Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

The Metropolitan Stock Exchange of India is preparing to restart trading operations by the end of January 2026, marking the return of a third national stock exchange after years of limited activity.

If the plan goes ahead as expected, MSE will re-enter a market currently dominated by the National Stock Exchange of India and the Bombay Stock Exchange. NSE accounts for more than 90% of cash market volumes, while BSE handles most of the remaining market share.

For market participants, the key issue is not the launch itself but whether MSE can generate consistent liquidity and trading depth.

Trading launch and liquidity support

MSE plans to begin operations with trading in around 130 stocks. To support volumes, it will roll out a Liquidity Enhancement Scheme under which designated market makers will provide two-way quotes. This is meant to ensure tighter bid-ask spreads and prevent thin order books in the early days.

This structure mirrors earlier attempts made by the exchange in its previous avatar. The difference this time is the scale of preparation and capital support behind the relaunch. The exchange is aiming to avoid direct competition on peak trading days and instead focus on building steady participation over time.

Changes in regulatory rules around derivatives expiries may also help. With limits on how exchanges schedule weekly expiry contracts, there is room for alternate expiry days, which could give MSE space to attract derivative traders without clashing directly with established players.

Capital base strengthened ahead of relaunch

Over the past year, MSE has raised about Rs. 1,240 crore through multiple funding rounds. This fresh capital has been used to upgrade technology systems, meet regulatory requirements, and support liquidity incentives.

The funding has also improved the exchange’s financial position, giving it a longer runway to operate without depending on immediate high volumes. This is important because new exchanges typically take time to build trust and trading activity.

A Difficult Market To Crack

Breaking into India’s exchange landscape will not be easy. NSE dominates equity derivatives trading, while BSE has also strengthened its position in select segments. Liquidity tends to concentrate where volumes already exist, making it hard for new platforms to gain traction.

That said, supporters of the relaunch point to India’s growing investor base and rising participation across asset classes. With the right incentives and stable systems, they believe a third exchange can gradually find relevance.

For now, the restart of MSE represents an attempt to bring competition back into India’s market infrastructure. Whether it can move beyond a symbolic relaunch and establish meaningful volumes will become clear only after trading begins and participation data starts coming in.

The first few weeks of operations are likely to be closely watched by brokers, traders, and investors alike.

Ownership structure

MSE has a diversified shareholding structure. Banks together hold roughly 23.6% of the exchange. This includes large public and private sector institutions. Corporate shareholders account for close to 30%, including entities linked to commodity and financial market infrastructure.

Individual shareholders make up over 40% of the ownership. In earlier years, this category included several well-known market investors.

SL | Top Shareholders | % Holding |

1 | Multi Commodity Exchange of India Ltd | 6.9% |

2 | Union Bank of India | 3.3% |

3 | State Bank of India | 2.0% |

4 | Bank of Baroda | 1.9% |

5 | Punjab National Bank | 1.8% |

6 | Radhakrishnan S Damani | 1.7% |

7 | Indian Bank | 1.6% |

8 | All Others | 80.8% |

Total | 100.0% |

While individual holdings have changed over time, the broad retail ownership base remains intact. Recent capital infusion has helped stabilise the exchange and reduce financial stress that had built up during its inactive phase.

MSE Background And Product Offering

MSE was originally established in 2008 and began operations in currency derivatives. It expanded into equities and equity derivatives in 2013, introducing the SX40 index, which tracks 40 large-cap stocks across sectors based on free-float market capitalisation.

Operations slowed significantly after market disruptions in the early 2010s, and liquidity gradually shifted toward the two larger exchanges. Despite this, MSE retained regulatory approval to operate in equity, debt, and derivatives segments.

As part of the relaunch, equity trading is expected to begin first, followed by futures and options linked to the SX40 index at a later stage.

MSEI Unlisted Shares Rise More Than 2X In Last 30 Days

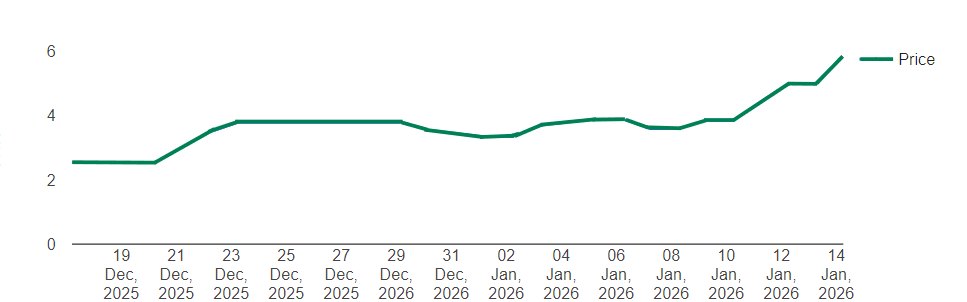

The MSEI Share price in the unlisted market has risen from Rs 2.55 in mid December 25 to Rs 5.5 In Mid Jan 26. Currently, the unlisted share is trading at Rs 5.62, drawing significant investor attention. This increase is most probably due to the stock exchange anticipation.