Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

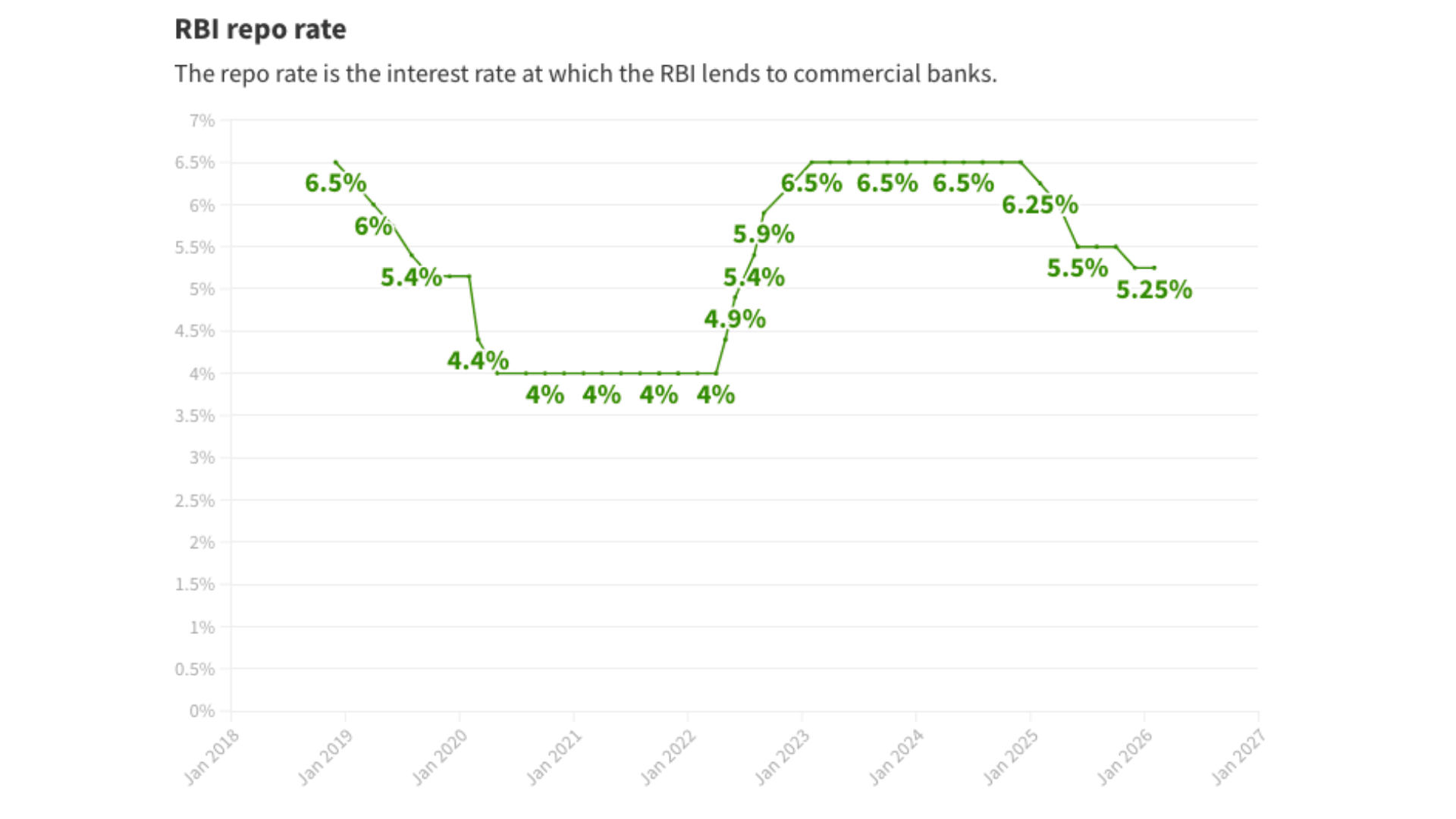

After the aggressive rate cuts From February 2025, RBI keeps the repo rate unchanged at 5.25%. In the RBI Monetary Policy Committee (MPC), 20 economists thought there would be a pause and 10 thought there would be a 25 basis point cut.

