* Ratio is calculated based on latest financial & current share price.

(All Amount in INR Millions)

(All Amount in INR Millions)

(All Amount in INR Millions)

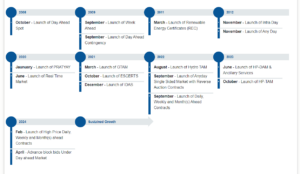

Power Exchange Limited (PXIL) is an electronic platform for trading electricity. It acts as an intermediary between electricity buyers and sellers. Established in 2008 under a public-private initiative, PXIL has improved the overall efficiency of power markets in India by accurately and seamlessly connecting the stakeholders of electricity.

Vision

To continually innovate and offer credible solutions to transform Indian power markets and efficiently allocate energy resources, thereby creating a significant difference for our stakeholders across the globe.

Mission

To increase the accessibility and transparency of the power market in India, and enhance the speed and efficiency of trade execution, via optimal utilization of local and global insights.

PXIL makes money from 3 segments:

A) Platform Fees

PXIL charges fees for registering & using the trading platform.

B) Transaction Fees

PXIL charges transaction fees based on the volume of electricity traded.

C) Other Products

PXIL has launched new products like Green Day Ahead markets.

|

S.no |

Investor | Holding stake |

|

1. |

NCDEX Limited |

24.2% |

|

2. |

NSE |

29.2% |

|

3. |

West Bengal State Electricity Distribution Co Ltd |

6.8% |

| 4. | Power Finance Corporation |

6.8% |

| Amount(In Rs Crores) | FY 21-22 | FY 22-23 | FY 23-24 |

|

Revenue |

40.2 | 55.5 |

63.2 |

|

EBITDA |

21.8 | 32.7 |

33.4 |

|

Profit After Tax |

15.7 | 21.6 |

22.1 |

|

Net Profit Margin |

39% | 39% |

35% |

| Earning Per Share | 2.7 | 3.7 |

3.8 |

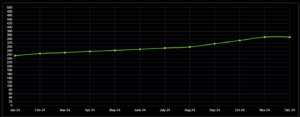

A)150% Revenue Growth

PXIL’s revenue has grown from Rs 40 crores in FY 21-22 to Rs 63 crores in FY 23-24. This is more than 150% growth in 3 years.

And clearly reflects the growth of operations for Power Exchange India ltd share price.

B) EBITDA growth in 3 years

PXIL’s EBITDA has grown from Rs 15.7 crores in FY 21-22 to Rs 22 crores in FY 23-24. This is a significant growth in 3 years

C) Net Profit Margin

PXIL’s Operating profit margin has significantly grown in the last 3 years. In Fy 22 , the net profit margin was 35%, But in Fy 23 Net Margin grew to 39% and remained stable in Fy 24.

Thus giving strong profitability growth for Power Exchange India Unlisted Shares.

D) Profit after Tax

PXIL’s profit was Rs 15 cr. in FY 22 which grew to Rs 21 cr. in FY 23. In FY 24, PAT reached 22 crores

Thus reflecting a strong prospect for growth in Power Exchange India unlisted share price.

E) Earnings Per Share

PXIL gave an earning of Rs 2.7 per share in FY 22. This rose to Rs 3.7 per share in FY 23 and 3.8 per share in FY 24

Earnings per share and P/E Ratio affect the Power Exchange India stock price.

Thus based on the above financial observations, Power Exchange India Unlisted Shares can give significant investment growth to investors.

In mid-Dec 2024, Power Exchange India ltd share price was trading at Rs 300 per share. By the end of December, the share price jumped to Rs 365 per share.

Currently, the Power Exchange India unlisted share price is trading at Rs 336 per share.

Buying and selling unlisted shares can be complex if you’re not aware of the process correctly. If you’re considering buying Power Exchange India Unlisted Shares and need help with how to go about it,India’s best unlisted shares broking platforms here to help.

There are many factors to consider before applying to unlisted shares, including EPS growth, KPI, EBITDA Margin, Profit & Loss summary, etc. The experts at Stockify will provide you with every valuable piece of information you need.

At Stockify, you get updated prices of Power Exchange India stock price, and the Power Exchange India unlisted share price today is Rs.336 per share. Keeping oneself updated with the costs of unlisted shares makes buying and selling easy. Since our experts possess a tremendous knowledge of the grey market, they update the prices whenever they get changed.

So login and subscribe to our Finance Newsletter for regular stock updates.

Are you interested in buying unlisted shares of other companies apart from the Power Exchange India? If yes, Stockify brings you a vast list of leading companies offering unlisted shares for potential investors to earn something big. You can choose the company to invest in the stock from manufacturing to healthcare, education, and energy. The companies you will find on Stockify are the best unlisted shares in India to buy. Just scroll through our list and get the updates on any unlisted company you’re looking for. For more information, we’re always here; connect with us.

Reliance Retail, Pharmeasy, Chennai super kings, Anglo-French Drugs & Industries, Hexaware Technologies Ltd, Five Star Business Finance Ltd Unlisted Shares, Fincare Small Finance Bank Ltd Unlisted Shares, Arohan Financial Services Unlisted Shares, Utkarsh Coreinvest Ltd Unlisted Shares, Fino Paytech Ltd Unlisted Shares, Hero Fincorp Ltd Unlisted Shares, National Stock Exchange Ltd Nse Unlisted Shares, National Commodity Derivatives Exchange Ltd Ncdex Unlisted Shares, MetroPolitan Stock Exchange MSEI Unlisted Shares, Capital, Small Finance Bank Ltd Unlisted Shares, And Motilal Oswal Home Finance Ltd Unlisted Shares.