* Ratio is calculated based on latest financial & current share price.

(All Amount in INR Millions)

(All Amount in INR Millions)

(All Amount in INR Millions)

Sambhv Steel is India’s leading manufacturer of Steel Products. It deals with manufacturers of electric resistance welded (“ERW”) steel pipes and structural tubes (hollow section) in India.

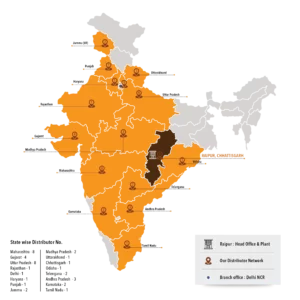

They have their Head Office and Steel Plant in Raipur, Chattisgarh with a distributor network across India. The company benefits from proximity to key raw material suppliers and operates India’s only single-location fully backward-integrated ERW steel pipe facility.

1.Mid Steel Coils :

2. ERW Steel Tubes and Pipes

3. CRFH Pipes

4. Steel Door Frames

5. Stainless Steel Coils

6. Superior Galvanised Pipes

7. Pre-Galvanised GP Pipes

8. Intermediate Products

| Amount(In Rs Crores) | FY 21-22 | FY 22-23 | FY 23-24 |

| Revenue | 819 | 936 | 1,287 |

| EBITDA | 120 | 114 | 158 |

| Operating Profit Margin | 14.65% | 12.18% | 12.28% |

| Profit After Tax | 73 | 62 | 83 |

| Earning Per Share | 36.5 | 31 | 3.44 |

A) Revenue Growth

Sambhv Steel’s revenue has grown from Rs 819 crores in FY 21-22 to Rs 1287 crores in FY 23-24. This is more than 57% growth in 3 years.

And clearly reflects the growth of operations for Sambhv Steel ltd share price.

B) EBITDA growth in 3 years

Sambhv Steel’s EBITDA has grown from Rs 120 crores in FY 21-22 to Rs 158 crores in FY 23-24. This is a significant growth in 3 years.

C) Operating Profit Margin

Sambhv’s Operating profit margin has been stable in grown in the last 3 years. In FY 22, the net profit margin was 14.65%, But in FY 23 Operating Margin grew to 12.18% and remained stable in FY 24.

Thus giving strong profitability growth for Sambhv Steel Unlisted Shares.

D) Profit after Tax

Sambhv Steel’s profit was Rs 73 cr. in FY 22 which dipped to Rs 62 cr. in FY 23. In FY 24, PAT reached 83 crores

Thus reflecting a strong prospect for growth in Sambhv Steel unlisted share price.

E) Earnings Per Share

Sambhv gave an earning of Rs 36.5 per share in FY 22. This dipped to Rs 31 per share in FY 23 and 3.44 per share in FY 24.

Earnings per share and P/E Ratio affect the Sambhv Steel stock price.

Thus based on the above financial observations, Sambhv Steel Unlisted Shares can give significant investment growth to investors.

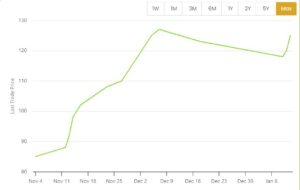

In the first week of November 2024, Sambhv Steel’s unlisted share price was Rs 85 per share. By the third week, the share price had jumped to Rs 108 per share.

By December last week, the share price jumped to Rs 110.

The Sambhv Steel unlisted share price is currently trading at Rs 124 per share.

Buying and selling unlisted shares can be complex if you’re not aware of the process correctly. If you’re considering buying Sambhv Steel Unlisted Shares and need help with how to go about it, India’s best unlisted shares broking platforms are here to help. There are many factors to consider before applying to unlisted shares, including EPS growth, KPI, EBITDA Margin, Profit & Loss summary, etc. The experts at Stockify will provide you with every valuable piece of information you need.

At Stockify, you get updated prices of Sambhv Steel stock price, and the Sambhv Steel unlisted share price today is Rs.124 per share. Keeping oneself updated with the costs of unlisted shares makes buying and selling easy. Since our experts possess a tremendous knowledge of the grey market, they update the prices whenever they get changed.

So log in and subscribe to our Finance Newsletter for regular stock updates.

Are you interested in buying unlisted shares of other companies apart from Sambhv Steel? If yes, Stockify brings you a vast list of leading companies offering unlisted shares for potential investors to earn something big. You can choose the company to invest in the stock from manufacturing to healthcare, education, and energy. The companies you will find on Stockify are the best unlisted shares in India to buy. Just scroll through our list and get the updates on any unlisted company you’re looking for. For more information, we’re always here; connect with us.

Reliance Retail, Pharmeasy, Chennai super kings, Anglo-French Drugs & Industries, Hexaware Technologies Ltd, Five Star Business Finance Ltd Unlisted Shares, Fincare Small Finance Bank Ltd Unlisted Shares, Arohan Financial Services Unlisted Shares, Utkarsh Coreinvest Ltd Unlisted Shares, Fino Paytech Ltd Unlisted Shares, Hero Fincorp Ltd Unlisted Shares, National Stock Exchange Ltd Nse Unlisted Shares, National Commodity Derivatives Exchange Ltd Ncdex Unlisted Shares, MetroPolitan Stock Exchange MSEI Unlisted Shares, Capital, Small Finance Bank Ltd Unlisted Shares, And Motilal Oswal Home Finance Ltd Unlisted Shares.