs 129 per share in FY 23 to Rs 167 per share in FY 24.

| Consolidated P&L Figures | FY24 | FY23 |

| Revenue from Operations | 14,780 | 11,856 |

| Employee Benefit Expenses | 460 | 366 |

| Other Expenses | 2,709 | 1,859 |

| EBITDA(Operating Profit) | 11,611 | 9,631 |

| Operating Profit Margin % | 79 | 81 |

| Other Income | 1,654 | 909 |

| Depreciation and Amortisation | 440 | 384 |

| Profit Before Tax(PBT) | 11,184 | 10,042 |

| Tax | 2,778 | 2,540 |

| Profit After Tax(PAT) | 8,406 | 7,502 |

| EPS(From Continued operations) | 169.83 | 151.55 |

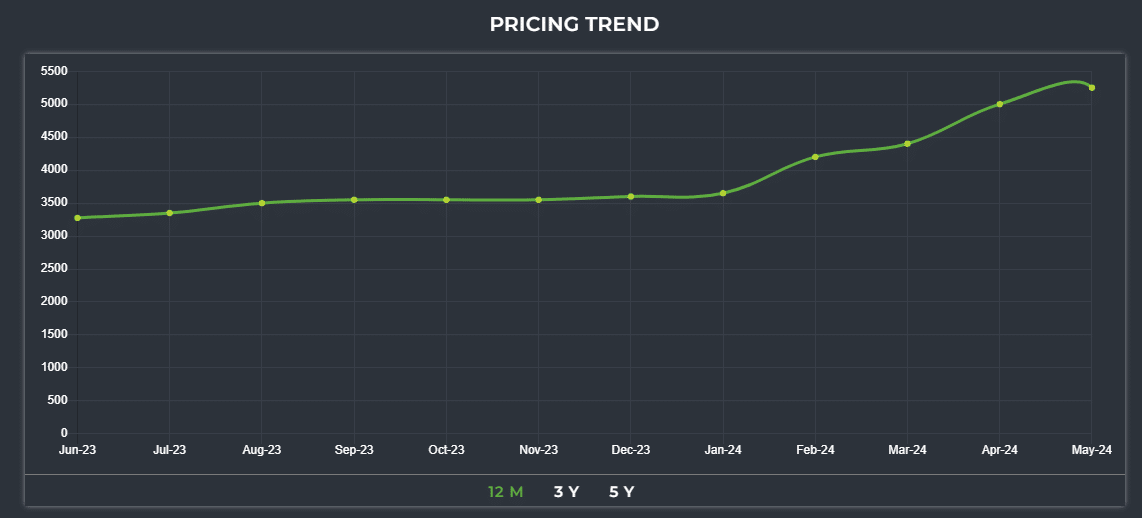

(II)Share Price Movement in the last 1 year.

The NSE unlisted share has skyrocketed in its share price in the last year. On June 23 the NSE Share price was floating around Rs 3200 per share, which increased to 3600 by Dec 23. On Feb 24, the price touched 4200 and by the end of FY24, the share price reached Rs 4800 per share. This is a whopping 33% increase in a single year.

Source: www.stockify.net.in

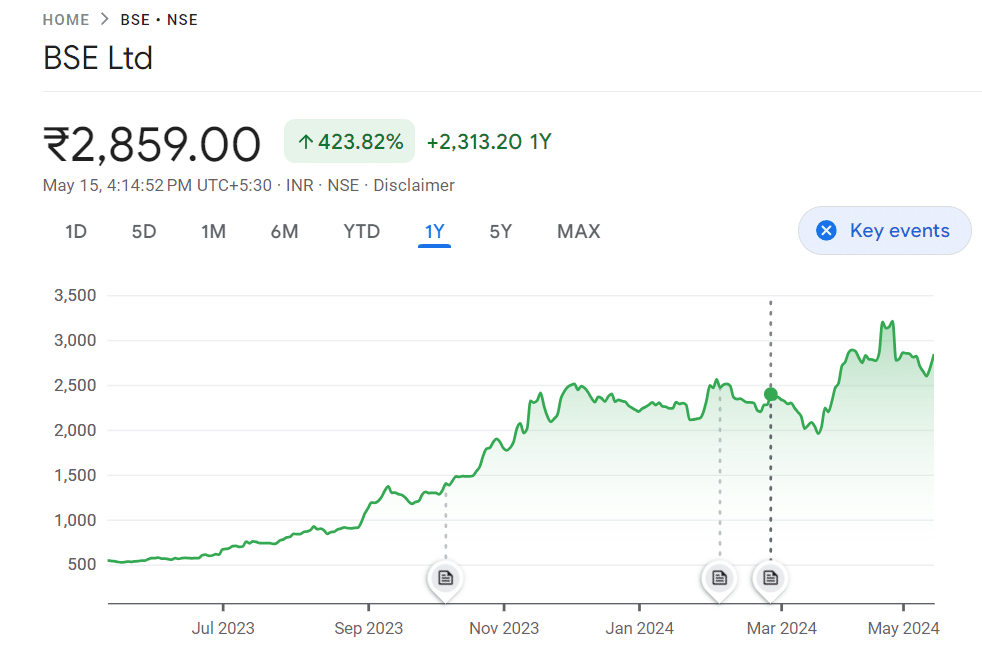

(III)ROI comparison with BSE

Source: Google

The BSE share price has surged significantly in the last 1 year. It grew from Rs 431 per share on 31st March 23 to Rs 2,709 per share on 31st March 24. This upsurge was due to the introduction of Future and Options (F&O), which impacted BSE’s income significantly. This led to a positive market sentiment led by more revenue and profit growth.

The initial clearing costs were high but we can expect scalability and economies of scale. This will reduce the expenses with time and increase the profit margins.

(IV) NSE’s operating cash flow jumped more than 15X

In FY24, the operating cash flow of NSE ended up at Rs. 29,744 crores as compared to Rs 1,734 crore in FY 23. This is a more than 15X jump from the changes in the operating assets and liabilities affecting the overall operating cash flow.

Cash outflow from investing activity has increased from Rs 3217 crore to Rs 8336 crore in FY 23 & 24 respectively. The financing activity cash flow has also increased from Rs 2100 crore to Rs 3993 crore in both years.

| Cash Flow | (In Rs Crores) | |

| FY 24 | FY 23 | |

| Net Cash Inflow from Operating Activities | 29,744.30 | 1,734.49 |

| Net cash outflow from investing activities | -8,336.31 | -3,217.04 |

| Net cash outflow from financing activities | -3,993.69 | -2,099.98 |

| Net Cash Flow | 17,414.30 | -3,582.53 |

(V) How to buy NSE unlisted shares?

One of the most actively traded stocks in the unlisted share market. After declaring a 4:1 bonus issue, theNSE Share price jumped from Rs 6000-6500 per share. You can buy NSE through Stockify. We are India’s one of the most trusted trading platforms for unlisted shares. With over 1000+ satisfied clients, we ensure to give our users the right information at the right time, reducing their barrier to trading in unlisted shares and gaining from their investments.

Connect with our expert team to know more.