Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

Studds Accessories Ltd has come a long way, from making their first helmet in a garage in 1973 to establishing the largest helmet manufacturing unit in Asia. It has become the largest two-wheeler helmet manufacturer in the world. Studds Accessories Ltd, however, shows no intention to limit its success to here and is constantly investing in significant expansion to other bike apparel and accessories segments.

Let us take a closer look at the forecasts on the Indian ride gear market for 2023. The success and the possible outcome of bullish moves on new large-scale investments in the bike apparel and accessories segment will be evident after a good understanding of it.

Ride Gear Market To Grow At Estimated CAGR Of 6.84%

The use of riding gear in the world is increasing faster, propelled by public awareness of safety. The riding gears limit injuries and avoid significant damage to body tissue by reducing abrasion and acting as armour at crucial spots. The boots in gear increase the rider’s stability and control over the gears and brakes.

In addition to the increasing awareness of safety, the growing sales of bikes in the Asia Pacific region are also fuelling the demand for bike ride gears. Moreover, the arrival of reputed companies like Ducati and Harley Davidson in the markets of various countries has added to the trend of premium biking experience. Now, 300-400 cc bikes are available at more affordable prices in developing nations. On a global average, the ride gear market is predicted to grow at a 6.84 CAGR during 2021-2031. The Compound Annual Growth Rate (CAGR) is the required rate of return for growth in the period from beginning to end.

In specific South Asian nations like India, the growth of bike ride gears is propelled by the increasing demand for motorcycles from the young generation. The surge in digital users in online platforms has created more sales for bike accessories companies. Covid 19 pandemic significantly impacted the biking and accessories industry due to the slowdown in manufacturing and sale during the lockdowns. It also had an effect of shifting consumers’ preference from public transport to personal transport methods, which is motorcycles for most of the population in emerging nations such as India, Bangladesh and China.

Studds Accessories Ltd - Background, Revenue, And Stock Performance

Studds Accessories Ltd, India’s leading bike accessories and apparel company, is planning to dominate the expanding industry. A brief summary of the company’s background, significant projects, revenue over the years, and stock performance will give a better idea of where the company stands in the market.

Studds Accessories was officially established in 1983 and had a net worth of Rs 3108.06 million as of March 31, 2022. The company’s debt includes Rs. 287.87 million from banks and financial institutions. It has four facilities and 2587 employees. Studds has more than 1000 suppliers and 660 plus international and domestic dealers.

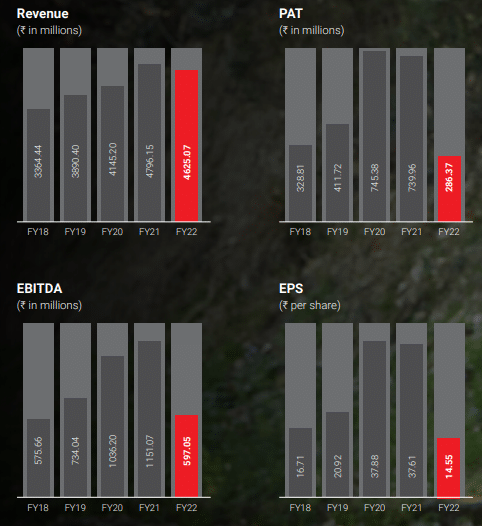

Let us take a closer look at the year-wise comparison of its revenue, Profit After Tax (PAT), Earning Per Share (EPS), and EBITDA. EBITDA is the total earnings before paying interest, taxes, depreciation and amortisation, while ROCE stands for the return on capital employed.

Here are the major financials of the company as of its annual report for the financial year 2021-22.

| Financial Indicator | Value |

| PAT | Rs. 286.38 million |

| PAT margin | 6.15 % |

| EBITDA | Rs. 597.05 million |

| EPS | Rs. 14.55 |

| ROCE | 16.58% |

Now let us take a comparative approach to the company’s financials in the last five years.

Studds showed an overall trend of growth when it came to revenue. The Covid 19 pandemic had a major impact on the financials of all businesses in the last few years. However, Studds ensured reasonable damage control and survived the adverse period. Now, the market is blooming again and registering increments in demand. To answer that, Studds is gearing up its manufacturing capabilities. Studds Accessories has largely expanded its production capabilities for helmets and ride gear in the past two years.

What Can You Expect from Studds IPO?

On Aug 29, 2018, Studds filed its Draft Red Herring Prospectus to the Securities and Exchange Board Of India. The regulatory body, SEBI, approved the company’s request to float an IPO and gave it the green light. Studds has not yet released the final dates of the initial public offering.

However, its unlisted shares continue to be traded in the grey market, and Studds share price holds fairly at a current price of Rs.815 . The pre-IPO share price is constantly changing, and Stockify updates them regularly, along with the market indicators like EBITDA growth and earnings per share. As Studds is a good investment choice among the pre-IPO Stocks, stock traders often ask if it is wise to purchase its shares before the IPO.

We have listed the pros and cons of investing in the Studds unlisted shares to answer that.

Pros of Buying Studds Unlisted Shares

- It is led by experienced professionals in its team of managers and promoters.

- Studds has a trend of market dominance, and it has set a good track record in the past few years.

- Studds employs diverse sales channels, has a large clientele base, and is increasing its exports.

- It has a growing overall figure such as profit margins (except for some downfall in the financial year 2021-22)

- The company has a healthy balance sheet and enormous debt coverage.

Cons of Buying Studds Unlisted Shares

- Studds share price is no exception to today's volatile market and is subject to change.

The share of organised manufacturing firms is dominating the landscape of the helmet and ride gear market in India. Studds is the major player among them, and retail investors should consider betting their money on it for a good return in the long term. Connect with our expert team to get a better overview of the high-potential unlisted shares, and start investing today!