Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

Bira 91, a popular Indian craft beer brand, has announced its ambitious plan to go public in 2026. Currently, the fourth-largest beer company in India, Bira 91 boasts a 5% market share in key regions.

According to ET reports, the company has hired investment bank Morgan Stanley to guide them through the pre-IPO process. "We are planning our IPO in 2026, contingent on meeting operating milestones in the business," stated Ankur Jain, CEO and founder of B9 Beverages.

CEO Ankur Jain on Supply Chain Issues

This decision follows recent supply shortages of Bira 91 in key markets like Delhi, Karnataka, and Haryana, along with profitability challenges and high competition in the craft beer industry.

“We had supply challenges in Q3 and Q4 of FY24 in some markets due to several factors,” explained Jain. Jain assured that supply issues have now been resolved in most markets, including Delhi, with license renewals completed in July. “The only market remaining to be resolved is Haryana,” he added.

Recent funding

Last month, the beer brand secured $25 million (approximately INR 208 crore) through external commercial borrowing (ECB) from its existing investor, Kirin Holdings.With this capital infusion, the company plans to expand its manufacturing footprint to new regions

Craft beer maker Bira 91 became a public entity in December 2022, while also renaming itself as B9 Beverages Ltd, as per its regulatory filings.

Bira 91's Growth Trajectory

Since its inception in 2015, Bira 91 has experienced remarkable growth, driven by several key factors:

- Distinct Approach to Craft Beer: Emphasizing quality ingredients and innovative flavors, Bira 91 has set itself apart in a competitive market.

- Expansion Within and Beyond India: The company has not only grown its presence within India but also established a robust brand identity internationally.

- Diverse Portfolio: Offering a range of products including Bira Blonde Lager, Bira White, and Bira Boom, Bira 91 has successfully catered to a wide array of tastes, securing a loyal customer base.

This impressive growth trajectory has laid a solid foundation for Bira 91's plans to go public.

Bira’s Financial Performance

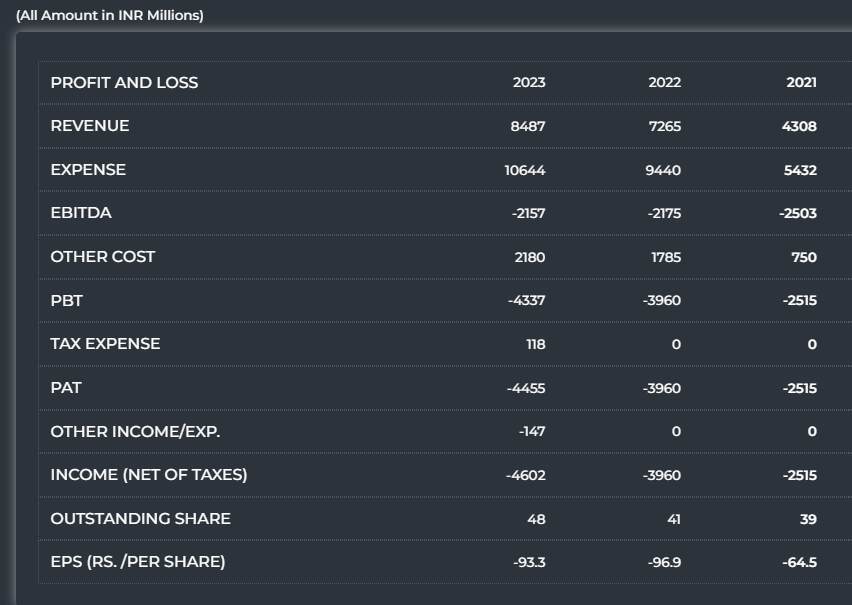

Bira Managed to touch a revenue of Rs 848.7 crore in FY 22-23. This growth was slow as compared to Rs 726.5 crore in FY 21-22.

Bira’s revenue from beer sales was 98% of total operation revenue. This increase by only 13% to Rs 807 crore. The remaining sales came from non-alcoholic products and scrap sold during FY23.

How To Purchase Bira Shares?

The Bira share is not listed. But it is being actively traded in theunlisted market. The sudden surge is mainly due to increased funding and growing investor trust in this beer brand.

This can be the right opportunity to invest in trending unlisted shares like Bira and increase your wealth by playing on the currentbira share price. Stockify reduces the barriers to entry into blue chip stocks and helps you gain before they get listed in the Indian stock market.

Connectwith our professionals to learn more.