Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

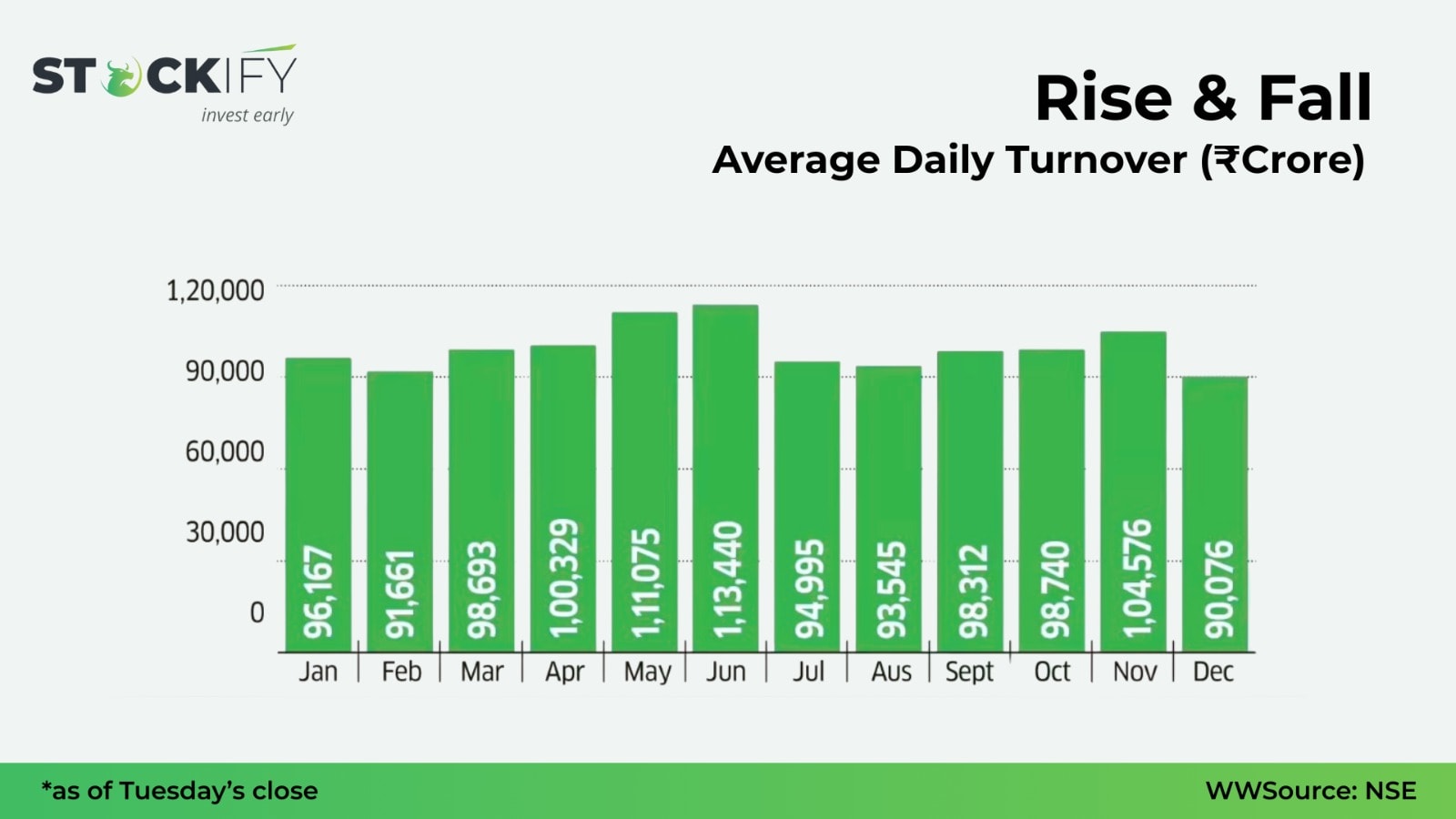

Indian equity markets are facing a growing disconnect between headline index levels and on-ground activity. As reported by The Economic Times, NSE turnover has dropped to its lowest level in nearly two years, even as benchmark indices touched record highs earlier this month. Average daily cash market volumes declined to Rs. 90,076 crore in December, down from Rs. 1,04,576 crore in November.

The slide in trading activity has coincided with a visible weakening in investor confidence. NSE turnover has fallen to an average daily level of Rs. 90,076 crore in December, a two-year low, down from Rs. 1,04,576 crore in November, even as benchmark indices remained near record levels.

Source: NSE Market Data

The decline in activity came despite the Sensex and Nifty hitting all-time highs on December 1, before slipping about 2% from those peaks. What has stood out is not the price movement but the lack of broad participation. Trading interest has continued to weaken, suggesting that index strength is masking stress across large parts of the market.

Concentrated Gains Mask Broader Market Weakness

Market participants point to the increasingly concentrated nature of recent gains. Data shows that just 10 large-cap stocks accounted for nearly 65% of the Nifty’s gains in 2025. Outside these names, performance has remained subdued. The Nifty Smallcap 250 index is down 8% year to date, while the Nifty Midcap 150 has posted limited gains and slipped in recent weeks.

