Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

On Wednesday, Indian IT stocks had one of their biggest drops in a long time, with the market capitalisation dropping by almost ₹1.9 lakh crore in just one trading session.

What caused it?

A groundbreaking announcement from Anthropic AI, a US based startup, sent shockwaves through the global technology markets. It left everyone startled for the future of traditional IT softwares and services.

What is Anthropic AI?

Anthropic is a US-based company that does research on artificial intelligence. It makes Claude, a large language model (LLM) and generative AI chatbot. Anthropic AI was started with the goal of making AI safe and developing ethical AI. Now, it is a leader in making responsible and capable AI systems.

Claude, the company's most important product, has gone through several generations (Claude 3, Claude 4, and now Claude 4.5) to become one of the best AI assistants on the market. Claude is not like regular chatbots that just answer questions. It has become an agentic AI system that can carry out complicated, multi-step tasks with little help from people

What Makes Anthropic AI a Danger to IT Services?

The effects of Anthropic AI are especially bad for Indian IT companies.

For a long time, their business model has been based on offering services like data processing, contract analysis, compliance monitoring, and customer support.

AI tools may now be able to automate these tasks.

Now, areas that were thought to be safe from automation, like legal services, data analytics, and customer support, are being seen as more vulnerable.

Why Did Anthropic AI Cause a Huge Sell-off of IT Stocks?

IT stocks Anthropic are a big concern as it can bring:

1.Threat to revenue:

Anthropic's tools automate workflows with high margins, so you don't need to pay for SaaS subscriptions or hire a lot of people.

2.Disruption of billing models:

Indian IT companies like Infosys and Wipro make money based on the number of employees they have, which AI automation directly threatens.

3.Valuation compression:

Tech stocks that were trading at high multiples saw quick drops as assumptions about future cash flow weakened.

4.Contagion selling:

Once the idea that "AI replaces software" spread, panic spread across the whole sector, hurting even companies that didn't have any direct exposure to Anthropic.

5.Mind shift:

People used to think that AI was good for everyone, but now they see it as a zero-sum disruptor that makes some people winners and others losers.

Effect on Indian IT Stocks

The damage to Indian IT companies was quick and severe.

