Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

Options trading has gained popularity and has become the biggest revenue source of the National Stock Exchange(NSE). In the last couple of years, the trading trend has changed, and investors prefer those investing methods that are less risky and provide higher returns. Options trading has been done in the Indian Derivative Market and contributes around 75% of NSE trading revenue. The daily turnover at NSE F&O trading surpasses 4 lakh crore, out of which ¾ comes from options trading.

Undoubtedly, this trading trend brings new investors and builds trust among experienced ones. NSE comes among the top stock exchanges for trading equity and currency derivatives. Since a large number of contracts trade the index options daily, the revenue of the National Stock Exchange also increases with every successful trade. Its direct impact can also be seen on the NSE unlisted shares traded in the Pre-IPO market. Let's see how options trading contributes to a major portion of NSE revenue and how you can benefit from it.

What Exactly Is Options Trading?

To understand Options Trading, let's break it down into "Options" and “Trading. Options is a form of derivative contract that provides the buyer(an owner of a contract) to buy or sell a security at a fixed price in the future. The "trading" here means buying or selling these contracts in the stock market exchange.

These options are generally divided into "call" and "put" contracts which imply two different things. With the call option, buyers have the right to purchase the underlying assets at the predetermined price in the future. However, with the put option, a buyer has acquired the right to sell the underlying assets at the predetermined price in the future.

Impact Of Options Trading On NSE

The massive revenue growth of NSE from options trading gives investors a way to put their hard-earned money in the stock exchange. Most investors don't know the difference between NSE and BSE, which are India's prominent stock exchanges. NSE vs BSE has differences in the functioning of options trading and the price of each stock exchange from investors for trading equity options.

If we see the NSE's revenue contribution by option trading category before the pandemic, it was around 25-30%, which increased to 36% at the current date. The other aspect of this is that NSE is less priced than BSE on cash market trade, and NSE charges Rs 32-34.5 for every traded value of million rupees whereas BSE charges Rs 37.5 for the same value. For premium equity options, NSE charges Rs 25,000 for the first 30 million and Rs 330-530 compared to the BSE's Rs 250 for the same equity options.

Stock Exchange Board Of India(SEBI) also stated that the number of traders in the equity F&O segment also rose 500% at the end of FY2022. In number, NSE reported 4.5 million traders, which was 7.1 lakhs in FY2019. It clearly shows the impact of option trading in bringing new investors and generating a whopping revenue for NSE.

Apart from this, the national stock exchange also gained a massive share in the cash market, which increased from 83% in FY13 to 93% in FY22. The cash equity volume also saw a sudden spike due to options trading, due to which NSE grew at the CAGR of 18%, which is 20 times over the past 20 years. The recent data showed that NSE has 70 million new investors registered with it. Of these, 34 million are those investors who have remained active and participated in options trading at least in the past 12 months.

After the pandemic, NSE’s revenue increased along with the number of its investors. In all these, options trading remains the best-performing category, contributing to ¾ of NSE revenue. As a result, NSE unlisted shares also perform well and give retail investors an opportunity for long-term returns.

Overview Of NSE Unlisted Shares

Many investors trust NSE for trading, and this number keeps growing faster. With the popularity of NSE, a public company, its unlisted shares also show exceptional growth in the past few years. NSE unlisted shares are available for trading in the Pre-IPO market and retail. Institutional investors can buy or sell it with the help of an unlisted shares brokerage platform. Here are some crucial details of the NSE unlisted shares:

| About NSE unlisted shares | Value |

| Lot Size | 100 shares |

| Face Value | Rs 1 per equity share |

| Total Available shares | Not disclosed |

| Market Cap | Rs 1,70,000 |

| Current unlisted share price | Rs 3400 per equity share |

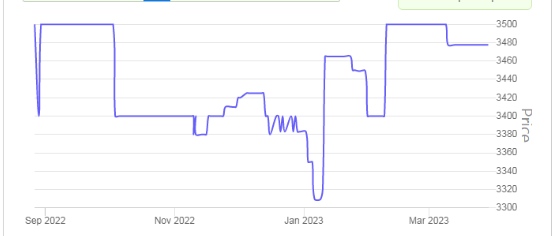

The performance and NSE unlisted share price are interrelated and determine how much an investor can earn in return. Here is the recent graph of NSE share price:

The price of NSE unlisted shares fluctuated in the last year. During FY22, the share dipped to its lowest value in January 2023( Rs 3310). However, after that, it grows steadily and is currently at Rs. 3275. The price and other performance metrics of the NSE give a clear indication that it is the best time to buy NSE unlisted shares. Various market conditions like EBITDA (64.9%), PAT(Rs. 510 crores), and dividend percentage(1.3%) also favour that the NSE share price is expected to go higher in the coming years.

Invest In NSE Unlisted Shares With Stockify

There is always a risk associated with an investment, and investors must conduct research about the company before buying unlisted shares. Getting the key metrics and financial data of unlisted companies is never easy. Stockify is India's most trusted online unlisted shares brokerage firm that provides access to trending unlisted shares along with their complete financial reports in different fiscal years. Here, you will get the updated NSE unlisted share price along with financial metrics like EBITDA ratio, revenue, PAT, etc. Connect with us to start in top blue chip stocks now!