Despite record index levels, returns at the portfolio level have remained weak for many investors. Retail ownership of NSE-listed companies rose to a 22-year high of 18.75 %in the September quarter. Yet, trading activity from this segment is estimated to be down about 20% year on year, as losses in mid- and small-cap stocks reduced risk appetite and led to churn.

At the same time, foreign portfolio investors have continued to pare exposure, with net outflows of about Rs. 1.6 lakh crore in 2025 amid valuation concerns, currency weakness, global policy uncertainty, and higher US interest rates. While domestic institutional investors have absorbed much of this selling to support market levels, their participation has been largely stabilising rather than volume-generating, contributing to lower NSE turnover despite higher participation on paper.

Regulatory Changes and Lower Risk Appetite

Regulatory changes have also played a key role in reducing activity. Higher transaction taxes, increased margin requirements, removal of volume-linked incentives, and larger contract sizes have sharply reduced futures and options participation. Monthly derivatives turnover has fallen by nearly half over the past year, removing a major driver of daily trading volumes.

Low volatility has added to the slowdown. The India VIX has remained close to 13, signalling limited price movement and fewer short-term trading opportunities. In such an environment, both traders and institutions tend to reduce activity, as the scope for quick gains narrows.

Investors Are Facing Valuation Sensitivity

At the same time, investor attention has shifted toward the primary market. A strong IPO pipeline has drawn capital away from secondary market trading, particularly among high-net-worth investors seeking listing gains. However, valuation concerns have tempered enthusiasm around several recent offerings.

Tata Capital’s IPO in October 2025 is a key example. The issue was priced at around 35 times earnings at the upper band of Rs. 326, compared with an industry average closer to 24 times. Lenskart’s IPO followed a similar pattern, attracting strong demand but listing largely flat. Market participants say this combination of capital moving to IPOs and sensitivity to pricing has further weighed on secondary market activity and NSE turnover.

What It Means for Brokerages and the Exchange

The slowdown in trading activity is beginning to reflect in brokerage earnings. Lower cash market volumes and a sharp decline in derivatives trading have put pressure on margins, with industry net margins estimated to have fallen by about 400 basis points. Revenue growth has cooled from the pace seen over the past three years, and near-term earnings are expected to remain subdued.

For the exchange itself, sustained volume trends remain an important factor for investors tracking the NSE Unlisted Share Price. Market participants note that while index levels provide visibility, long-term valuation for exchange businesses is closely tied to transaction volumes, product mix, and the breadth of participation.

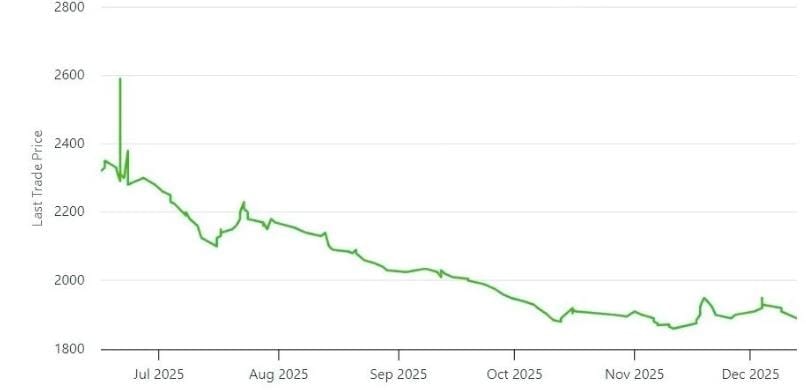

NSE Unlisted Share Declines Almost 20% In 6 Months

NSE unlisted share price has corrected sharply in recent months, reflecting the broader slowdown in market activity and declining trading volumes. After trading above Rs 2,400 in mid-2025, the share has steadily trended lower, currently hovering around Rs 1,931 per share. This decline mirrors the fall in NSE cash market turnover to a two-year low of about Rs 90,076 crore in December, despite benchmark indices remaining near record highs. Weak participation beyond a handful of large-cap stocks, reduced derivatives activity due to regulatory changes, and sustained foreign investor outflows have weighed on sentiment. As exchange valuations are closely linked to volumes and participation, the muted turnover environment has directly impacted the NSE unlisted share price.

A Market in Consolidation, Not Retreat

Despite current challenges, analysts view this phase as one of consolidation rather than contraction. Trading volumes have historically recovered as earnings visibility improves and participation broadens. A return of foreign investor flows, stronger corporate results, and wider engagement beyond a narrow group of large-cap stocks could gradually lift activity.

For now, confidence remains selective. The indices continue to hold up, but turnover trends suggest the market is still searching for broader conviction. As conditions stabilise, both NSE turnover and sentiment around the NSE Unlisted Share Price are likely to reflect a more balanced and sustainable recovery rather than a sudden surge.