Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

If you track India’s unlisted shares market, you must have noticed one name trending sharply in recent weeks: Metropolitan Stock Exchange of India (MSEI). After years of almost no activity, MSEI is trying to make a comeback. The MSEI unlisted shares have almost jumped 110% within a week. This doesn't happen overnight. And in MSEI’s case, it is a trading restart plan, SEBI approvals and a liquidity push.

Let’s break it down.

MSEI Coming Up Vs BSE And NSE

MSEI is trying to position itself as a serious contender to become India’s 3rd major stock exchange, after NSE and BSE. The exchange has remained relatively inactive for years, but fresh regulatory updates and business plans are now creating momentum. MSE plans to begin operations with trading in around 130 stocks.

This structure mirrors earlier attempts made by the exchange in its previous avatar. The difference this time is the scale of preparation and capital support behind the relaunch. The exchange is aiming to avoid direct competition on peak trading days and instead focus on building steady participation over time.

Read More: MSEI Set To Compete BSE, NSE In Trading

Trading Restart by the end of Jan 2026

One of the biggest headlines around MSEI is that the exchange is working towards restarting stock trading operations, reportedly beginning with trading in nearly 130 stocks. This development matters because it immediately changes the perception of MSEI in the market.

For years, the exchange has remained relatively inactive, so a confirmed restart is being seen as a comeback.

From a business point of view, this is clearly positive for MSEI because an exchange only becomes meaningful when trading activity exists. Revenue streams such as transaction charges, listing-related income, membership fees and data/technology services can only scale when trading resumes.

Even if the initial volumes are limited, the restart shifts MSEI’s identity from an inactive to an operational exchange, which is exactly what investors are pricing in.

SEBI Approved Liquidity Enhancement Scheme (LES)

Along with the relaunch narrative, SEBI’s approval for MSEI’s Liquidity Enhancement Scheme (LES) has become a major confidence booster.

Under LES, designated market makers are expected to provide 2-way quotes, both buy and sell orders, so that volumes build consistently and trading does not look thin during the early days.

This is important because exchanges are not built on branding or announcements.

They survive on liquidity. If traders do not see tight bid/ask spreads, quick execution and a strong order book, they simply won’t participate. That is why LES acts like a growth engine for MSEI.

It improves daily trading activity, reduces the risk of the exchange looking inactive and makes participation smoother for brokers and investors.

Rs.1,240 Crore Funding

Another major reason the market is taking MSEI more seriously this time is the funding support. Reports suggest that MSEI has raised around Rs. 1,240 crore across multiple rounds, and this capital infusion changes the strength of the relaunch.

Exchange businesses require strong technology infrastructure, surveillance and risk control systems and strict compliance frameworks, especially under SEBI guidelines. Additionally, liquidity incentives themselves need working capital. This funding means MSEI is not restarting cheaply or casually. It has the financial capacity to upgrade systems, meet regulatory requirements and support liquidity-building efforts under LES.

In investor terms, this gives MSEI runway, time and resources to operate and build momentum without depending immediately on massive trading volumes.

SEBI’s Broader Governance Push

SEBI has initiated reviews like LODR (Listing Obligations and Disclosure Requirements), and institutions such as NSE and BSE are also strengthening senior leadership teams in areas like compliance, risk management and investor grievance systems. This matters because its biggest challenge is not just relaunching trading, but rebuilding credibility. When regulatory expectations rise across the ecosystem, exchanges are judged on governance standards, surveillance capability, transparency and operational stability.

For MSEI, this becomes both an opportunity and a pressure point. If the exchange builds strong systems and governance, it can position itself as a serious market institution. But if it falls short, the market will quickly lose confidence.

However, the NSE and BSE already dominate liquidity and shifting traders away from established platforms is complicated.

MSEI Share Price Jumps 2X In 1 Week

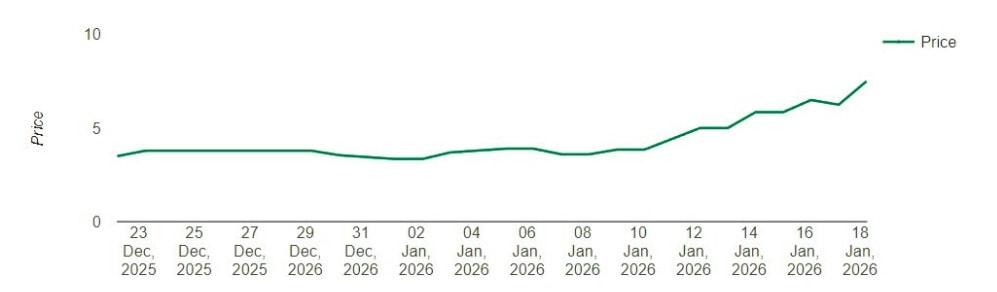

The MSEI share price action has been hard to ignore. In just one week, the share price jumped from Rs. 3.85 on 10 January to Rs. 7.5 on 19 January, almost a 2x. And within a month, it almost doubled, from Rs. 3.5 on 22 December to Rs. 7.5 by 19 January. When an unlisted share rises this fast, it usually means the market has picked up strongly.

The current jump is mainly built on 3 pillars:

MSEI may restart trading operations by the end of Jan 2026

SEBI approved Liquidity Enhancement Scheme (LES)

Massive capital raised and utilised (Rs.1,240 crore), giving it financial strength

Together, these signals are making investors believe that MSEI could finally attempt a comeback. That is why the real question isn’t whether MSEI will restart, it is whether MSEI can sustain liquidity after the initial excitement fades. If it succeeds, this could become one of India’s most interesting market infrastructure turnaround stories. But if trading volumes remain weak, the MSEI Share Price rally may stay largely sentiment-driven rather than business-driven.