Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

National Commodity & Derivatives Exchange Limited (NCDEX), the largest Agri Commodity Derivatives Exchange, has incorporated an institution and a market intermediary, National E-Repository Limited(NERL).

NERL started its operations on September 26, 2017, and is regulated by the Warehousing Development and Regulatory Authority (WDRA) as a Repository and Platform for the Creation and Management of Electronic Negotiable Warehouse Receipts (eNWRs).

Business Model of NERL

A) NERL's main business is offering a digital platform for creating and managing eNWRs issued in warehouses registered with the WDRA.

B) In India, EWRs (specifically called "Electronic Negotiable Warehouse Receipts" or eNWRs) are mandatory for all registered warehouses.

C) Effective from 1st August 2019, the Warehousing Development and Regulatory Authority (WDRA) guidelines require the issue of warehouse receipts electronically.

D) With coverage across 15+ states & 11k+ clients, NeRL has a market leadership in terms of warehouses and issuance of eNWRs and highly prominent and reputable key shareholders. Thus signaling huge growth potential.

The Company does not have any Subsidiary, Joint Venture, or Associate Company.

What are the benefits of E Warehouse Receipts?

- Centralized online recordkeeping.

- Connectivity to commodity exchanges.

- Fiduciary trust is regulated by the WDRA Act.

- Access to Institutional Finance with Lower Interest Rates.

- No additional cost for collateral monitoring and surveillance.

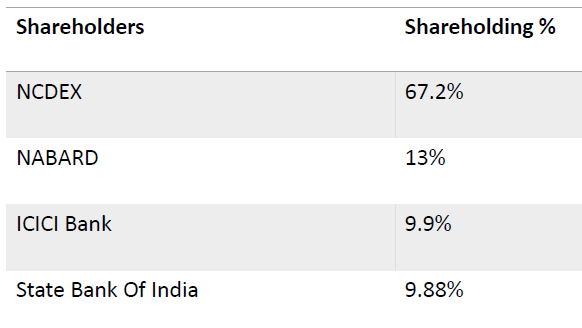

Key Stake Holders In NeRL

NeRL's Achievements And Growth Potential

- NERL has more than 9,980 active customers (over 2,000 customers added in FY 2023-24), 76 pledgee Banks/ NBFCs, 3 CM Pledgees, 1096 unique Warehouses issuing eNWR/eNNWR, and 99 Repository Participants ('RPs') across 17 states and 1 UT in India.

- NERL has issued more than 5.5 lakh eNWRs (Exchange + Emerging Business) for commodities over 59.70 Lakhs MT (Exchange + Emerging Business) deposited in registered warehouses of WDRA.

- A new milestone was achieved in FY 2023-24 as Banks crossed Rs. 7,000 Crores finance against eNWR since inception, a clear indication of the growing confidence of banks in eNWR.

- Soon, all warehouse storage will be required to use eWR, which will significantly benefit NeRL as the market expands.

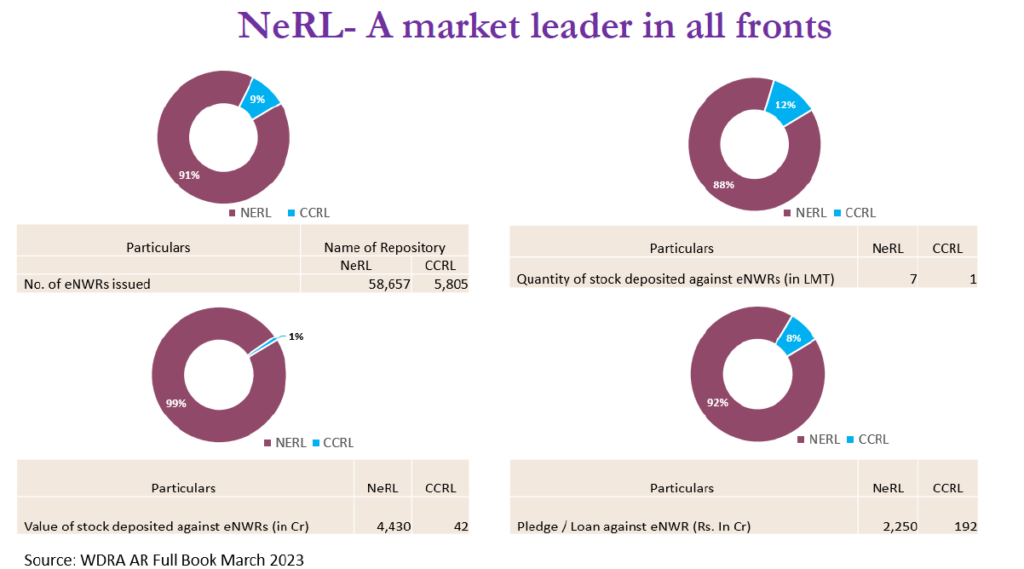

NeRL's Comparision With Competitor CCRL

The Repository for Agricultural Commodities approved by WDRA is currently a duopoly in the Indian ecosystem comprising of:

A) NERL - Backed by NCDEX.

B) CCRL - Backed by CDSL.

Thus NeRL holds a strong position in the commodities market due to its parent company's expertise in the commodities exchange as compared to its rival CDSL-owned CCRL which lacks the experience and know-how of the commodities market.

In comparison, NeRL can be seen as the "CDSL" or "NSDL" of the commodity market. While CDSL and NSDL are valued at Rs 35,000 crore and Rs 20,000 crore respectively, NeRL’s current valuation is only around Rs 500 crore.

The Effect On National E Repository Limited Unlisted Shares

With outstanding shares of 8.1 Cr. their market cap at the current share price stands at 66.67 per share with a PE multiplier of -10.7. Soon, all warehouse storage will be required to use eWR, which will significantly benefit NeRL as the market expands.

NeRL reported a revenue of ~Rs 11 crore in FY23-24. Given its dominant position in the commodities repository market, supported by its parent company NCDEX and its strong technology and market knowledge, it is reasonable to apply a higher revenue multiple.

With a multiple of 50x, NeRL’s valuation could rise to approximately Rs 540 crore - with an Unlisted Share Price of Rs 66.67). National E RepositoryLimitedPre Ipo shares are available in the unlisted market.

Even after all these indicators, knowingNational E Repository Limited before buying its unlisted shares is essential.

If you are new to investing, taking expert advice on such matters becomes crucial. You can get the best advice and updates on the latest unlisted shares in India with a simplified process of buying and selling unlisted shares in India, with thebest trading platform to buy and sell unlisted shares: Stockify.

Connect with our experts for more details!

FAQs:

1.What is National E Repository Limited Unlisted Shares Price in India?

Ans- Currently, the Nerl unlisted share trades at Rs. 66.67 per share. You can visit Stockify to get updates about the updated share prices.

2.Is it legal to buy NeRL Unlisted Shares in India?

Ans- Buying NeRL Unlisted Shares in India is legal. You can use online trading platforms like Stockify to buy and sell unlisted shares.

3.How to check National E Repository Limited Unlisted Shares Price?

Ans- Stockify is the right platform to check Nerl unlisted share price. It offers the best and most updated prices for unlisted shares.