Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

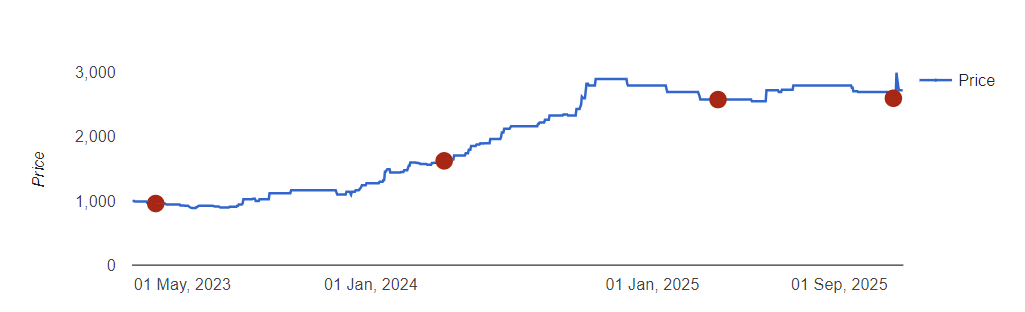

SBI Funds Management Ltd (SBIFML), the asset management arm jointly owned by the State Bank of India and French investment major Amundi India Holding, has become one of the most talked-about names in India’s unlisted share market. Over the past two years, the SBI AMC Share Price has seen a remarkable increase from around Rs. 1100 in 2023 to approximately Rs. 2730 per share in 2025.

This 2.5 times increase in valuation highlights renewed investor confidence in SBIFML’s performance and the broader potential of India’s asset management industry. The rise in its unlisted share price is not just sentiment-driven; it’s backed by solid fundamentals and consistent financial growth.

Let's check

Financial Growth In The Last 3 Years

Over the past three financial years, the company has delivered impressive growth across all major parameters like revenue, profitability, and return ratios, which has driven a sharp rise in its unlisted share price.

Metric ( In Rs Crore) | FY 2023 | FY 2024 | FY 2025 |

Revenue | 2,412 | 3,426 | 4,236 |

Profit After Tax | 1,329 | 2,073 | 2,540 |

SBIFML’s revenue grew at a healthy compound annual growth rate (CAGR) of around 33% between FY 2023 and FY 2025, while profits nearly doubled in the same period. This consistent rise highlights the company’s ability to scale efficiently and maintain profitability even in a competitive mutual fund landscape.

Profitability and Efficiency Metrics

Metric | FY 2023 | FY 2024 | FY 2025 |

Return on Equity (ROE) | 24.5% | 28.7% | 30.5% |

Return on Total Assets (ROA) | 26.3% | 27.8% | 28.9% |

Net Profit Margin | 55.1% | 60.5% | 59.8% |

Debt-to-Equity Ratio | 0.12 | 0.11 | 0.10 |

The steady improvement in return ratios showcases efficient capital deployment and strong operational performance. The rally means that the valuations are now rich. The company’s near-60% profit margin highlights its scalability and cost efficiency. These indices indicate that investors are pricing in strong future growth and potential listing gains.

Share Price Growth And Valuation

Parameter | FY 2023 | FY 2024 | FY 2025 |

Unlisted Share Price (Rs.) | 900 | 1,800 | 2,700 |

Estimated Market Capitalisation (Rs. crore) | 45,000 | 91,400 | 143,536 |

Price-to-Earnings (P/E) | 34.0 | 44.1 | 55.9 |

Price-to-Book (P/B) | 10.5 | 13.8 | 17.1 |

Overall Assessment

SBIFML’s financial trajectory over the past three years paints the picture of a high-quality, growth-oriented business. Strong return metrics, minimal leverage, and a scalable business model support the company’s rising revenues and profits.

On November 23, the SBI Mutual Fund Unlisted Share Price was trading around Rs 1100 per share. In 3 years, the price increased to Rs 2,700, marking an almost 2.5X growth in just 2 years. Currently, the share is trading around Rs 2730. This growth can be primarily attributed to the primarily by strong financial performance and industry leadership.

The company’s revenue grew from Rs 2,412 crore in FY2023 to Rs 4,236 crore in FY2025, while profit after tax nearly doubled from Rs 1,329 crore to Rs 2,540 crore over the same period. This sharp growth in profitability, combined with exceptional return ratios such as a 30.5% ROE and 28.9% ROA, reflects the growth of SBI Mutual Fund. Share price.

The surge in SBI Mutual Fund unlisted shares is a reminder that India’s unlisted market still offers substantial value, provided the business fundamentals are sound. Yet, with high valuations and limited liquidity, investors will need to remain patient and watch how the company’s growth and eventual listing unfold in the coming years.