Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

IPO bound National Stock Exchange (NSE) released its FY26 Q1 Financial Statements, reporting a 14% YoY rise in Profit After Tax. However, at the same time, we observed a dip in total income year-over-year for Q1.

Let's analyse the financial aspects of the latest NSE Q1FY26 results.

Particulars | Q1 FY 26 | Q1 FY 25 | Growth YoY% | FY 25 |

Total Income | 4,798 | 4,950 | (3%) | 19,177 |

Revenue from operations | 4,032 | 4,910 | (11%) | 17,141 |

Total Expenses (Including contribution to Core SGF) | 1,053 | 1,530 | (31%) | 5,040 |

Operating EBITDA | 3,130 | 3,106 | 1% | 12,647 |

EBITDA Margin | 78% | 69% | - | 74% |

PAT | 2,924 | 2,567 | 14% | 12,188 |

EPS | 11.81* | 10.37* | - | 49.24 |

*Not Annualised.

Revenue from operations declined 11% YoY from Rs 4,510 crore in Q1FY25 to Rs 4032 crore in Q1FY26. A major factor contributing to this reduction can be the negative market sentiment, primarily driven by US trade tariffs under President Trump.

Total income of the stock exchange remained almost stable (with a 3% decline YoY), as NSE's other income from investments jumped by 41% from Rs 436 crore in Q1FY25 to Rs 616 crore in Q1FY26.

The operating EBITDA didn't change, but the EBITDA margin saw an improvement from 69% in Q1FY25 to 78% in Q1FY26.

PAT grew by 14% YoY from Rs 2,567 in Q1FY25 to Rs 2924 crores in Q1FY26.

The Quarterly EPS grew by almost 14% YoY from Rs 10.37 per share in Q1FY25 to Rs 11.81 in Q1FY26.

Check here for the full presentation document by NSE (Click Here).

F&O Transactions Decline

The F&O transactions charges, which are one of the main sources of NSE's operational revenue, saw a decline by 14% YoY as NSE collected only Rs 3,150 crores in Q1FY26 as compared to Rs 3,653 crores in Q1FY25. Despite this, average daily turnover in the F&O segment rose 39% YoY to ₹360 lakh crore. (Source: Mint).

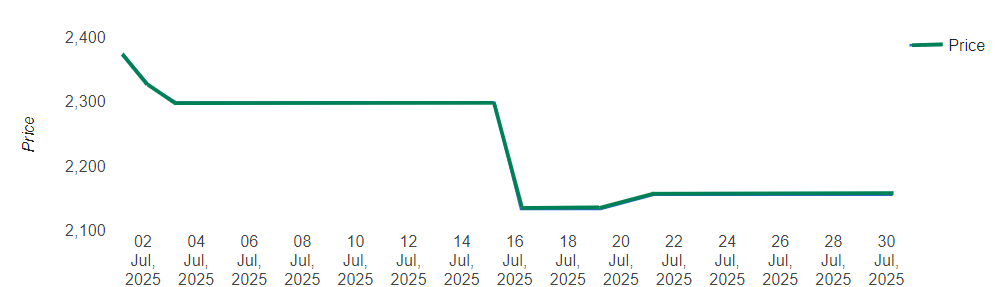

NSE Unlisted Share Price Declines 6% One Month

The NSE Share price has declined by 6% in the unlisted market, from Rs 2,375 per share to Rs 2,243 per share. However stock has risen by 14% in the last 6 months. So the overall trend is upwards.

How can these results impact investor sentiments?

With the IPO around the corner, these results will be viewed positively by investors. The scale on which NSE is operating, as well as its duopoly status, has always been a positive factor for the rise of NSE Pre-IPO Shares. However, we will always advise investors to do thorough research before making any investment decision.