Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

As India’s economy grows more organised and transparent, exchanges like NCDEX are becoming key pillars of the financial system. Once seen as a niche agriculture platform facing low volumes and policy hurdles, NCDEX is now diversifying into mutual funds, equity derivatives, and overseas ventures like Sri Lanka’s exchange.

Supported by a strong balance sheet and an asset-light model, it’s evolving into a broader financial infrastructure player. By 2030, NCDEX’s value will depend on execution, volume revival and success in new ventures, marking its transformation from a commodity-focused exchange to a diversified market institution.

Further, we explain how NCDEX works, its business model and why it matters in the long run, in simple and practical terms.

What Does NCDEX Do?

NCDEX operates as India’s leading agriculture-focused commodity derivatives exchange. It is a SEBI-regulated electronic commodity derivatives exchange, headquartered in Mumbai. Established in 2003, it's a government company under the ownership of the Ministry of Finance, Government of India.

Its business can be understood across the following key segments:

1) Agricultural Derivatives Trading Platform

NCDEX provides a transparent, nationwide electronic platform for trading futures and options contracts in agricultural commodities such as pulses, oilseeds, spices and other agri products.

This segment enables farmers, FPOs, traders, processors and institutional participants to hedge price risks and participate in orderly markets.

2) Price Discovery & Risk Management

Prices discovered on NCDEX are widely used as benchmarks across the agri value chain. These prices help market participants:

Plan production and procurement

Handle price volatility caused by weather, supply changes and policies

This is the core purpose of the exchange.

3) Market Infrastructure & Regulation

NCDEX does not trade commodities itself. Instead, it provides:

Trading technology and systems

Contract design and market monitoring

Clearing, settlement and risk controls

All activities are conducted under the strict regulation of the Securities and Exchange Board of India (SEBI), ensuring trust, transparency and market stability.

Management & Leadership

Mr Ashish Bahuguna – Chairman

Ashish Bahuguna is a former senior Indian bureaucrat with decades of experience in public policy, agriculture and market regulation.

He has previously served as Secretary, Ministry of Agriculture and also Chairman of the Food Corporation of India (FCI). His background gives NCDEX:

Deep understanding of India’s agricultural ecosystem

Strong grasp of government policy and reforms

Institutional credibility in dealing with regulators and policymakers

Mr Arun Raste – Managing Director & Chief Executive Officer

Arun Raste has over 30 years of experience across diverse sectors, including BFSI, corporate and social development. He holds an M.A. in Economics with postgraduate diplomas in Marketing, Communications & Journalism

He has previously served as Executive Director at NDDB and as a board member at Indian Immunologicals, Mother Dairy, and IRMA. He brings wide experience across banking, agriculture and financial inclusion, having worked with IDFC First Bank, Kotak Mahindra Bank, and NABARD.

He has also represented India at global policy forums and participated in international leadership and sustainability programmes.

Mr Atul Roongta – Chief Financial Officer

Atul Roongta has over 27 years of experience in finance, consulting and investment banking. He is a qualified chartered accountant from the Institute of Chartered Accountants of India.

He is a former Chief Operating Officer of BOI AXA Investment Managers and has worked with Bharti AXA Life Insurance Company Limited and KPMG Advisory Services Private Limited.

He oversees NCDEX’s financial strategy, capital management and reporting.

Mr Hoshi D. Bhagwagar – Company Secretary

Hoshi D. Bhagwagar holds a Bachelor's degree in Commerce from the University of Mumbai and a Bachelor's degree in Law from the same institution. He is a qualified company secretary and a member of the Institute of Company Secretaries of India.

He has previously worked with The Bombay Burmah Trading Corp. Ltd, Infiniti Retail Ltd, Oracle Financial Services, ICICI Bank Ltd, The Bombay Stock Exchange Limited & Deutsche Bank. He has nearly three decades of work experience in company secretarial affairs, governance, compliance, ethics, and stakeholder management across various domains.

He is responsible for corporate governance, regulatory compliance and board processes. For an exchange business, this function is essential in maintaining market trust and institutional integrity.

NCDEX Financial Performance Analysis

Particulars (In Rs Crore) | FY23 | FY24 | FY25 |

Revenue | 135.6 | 136 | 122.1 |

Revenue Growth | -12.20% | 0.30% | -10.20% |

EBITDA | -34 | -25.2 | -48.9 |

EBITDA Margin | -25.10% | -18.50% | -40.00% |

Profit After Tax | -42.4 | -27.7 | 236.1 |

Net Margin | -32.40% | -19.90% | 192.20% |

Earnings Per Share | -8 | -5.1 | 46.86 |

Outstanding Shares | 5.1 | 5.1 | 5.1 |

A) Revenue Trend Over 3 Years

NCDEX’s revenue has remained largely flat to declining over the last three years, from Rs 135.6 crore in FY23 to Rs 122.1 crore in FY25.

This reflects lower trading volumes and muted participation in agricultural derivatives during this period.

B) EBITDA Performance

NCDEX has reported negative EBITDA across all three years, from -Rs 34 cr. in FY23 to -Rs.48.9 cr. in FY25.

