Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

After years of limited activity and repeated questions about its future, the Metropolitan Stock Exchange of India (MSEI) has officially resumed trading from 27th Jan, 2026. Live trades are now visible on the exchange’s website, indices are updating in real time, and market turnover data is being published.

Adding to this early momentum, MSEI will hold a special trading session on February 1, 2026, the day the Union Budget 2026 is presented. This year’s Budget carries a unique twist. It will be presented on a Sunday for the first time, prompting regulators to keep markets open to avoid a buildup of risk and uncertainty.

What All Happened On 27th Jan, 2026?

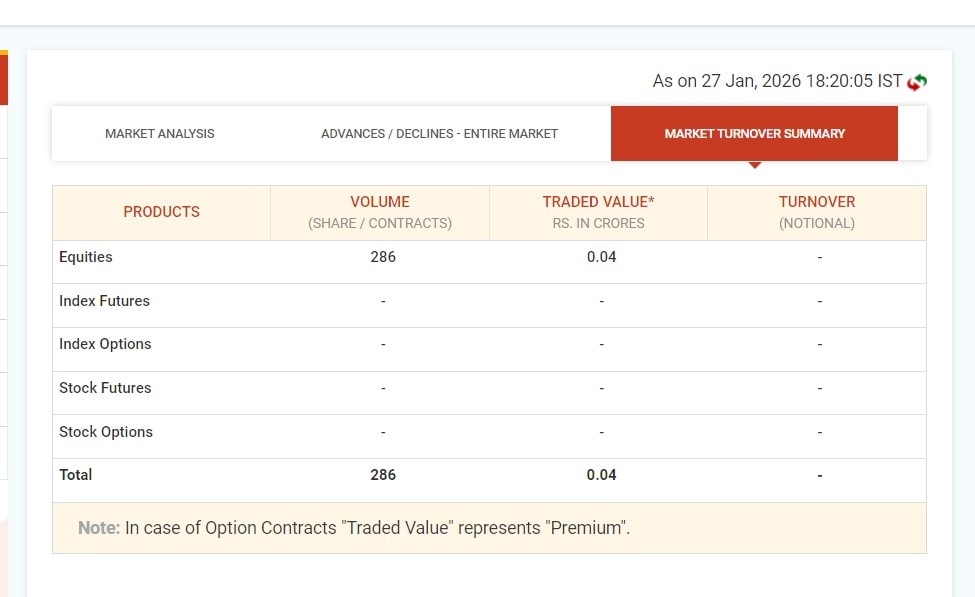

As per the latest MSEI market turnover data:

Equity trading has recorded 286 shares traded

Total traded value stands at around Rs 4 lacs.

Other segments, such as index futures, options and stock derivatives, have not yet seen activity

In addition to this, MSEI’s key indices like SX40 and SXBANK are now showing live data including open, high, low and last traded values. This confirms that:

Trading systems are live

Order matching is working

Price dissemination is active

Hence, from a market structure perspective, this is the first essential milestone for MSEI as it rested its trading now,

While the scale of activity remains modest, the restart marks an important shift. MSEI has moved from being an inactive exchange to a functioning market platform. It may not be a big move in terms of volumes or liquidity, but it is clearly a step in the right direction.

Slow Progress, But In the right direction

For any exchange, competing with NSE and BSE is not easy, especially one returning after a long pause. Hence, MSEI has chosen a cautious path.

Trading has begun with around 130 stocks

A SEBI-approved Liquidity Enhancement Scheme (LES)

The focus might be on stability rather than chasing volumes aggressively

This shows why current volumes are thin. The exchange seems to be prioritising orderly functioning first, liquidity later.

MSEI’s Special Trading Session On February 1

The Metropolitan Stock Exchange of India will remain open for trading on February 1, 2026. Coming just days after the exchange resumed trading, this session can act as an early real test for MSEI’s systems, liquidity support and execution quality during a high volatility event.

Trading alongside NSE and BSE, MSEI will be closely watched for how smoothly it handles price discovery under pressure.

MSEI Unlisted Share Jumps Almost 2X In 1 Month

In late December, shares were trading around Rs3.5 to Rs.3.8, when optimism around a possible restart started building.

In early January, the share price nearly doubled within two weeks, driven by expectations of a trading restart, SEBI’s approval of the Liquidity Enhancement Scheme (LES) and a Rs.1,240 crore capital infusion.

As a result, the price rose from around Rs.3.85 to nearly Rs.7.5 by 19 January, largely on expectations.

After trading resumed, a natural correction followed, with shares now trading around Rs.6. This appears to be a healthy adjustment, indicating that optimism remains, but investors are now looking for sustained liquidity and execution, not just announcements.

Read More Here About: MSEI Share Price Doubles In 1 Week. What's Happening?

Factors Deciding MSEI Trading Operations Growth?

Should trading spreads to more stocks instead of staying limited to just a few stocks?

How smooth trading is, especially whether buy and sell price gaps remain reasonable under the Liquidity Enhancement Scheme (LES)

Do brokers regularly place and route orders through MSEI?

How does the exchange perform during busy and volatile days, particularly around the Union Budget?

Whether this restart develops into a lasting revival will depend on how trading activity and liquidity evolve in the coming weeks. However, one thing is now clear: MSEI is no longer inactive. It is operational. This development alone is significant for MSEI operations. While the progress so far is little, it has been deliberate and measured.