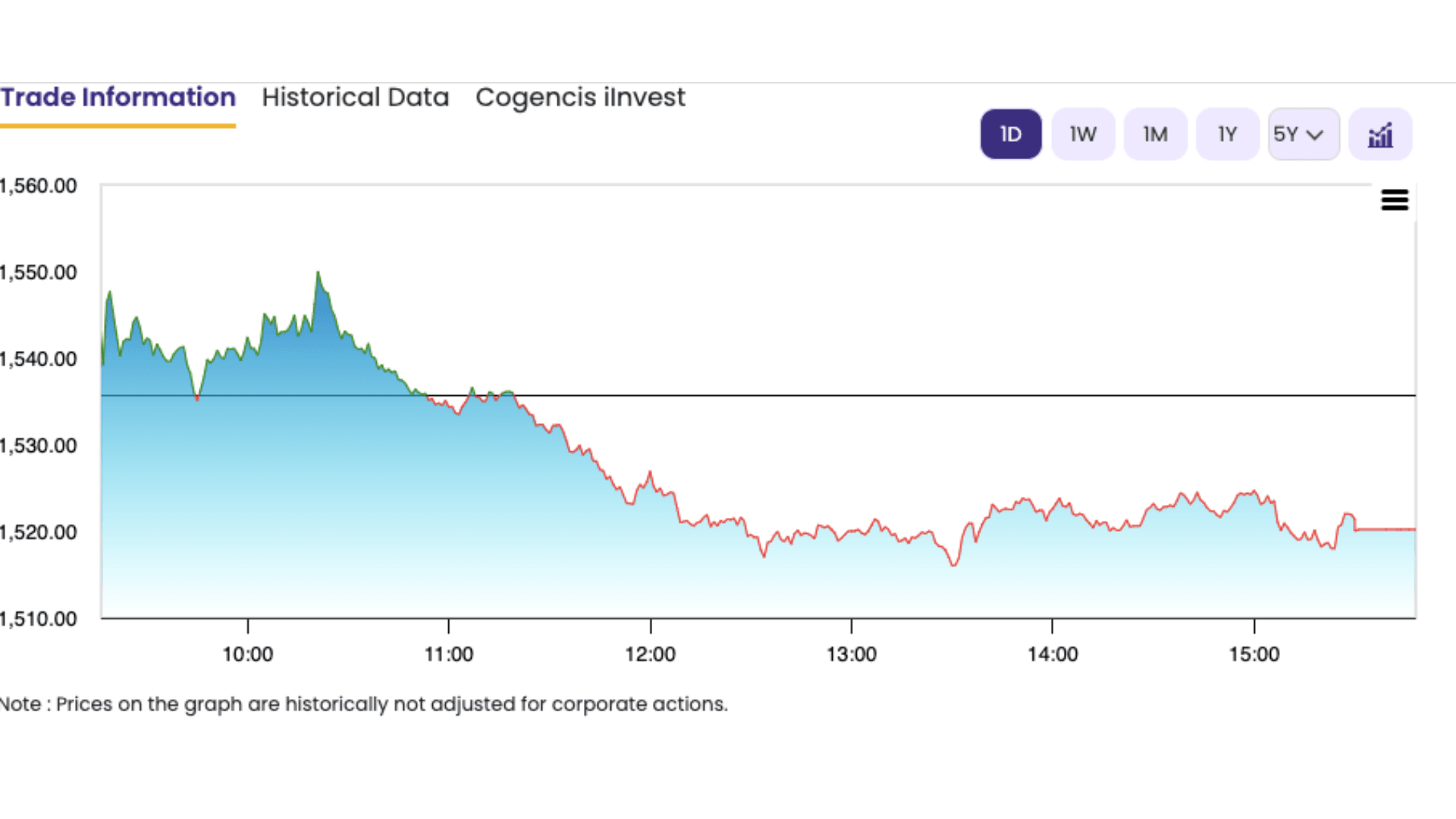

Source: NSE India

The graph shows how the stock prices have dipped in the last few hours.

Infosys and Mphasis were the biggest losers, with each losing more than 7%. Other big companies also lost money. LTIMindtree, Coforge, TCS, and HCL Tech all lost between 5% and 7%, and Wipro lost almost 4%.

At the end of the day, Infosys was down 7.37%, TCS was down 6.99%, HCL Tech was down 4.58%, and Wipro was down 3.79%. The Nifty IT index fell below the important ₹30 lakh crore level.

The Anthropic AI IT Stocks: Ripple Effect on the Global Tech Selloff

The IT stocks that Anthropic's announcement set off weren't just in India. The S&P 500 fell 0.84% to 6,917.81 and the Nasdaq Composite fell 1.43% to 23,255.19, which was similar to the technology-led weakness in US markets.

Nvidia and Microsoft both dropped almost 3%, and Alphabet dropped 1.2% before it announced its earnings. ServiceNow and Salesforce, two software companies, saw their stock prices drop by almost 7% each.

Thomas Shipp, who is in charge of equity research at LPL Financial, which manages $2.4 trillion in assets, summed up the market's worries: "The fear with AI is that there's more competition, more pricing pressure, and that their competitive moats have gotten shallower, meaning they could be easier to replace with AI.

Change in Market Sentiment

The selloff is a big change. For two years, the story said that AI would make people more productive and give tech companies new chances. Investors put a lot of money into anything related to AI, which drove prices to all-time highs. Now, a different story is coming out. In this one, AI agents might not even need traditional software platforms at all.

In early February, the international brokerage Jefferies cut its stake in India's IT sector, bringing its weight down to 5.6% of its India portfolio. This is much lower than the 9.7% assigned to the MSCI India index.

This cautious approach comes at a time when foreign portfolio investors are still selling, with about $34 billion leaving Indian stocks over the past 16 months.

FAQs

Why are IT stocks going down today because of Anthropic?

Today, IT stocks are falling because Anthropic released AI automation tools that can do legal, compliance, and data analytics tasks. These are tasks that Indian IT service companies usually do. This made people worry that AI would cause problems and lower profits in the IT sector.

Why are IT stocks going down because of Anthropic's new AI tool?

Anthropic showed off plugins for its Claude AI platform that can automate things like reviewing contracts, sorting NDAs, compliance processes, and writing legal briefs. These features are in direct competition with what traditional IT companies offer.

How much did Anthropic hurt the value of Indian IT stocks?

After Anthropic's announcement, Indian IT stocks lost about ₹1.9 lakh crore in market capitalisation in just one trading session. The Nifty IT index dropped below ₹30 lakh crore.

Are IT stocks crashing today only in India, or all over the world?

The crash of IT stocks is happening all over the world. The US markets also fell a lot. The Nasdaq fell 1.43%, and big tech stocks like Microsoft and Nvidia fell almost 3% each.

Should people who own IT stocks sell them after the Anthropic news?

People should make investment decisions based on how much risk they can handle and how they see the future. Anthropic AI could cause problems, but IT companies that can adapt and use AI features may still be able to take advantage of them. It's a good idea to talk to a financial advisor.