Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

After years of regulatory hurdles and speculations, SEBI has finally given a nod to the NSE IPO. The regulator has given a No Objection Certificate (NOC) to NSE, which means the exchange can finally move forward with filing its Draft Red Herring Prospectus (DRHP) by end of January 2026.

This NSE news came after a long wait of 10 years, during which SEBI did not permit India’s largest exchange until issuing an NOC on Friday, January 30, 2026.

The Long Wait Of NSE IPO: Why Does This NOC Matter?

Unlike other companies, market infrastructure institutions like stock exchanges, depositories and clearing corporations must secure a No Objection Certificate (NOC) from SEBI before filing their draft red herring prospectus (DRHP).

The NSE IPO has been one of the most awaited IPO in the last decade. In 2015, NSE filed its draft papers with SEBI for its IPO. But SEBI raised certain governance issues with NSE, like the colocation issue and other issues, which were flagged by SEBI.

Hence, NOC was a mandatory requirement as well as a hurdle delayingthe NSE IPO.

NSE Chairperson Srinivas Injeti Confirms NOC

SEBI Chairman Tuhin Kanta Pandey had earlier hinted that the regulatory body has given in principle approval for the NOC to come by the end. of the month.

Now Reuters has confirmed that NSE has received regulatory approval. NSE Chairperson Srinivas Injeti stated, “We are delighted to receive Sebi approval for our IPO, a significant milestone in our growth journey. With SEBI’s approval, we embark on a new chapter of value creation for all our stakeholders. This approval also reinforces confidence in NSE being an integral part of the Indian economy and a beacon of Indian capital markets”

Is NSE IPO Coming In 2026?

NSE was yet to start the IPO process. But after this confirmation, the exchange can start the following process

1.The next step is filing the Draft Red Herring Prospectus (DRHP), detailing NSE’s financials, governance framework, risk factors, and IPO structure.

2. The issue is expected to be largely an Offer for Sale (OFS), allowing existing shareholders to dilute stakes rather than raising fresh capital.

3. SEBI will then conduct a detailed review of the DRHP, with focus on governance history, revenue concentration, regulatory risks, and technology resilience.

4. Post SEBI observations, NSE will file the Red Herring Prospectus (RHP) and announce price bands and issue timelines.

5. Roadshows, anchor investor allocation, and public subscription will follow this.

7. Successful completion would lead to listing, marking one of India’s most significant capital market events in recent years.

NSE CEO Ashish Chauhan stated that it will take 3-4 months for NSE to prepare DRHP documents, including offer for sale (OFS). The IPO process is expected to take approximately 8-9 months.

Also Read: “NSE IPO May Take 8-9 Months” MD Ashish Chauhan.

Will NOC Effect NSE Unlisted Share?

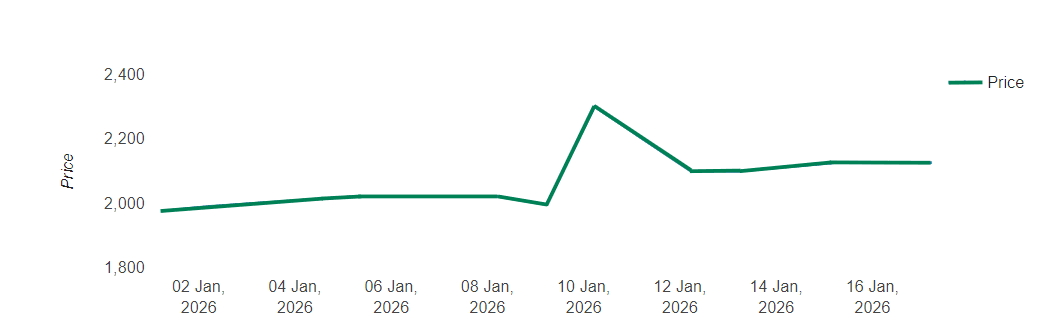

The NSE Unlisted Share has remained stable for the last 1 month. While the NSE unlisted share has always remained a significant interest for investors, the recent NSE news of the NOC update can attract further investor interest, which can be a potential developing opportunity for investment.

The share has remained stable, trading around Rs 2,000 inthe last month.

Is It Possible to Invest in NSE Before IPO?

Although NSE is not listed on any stock exchange, NSE Unlisted shares are actively traded in the private unlisted market. You can buy an NSE unlisted share through Stockify.