This indicates that the exchange has not yet reached operating scale, where revenues can comfortably cover its fixed cost base.

C) Operating Margin (EBITDA Margin)

Operating margins have remained under pressure, from -25.1% in FY23 to -40% in FY25.

The sharp decline in FY25 indicates that costs remain high while volumes soften, a common challenge for exchange businesses during periods of low activity.

D) Profit After Tax (PAT)

NCDEX reported losses in FY23 (-Rs 42.4 cr) and FY24 but posted a sharp profit in FY25 (Rs 236.1 cr).

However, this FY25 profit is driven by non-operating or exceptional items, not core exchange operations.

E) Earnings Per Share (EPS)

EPS was negative in FY23 (Rs.8) and FY24 (-Rs.5.1). In FY25, EPS jumped to positive Rs. 46.86 per share.

While this looks strong on paper, the EPS surge is not backed by operating profits, making it less reliable as a long-term indicator unless core volumes improve.

NCDEX’s financials show:

A strong and essential business model

But weak operating performance due to low trading volumes

FY25 profits are one-time in nature, not recurring

Long-term improvement depends on growth in agri-derivatives participation

NCDEX is a structurally important exchange, but its financial performance will meaningfully improve only when trading volumes rise and operating leverage kicks in

NCDEX Share Price Analysis

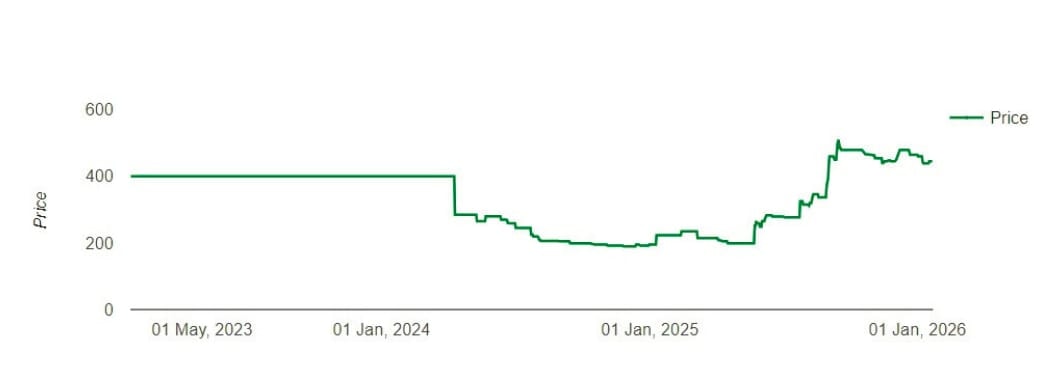

Over the last two years, NCDEX’s unlisted share prices were around Rs 400 to Rs 420 in FY23 and slipped sharply to nearly Rs 200 to Rs 220 in FY24, when agri derivative volumes were hit by trading bans and operating losses widened. That phase reflected real business pain, not speculation.

But from mid-FY25, the stock recovered to the Rs 450 to Rs 500 range, even though operating revenues fell 10% YoY to Rs 122.1 crore in FY25. This rebound wasn’t due to core earnings, but rather to future visibility. Markets began factoring in NCDEX’s transformation plan rather than its temporary slowdown.

From a valuation perspective, FY25 reported a net profit of Rs 234 crore, but that came largely from one-time stake sales (NERL and PXIL). This is why the current P/E of 9.7 appears low, but this is largely influenced by one-time gains in FY25.

That’s also why for an exchange business like NCDEX, P/B and future earnings potential matter more than near-term profits (P/E). At around 3× book value, the stock is being valued for its regulatory licence, network effects and scalability, not its current margins.

At a market cap of roughly Rs. 2,400 to 4,000 cr, NCDEX is being valued not for what it earned last year, but for what it could become.

What truly supports the current valuation is optionality:

Expansion into mutual fund distribution

Planned entry into equity and equity derivatives

Overseas foray into Sri Lanka’s derivatives exchange

At the same time, risks remain. Core agri derivative volumes are still recovering, operating profits are yet to stabilise, and new segments will require execution discipline and time to scale.

Also Read: NCDEX Shows Steady Balance Sheet Despite Low Agri-Trade Activity

NCDEX Recent Projects And Future Plans

A)Aquiring 20% Stake in Sri Lanka's Commodity Exchange

NCDEX plans to acquire a 20% stake in Sri Lanka’s first commodity and financial derivatives exchange, marking a rare overseas equity move by an Indian exchange. The partnership will see NCDEX provide technology, product design, and regulatory expertise, strengthening India’s presence in South Asia’s exchange ecosystem. This strategic step comes as NCDEX looks to diversify beyond domestic agri volumes and expand regionally.

B)Launching Mutual Funds Platform

NCDEX has received in-principle approval from the Securities and Exchange Board of India (SEBI) to launch a mutual fund transaction platform, marking a shift beyond its commodities-only identity.

The move is seen as a strategic entry point ahead of NCDEX’s planned equity trading launch in 2026, helping it diversify revenue streams. By targeting rural and first-time investors, NCDEX is positioning itself as a broader financial market institution.