Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

India’s National Stock Exchange has received regulatory clearance to move ahead with its IPO, ending nearly a decade of regulatory uncertainty. The Securities and Exchange Board of India granted a no-objection certificate on January 30, 2026, allowing the exchange to proceed with filing its Draft Red Herring Prospectus.

NSE IPO Is On Offer For Sale, No Fresh Issue

The NSE IPO is structured as a pure Offer for Sale of approximately Rs 22,900 to Rs 23,000 crore, with no fresh equity issuance. Existing shareholders will dilute a small portion of their holdings, led by Life Insurance Corporation of India and Temasek Holdings.

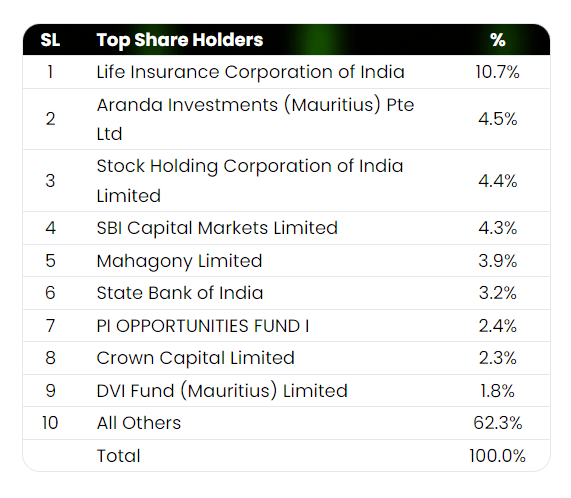

NSE Current Shareholding

LIC holds a 10.72% stake in NSE, while Temasek (Aranda Investments) owns around 4.5%. SBI Capital Markets and the State Bank of India together hold a stake of close to 7.7%.

Based on recent unlisted market transactions at around Rs 2,150 per share, NSE is valued at roughly Rs 5.3 lakh crore, placing it among the world’s most valuable exchange operators. The NSE IPO would rank among the largest listings ever undertaken in India’s capital markets.

Regulatory Clearance Removes Long-Standing Constraint

NSE first filed draft papers for the NSE IPO in 2016, but the process was halted following SEBI’s investigation into governance failures, including the co-location matter involving preferential access to trading infrastructure for select brokers. In 2019, SEBI imposed monetary penalties and barred former senior executives from associating with market infrastructure institutions. Over subsequent years, NSE resolved multiple enforcement actions and implemented changes to governance and technology frameworks.

The January 2026 clearance indicates that the regulator is satisfied that legacy issues have been addressed, enabling NSE to proceed under public market oversight. As a market infrastructure institution, the exchange is subject to a higher regulatory threshold than typical issuers and requires explicit SEBI approval before advancing the NSE IPO process.

Also Read: NSE Offers 1000 Crore To Settle SEBI Case, Bring Back IPO

Timeline, financials, and market context

NSE Managing Director and CEO Ashish Chauhan said preparation of documentation for the NSE IPO would take three to four months, followed by SEBI’s review. The overall IPO process is likely to extend over seven to eight months, placing the listing toward the end of 2026. A board-level committee is expected to be constituted in early February to oversee banker appointments, documentation, and regulatory coordination.

NSE Valuation And Financial Comparision With BSE

For FY25, NSE reported consolidated total income of Rs 19,177 crore and net profit of Rs 12,188 crore, supported by strong derivatives activity and high operating margins. Transaction charges accounted for nearly three-fourths of operating revenue.

The NSE IPO will place the exchange in direct valuation comparison with BSE Limited, which is already listed. Market participants are likely to reassess exchange economics, governance standards, and regulatory risk before trading in NSE Unlisted Shares.

For investors, the NSE IPO enables direct participation in India’s core market infrastructure. Valuation discipline, regulatory oversight, and long-term competitive dynamics are expected to shape how the stock is assessed once listed.