Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

The much-awaited SBI Mutual Fund IPO is moving closer to reality. Fresh reports suggest that SBI Funds Management Ltd, the investment manager of SBI Mutual Fund, may file its Draft Red Herring Prospectus (DRHP) by March 2026 through conifidential route. According to recent market updates, SBI Mutual Fund plans to file IPO papers mid-March, reinforcing expectations that the listing process is entering its final preparation phase.

C S Setty, chairman of the State Bank of India, said on February 20 that SBI Mutual Fund is planning to submit its draft red herring prospectus for a public issue by March. He added that the sbi amc ipo is targeted for stock market listing by September.

This update has renewed investor interest, as the IPO is expected to be one of the largest asset management company listings in India.

SBI Mutual Fund IPO Details

According to market sources, the issue size of the SBI Mutual Fund IPO is expected to be around Rs.12,500 crore. The IPO is likely to be dominated by an Offer for Sale (OFS), allowing existing shareholders to partially monetise their holdings rather than raising fresh capital.

The company behind the IPO, SBI Funds Management Ltd, is jointly owned by State Bank of India and Amundi.

SBI MUTUAL FUND IPO GMP: At this stage, GMP (Grey Market Premium) trends are not yet relevant, as the IPO is still a few months away. Clearer signals on GMP are likely to emerge only after the DRHP is filed and pricing discussions begin.

Nine merchant bankers have reportedly been appointed for the issue, including both global and domestic names, indicating a large, institution-focused offering.

Also Read: SBI MF IPO Bankers Appointed For Rs 12,500 Crore Listing

SBI Mutual Fund IPO Date

While the final SBI Mutual Fund IPO date has not been officially announced, the expected timeline is:

DRHP filing: March 2026

IPO listing: Expected to be around September 2026 (subject to approvals)

This timeline aligns with earlier statements from SBI management indicating that the listing of SBI Mutual Fund would be completed within the next 12 months.

India’s Largest Asset Manager Prepares for a Historic IPO

SBI Mutual Fund is India’s largest asset manager by assets under management, backed by the State Bank of India.

The top shareholders of SBI MUTUAL Fund are SBI with its 62.2% holdings and Amundi India Holdings (one of Europe’s leading asset managers) with 36.5% of share holdings.

As India’s largest asset manager prepares to go public, investors will watch closely for updates on valuation, shareholding quota and final timelines once the DRHP is filed.

.png)

Will The Existing SBI Bank Shareholders Will Get Alloment In SBI MF IPO?

One of the most discussed aspects of the IPO is the shareholding quota. Market buzz suggests that existing SBI shareholders may get a reserved quota in the IPO, similar to earlier PSU-linked listings.

While this has not yet been officially confirmed by SBI or SEBI, such a quota, if announced, could significantly boost retail participation and early demand for the issue.

Who Are The Listed Peers Of SBI Mutual Fund?

Once listed, SBI Funds Management will join peers such as HDFC AMC, Nippon Life India AMC and UTI AMC.

Given its scale, brand strength and distribution reach, the market will closely watch:

Valuation benchmarks

Growth in AUM and profitability

Long-term earnings visibility

Recent Investments by SBI Mutual Fund

According to available shareholding data, SBI Mutual Fund holds equity stakes in around 44 listed companies, with a total investment value exceeding Rs. 2.75 lakh crore (based on the latest quarterly filings).

This is likely to show that the portfolio is well diversified across large cap, mid cap and small cap stocks, spanning multiple sectors such as financial services, pharmaceuticals, industrials and consumer businesses.

Here are some recent investments :

Restaurant Brands Asia Limited

SBI Mutual Fund acquired 50.85 lakh additional shares, raising its stake to 5.4272% of the company’s paid-up capital. This purchase pushed the holding beyond the 5% threshold, triggering mandatory disclosure under SEBI takeover norms.

Belrise Industries

Through a block deal, SBI Mutual Fund bought 5.12 crore shares of the company, alongside global investor BlackRock.The transaction was valued at approximately ₹788 crore and led to increased market interest in the stock.Biocon

SBI Mutual Fund earlier increased its stake to around 5%, indicating a steady accumulation strategy in the pharmaceutical major.Elgi Equipments

The fund house purchased 18.12 lakh shares in a bulk deal, a move that positively impacted the stock price at the time.

SBI Mutual Fund Unlisted Share Gives 20% Return In 1 Year

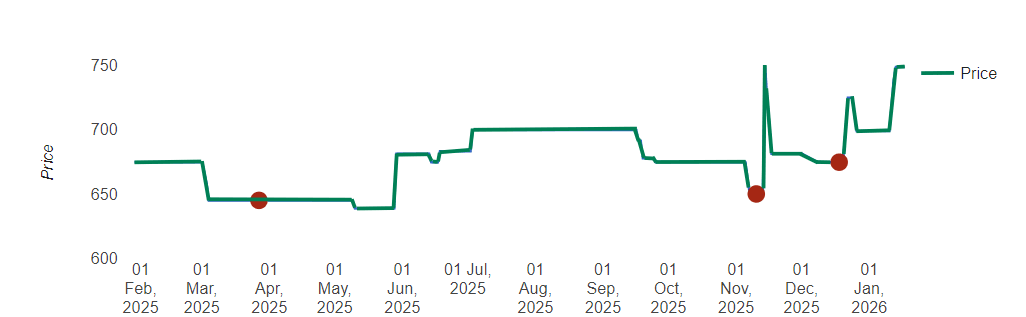

The SBI Mutual Fund unlisted shares have grown by 20% from Rs 674 in Jan 25 to Rs 814 by Jan 26. In the last 3 years, revenue grew at a healthy compound annual growth rate (CAGR) of around 33% between FY 2023 and FY 2025, while profits nearly doubled in the same period. Thus making it an attractive investment in the eyes of investors.

Also Read: How SBI AMC Share Price Grew 2.5 Times In 2 Years?

Frequently Asked Questions

What is the expected price band and lot size for the SBI MF IPO?

No official price band or lot size has been announced for the SBI Mutual Fund IPO, as the DRHP remains pending with SEBI.

What is the SBI Mutual Fund IPO Date?

The SBI Mutual fund IPO Date is likely to be September, whereas the DRHP is expected to be filed by March 2026.

What is the expected issue size and valuation of the SBI Mutual Fund IPO?

The estimates for the issue size range from Rs.12000 cr to Rs.12500 cr.