Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

OYO is preparing to launch its IPO. The hospitality start-up plans to file a DRHP (Draft Red Herring Prospectus) with SEBI. OYO IPO aims to raise ₹8,430 crores. This will include an offer for sale of about Rs. 1,430 crores and a fresh issue equity share sale of Rs. 7,000 crores.

Let’s explore various aspects of the Oyo IPO from an investor’s point of view:

OYO IPO Details

OYO IPO Price Band: OYO IPO is a book-built issue which is expected to be announced near the IPO date. When the IPO opens, interested investors can choose the price given within the price band to apply for an IPO.

OYO IPO Listing Date: OYO's IPO is expected to be in the first week of March 2025. As of now, the open date and close date are not yet finalised.

OYO IPO Issue Size: OYO aims to raise ₹8,430 crores. This will include an offer for sale of about Rs. 1,430 crores and a fresh issue equity share sale of Rs. 7,000 crores.

OYO IPO – About The Company

OYO is a leading, new-age technology platform empowering the large yet highly fragmented global hospitality ecosystem. It started in 2012 as Oravel Stays and later rebranded as OYO Hotels and Homes. OYO is one of the popular Indian startups founded by Ritesh Agarwal.

The hospitality start-up became profitable for the first time in FY 23-24. Oyo has expanded globally, adding its hotel chains in Europe, the UAE, and the USA.

OYO Financial Performance

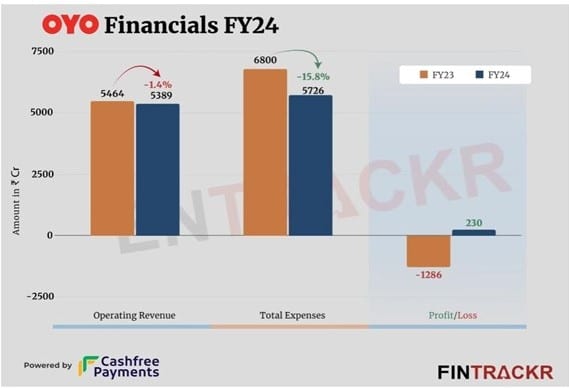

Source: FINTRACKR

Oyo has become profitable for the first time in FY24. The start-up posted a consolidated profit of Rs 141.2 crore. This is a major reversal from the Rs 1,286 crore loss reported in FY 23.

Oyo’s cost-cutting has been one of the major reasons for gaining profitability in FY 24

The company slashed its operating expenses by 8% from Rs 3137.27 crore in FY23 to 2885.44 crore in FY24.

Their employee costs were reduced by a whopping 51%, from Rs 1549 crores in FY 23 to Rs 744 crores in FY 24.

Finance costs increased by 23% to Rs 843.81 crores from Rs 681.6 crores in FY23. This can be due to the possible refinancing of its loan & bonds done last year.

Depreciation and other expenses were also reduced by 28% & and 8%, respectively.

Thus Oyo's Profit in FY 24 is a direct result of its cost-cutting measures

Also Read: Oyo Financial Performance Analysis FY 23-24

A Quick Look At OYO IPO's Risk & Strengths

Risk Factors

Impact of the Covid-19 pandemic on the travel industry.

Negative cash flows from operating activities in prior years.

The company has incurred net losses in each year since incorporation.

A substantial amount of debt in the past

No control over or ability to predict the actions of our patrons, customers, and other third parties, such as neighbors or invitees, during a customer's stay

Any adverse outcome in legal proceedings involving Zostel may affect the business.

The company is currently involved in a matter before the Competition Commission of India.

There is pending litigation against the company, certain subsidiaries and directors, and promoters.

Strengths

Largest footprint in terms of hotel storefronts in India and SEA

Second largest footprint in Europe in terms of home shopfronts among full-stack short-stay accommodation players, according to RedSeer.

Asset-light business model and a lean cost structure: the company does not own the storefronts listed on its platform

Two flagship Patron applications – Co-OYO and OYO OS

An increase in Patron satisfaction score from 30.1% for the three months ended September 30, 2020, to 72.3% for the three months ended March 31, 2021

Unit economics, measured based on Contribution Profit, has improved from 5.1% in Fiscal 2020 to 18.4% in Fiscal 2021

The proportion of hotel and home shopfronts with minimum guarantees or fixed payout commitments from the company has decreased from 14.7% in Fiscal 2019 to 0.1% in Fiscal 2021.

How to Buy OYO Shares Before IPO?

Currently, Oyo is not listed on the stock market. However, investors can buy pre-IPO shares and own Oyo shares before they get traded in the listed market.

Interested investors can buy Oyo unlisted shares by clicking here. Investors can check the details of other pre-IPO shares at Stockify.

Oyo IPO FAQs

Q1: Is OYO getting listed in the stock market?

Oyo has filed its DRHP (Draft Red Herring Prospectus) with SEBI, and it is estimated to be listed by March 25.

Q2: Why did OYO withdraw the IPO?

Oyo withdrew its application due to material changes in finance and its plan to raise money privately.

Q3: Is it legal to buy unlisted shares of OYO in India?

Yes, this is 100% legal and safe to buy unlisted shares of Oravel Stays Ltd (OYO Rooms). However, this is applicable when you buy Oravel Stays Ltd (OYO Rooms) unlisted shares from reliable and known unlisted share dealers. You can request a quote or trade online at Stockify; we are ready to assist you.