Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

Hero FinCorp Limited has recently announced its 9M Financial Statements for the period ending 31st Dec 2025, reflecting strong revenue growth alongside pressure on profitability and asset quality.

Let’s take a closer look at Hero FinCorp’s profitability trends and share price performance to understand what is shaping investor sentiment around the company.

Hero Fincorp 9 Month Financial Performance Overview

UNAUDITED | UNAUDITED | UNAUDITED | UNAUDITED | UNAUDITED | |

Particulars (In Rs. Crore) | Q3 FY 25-26 | Q2 FY26Sep 30, 2025 | Q3 FY25Dec 31, 2024 | 9M FY26Dec 2025 | 9M FY25Dec 2024 |

Revenue from Operations | 2,158.75 | 2,137.36 | 2,290.20 | 6,629.33 | 6,805.91 |

Total Income | 2,160.05 | 2,139.49 | 2,306.41 | 6,634.13 | 6,835.98 |

Finance Costs | 807.01 | 835.15 | 886.71 | 2,533.20 | 2,524.63 |

Impairment on Financial Instruments | 604.54 | 648.44 | 751.27 | 1,989.67 | 2,180.91 |

Total Expenses | 2,241.63 | 2,239.50 | 2,318.29 | 6,839.45 | 6,696.39 |

Profit / (Loss) After Tax | -121.69 | -112.82 | -32.43 | -284.23 | 33.61 |

EPS | -9.39 | -8.71 | -2.55 | -22.03 | 2.63 |

Yearly performance

AUDITED | AUDITED | |

Particulars ( Rs Crore) | FY24 | FY25 |

Revenue from Operations | 8,290.90 | 9,832.73 |

Operating EBITDA | 3,772.38 | 3,676.44 |

Profit After Tax (PAT) | 637.05 | 109.95 |

EPS | 50.04 | 8.63 |

Gross NPA (%) | 4.02% | 5.05% |

A)Revenue Growth

For 9 months, revenue from operations stood at Rs.6,629.33 crore, slightly lower than Rs.6,805.91 crore reported in the same period last year. It shows revenue is largely stable, supported by steady lending activity.

At the quarterly period, revenue from operations stood at Rs.2,158.75 crore in the December FY25 quarter, largely stable compared to Rs.2,137.36 crore in the September FY25 quarter, though lower than Rs.2,290.20 crore reported in the December 2024 quarter.

B)EBITDA

Operating EBITDA declined marginally to Rs.3,676.44 crore in FY25 from Rs.3,772.38 crore in FY24. Despite strong revenue growth during the year, rising expenses, particularly higher finance costs and impairment provisions, limited operating profitability.

It shows high costs kept squeezing profits quarter after quarter.

C)PAT

In the unaudited results, Hero FinCorp reported a loss after tax of Rs.121.69 crore in the December 2025 quarter, compared to a loss of Rs.32.43 crore in the same quarter last year.

For the nine months ended December 31, 2025, the company posted a loss of Rs.284.23 crore, compared with a profit of Rs.33.61 crore in the corresponding period last year. It shows costs grew faster than income, which pulled profits down.

D)EPS

In the unaudited period, EPS stood at Rs. (9.39) for the December 2025 quarter and Rs. (22.03) for the nine months ended December 2025, compared with positive earnings in the previous year period, indicating continued pressure on shareholder returns.

E)NPA

Year on Year, the asset quality weakened in FY25, with Gross NPA rising from 4.02% in FY24 to 5.05%. Whereas, if we look at Nine months (unaudited), it showed stabilisation. Gross NPA stood at 5.28%, slightly lower than 5.36% a year ago, while Net NPA improved to 2.31% from 2.49%.

Quarterly (unaudited), December 2025 showed early improvement, with Gross NPA to 5.28% from 5.41% in the previous quarter and Net NPA declining to 2.31% from 2.41%, supported by higher provisioning.

Overall, the company continued to expand its lending operations and delivered an 18.6% rise in revenue in FY25, earnings were hit hard by higher credit costs and funding expenses. Profitability is getting weak, with profit after tax declining by over 80% in FY25, followed by losses in the unaudited quarterly and nine-month periods ended December 31, 2025. Asset quality also remained a key area of concern, as Gross NPA rose every year.

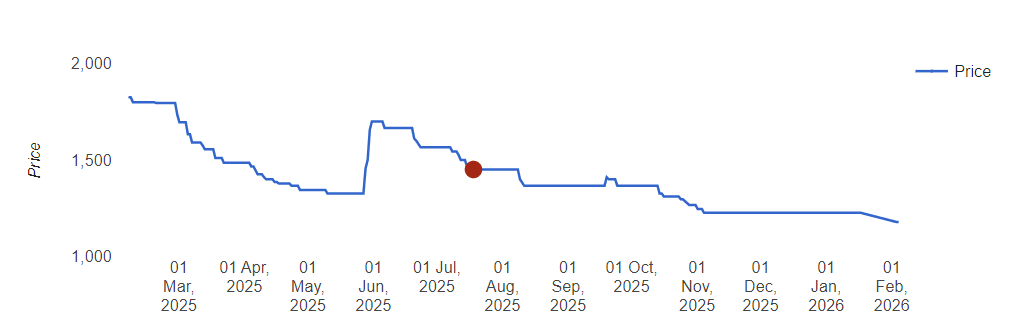

Hero Fincorp Unlisted Share Is Falling

Hero FinCorp’s unlisted share price has come down quite a bit over the past year. It was trading around Rs. 1,800-Rs.1,900 in early 2025, but is now at about Rs.1,185.

This fall is mainly due to the financials, as we discussed previously. While strong revenue growth of 18.6% in FY25, its profits took a big hit, with PAT dropping by over 80%.

From a valuation perspective, FY25 EPS of Rs. 8.63, Hero FinCorp is trading at a P/E of roughly 135-140 times based on last year’s earnings.

This may look quite high at first, but it’s important to understand the context. The high P/E is not because the share price is high, but because profits fell sharply in FY25, which reduced EPS.

In simple words, earnings are currently low due to higher credit costs and provisioning. The market is effectively pricing in the expectation that profitability will normalise over time, while also factoring in near-term risks related to asset quality.

Should Investors In Hero Fincorp Be Concerned?

Though the business is still growing, concerns around earnings and asset quality have made investors cautious, which is why anaylsing hero fincorp unlisted share will be important before investing.