But the governor confirmed that they are being careful to watch inflation trends and the market during global economic uncertainties.

The current situation demands eyeing on inflation trends, geopolitical situations, and domestic indicators before taking any more policy action for RBI repo rate today.

Source: Minutes of Monetary Policy Meetings, RBI

What is a Repo Rate?

The interest rate that the Reserve Bank of India levy on commercial banks in India for borrowing money is Repo Rate.

Altering the repo rates is a standard measure the government takes to control inflation in a country. For borrowing, the banks have to provide collateral as a security and pay interest at the repo rate.

The repo rate today of 5.25% influences other key rates in the financial system: the standing deposit facility (SDF) rate at 5.00% and the marginal standing facility (MSF) rate and bank rate at 5.50%.

Today RBI Repo Rate remains Unchanged- What does it Mean?

The weighted average lending rate (WALR) of Scheduled Commercial Banks fell by 105 basis points. And similarly, the weighted average domestic term deposit rate (WADTDR) on new deposits fell by 95 basis points. (Source: RBI Press Release Dt. 6.2.26)

But now the RBI's decision to keep rates at 5.25% provides borrowers, especially those with floating-rate home loans, greater stability and predictability.

When the repo rate changes, it has an impact on borrowing costs, spending habits, and the economy as a whole in India.

For Borrowers:

When the repo rate decreases, banks typically reduce the rates which they charge for loans, making home loans, personal loans, and business loans cheaper.

On the other hand, when rates go up, borrowing costs go up, which means that people with floating-rate loans have to pay more in EMIs.

For Savers:

Lower repo rates usually mean that savings accounts and fixed deposits earn less interest, while higher rates mean that depositors get more money back.

On Economic Growth:

Lowering interest rates makes credit more accessible, which encourages people to spend and invest. Raising interest rates, on the other hand, keeps inflation in check. The RBI uses 5.25% repo rate today as a mechanism to keep prices stable while still reaching its growth goals.

How Much Borrowers Have Already Gained from Past Repo Rate Cuts

The effect has been significant for people who borrow money to buy a home. The study found that people who took out a ₹40 lakh home loan over 20 years could save more than ₹7.43 lakh in interest payments as rates kept falling.

Particulars | Original Loan | Lower Rate, Lower EMI |

Loan | ₹ 40,00,000.00 | ₹ 40,00,000.00 |

Tenor | 240 | 240 |

Rate | 8.50% | 7.25% |

EMI | ₹ 34,712.93 | ₹ 31,614.94 |

Total Interest | ₹ 43,31,103.04 | ₹ 35,87,609.46 |

Interest Saved | ₹ 0.00 | ₹ 7,43,493.58 |

EMI Saved | ₹ 0.00 | ₹ 3,097.89 |

Monthly EMIs have decreased by almost ₹3,097, which is a big help for families. At a time when demand for real estate is still high in major urban areas, the rate cuts have made housing more affordable.

Borrowers who took out floating-rate loans or refinanced during this easing cycle have seen their interest costs go down over time. This has made it easier for them to pay off their debts and given them more money to spend on other things or invest. (Source: MoneyControl)

Conclusion

This decision to keep the RBI repo rate unchanged is influenced with the aim to prioritise stability amidst the vast global uncertainties. The governing body acknowledges the domestic growth and controlled inflation.

More to see what is in the repo rate cut in the first quarter.

For more details on financial investment visit Stockify.

FAQs

What is the current RBI repo rate in India?

The RBI repo rate is still 5.25%.

Why didn't the RBI change the repo rate in February 2026?

The RBI repo rate stays the same keeping in mind inflation and global uncertainties.

How much has the repo rate dropped in the past year?

A total of RBI repo rate cut by 125 basis points has been observed from February 2025 to December 2025, .

Will the EMIs on home loans go up or down after the RBI's decision in February 2026?

The floating-rate home loan EMIs should stay the same as the repo rate remains the same.