Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

The National Stock Exchange (NSE) has been attracting investors at war footing.

With 1 crore new investors in the last 8 months alone, NSE now has a total 8 crore investor base. But, the actual trading is much more than that. The total investor codes touched are around 14.9 crores, as a user can register with more than 1 trading number.

What do these 8 crore retail investors represent?

These 8 crore retail investors represent around 5 crore Indian households which is 17% of the total households of the country. States in the northern region take the lead, accounting for 43 percent followed by the West with 27 percent, the South with 17 percent, and the East with 13 percent towards the last one crore new investor registrations.

Zooming in on cities, Delhi NCR tops the contribution with 7% of total new investors followed by Mumbai (Including Thane & Raigarh) & Pune contributing 4.6% and 1.7% respectively.

45% of these new retail investors came from beyond the top 100 cities, signifying a remarkable surge in financial awareness and retail participation from smaller towns and cities, indicating the democratization of financial markets across India.

When & how did this investor boom begin?

Right after COVID-19 happened and markets crashed in March 2020, a lot of retail participation picked up.

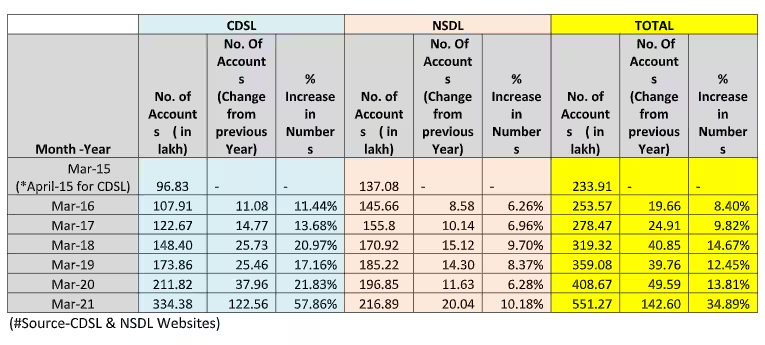

In financial year 20-21 the number of Demat accounts opened with NSE in India was more than the previous 3 years combined.

The reason contributing to this heavy investment rush was a major lack of investment alternatives, with traditional options like FDs & Bonds offering relatively low returns.

This prompted a lot of millennials and first-time investors to look toward a crashed share market for investment opportunities.

Higher returns made retail participants resilient.

Despite wars, economic slowdowns, and business uncertainties. After the COVID-19 crash, we haven’t seen a big crash in the market. Retail investors are getting more familiar with the markets because of the innovations in fintech leading to ease of translations.

Nifty and Sensex doubled in the COVID years, giving investors an incentive to hold up even in the financial uncertainties.

NIFTY gave an Average Annualised Return of 22.66% in the last 3 years.

If we compare it to FD, it does not even beat inflation.

7 crore taxpayers with 8 crore investors, are one crore people not paying taxes?

With close to 7 crore taxpayers in India, the total number of investors is around 8 crore.All have done their KYCs, their PAN is registered.

While the apparent tax non-compliance of 1 crore individuals might raise concerns if you read between the lines you can conclude that:

- More number of dependents are participating.

- More housewives taking out money from their almirahs.

This extends beyond earning members to include non-earning ones, contributing to the cumulative tally of 8 crore investors.

This indicates a larger spectrum of financial involvement, bringing a diverse range of individuals beyond traditional income earners.

We are shifting from a country of savers to a country of investors.

The daily average turnover of Exchange Traded Funds (ETFs) has increased close to 11 times from ₹46 crore in FY14 to ₹605 crore in FY23.

Moreover, Real estate investment trusts (REITs) and infrastructure investment trusts (InvITs) observed a daily average turnover of ₹83 crore in this financial year in the Capital Market Segment of the Exchange.

Simultaneously, the net financial savings have fallen to a 5-decade low of only 5.1% of the GDP in FY 2023. Government bonds listed in the Capital Market Segment of NSE also saw a daily average turnover of ₹13 crore.

India, once known as a ‘country of savers’ is smoothly shifting towards becoming a ‘country of Investors’.

This trend will help NSE grow exponentially in the next 5 years.

How you can plan your investment in NSE?

The substantial growth in the investor base reflects a significant opportunity for retail investors to earn high returns. To take the financial benefits of this opportunity, you must plan your investments in the NSE unlisted shares to get the maximum returns on nse stock price at this peak time.

As NSE is expanding its user base and diversifying into new products, you need to assess the company's growth and plan your investment accordingly.NSE is planning its IPO, where it offers its investors a share in its wealth through the secondary market. But you have the chance to buy NSE Pre-IPO for your long-term investment growth. Currently trading at Rs 4200 per share, NSE Share price will be expected to increase with better financial performance & broader user base coming in.