Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

Blackstoned-backed Ask Investment Managers have received an In-Principle Approval(IPA) from SEBI for their mutual fund business. This will complement Ask Investment's existing solutions, as they are a leader in the investment and wealth management space.

Ask Investment's Strategic Expansion

This development is an important step in Ask Investment's expansion plan, as they look forward to delivering a wide range of quality investment solutions. Their current offerings include :

A) Portfolio Management Services-

This includes tailoring the investment strategy to a range of clients to meet their financial goals and ensure their returns match their risk appetite.

B)Alternate Investment Funds(AIFs)-

AIF are an innovative alternative form of investment opportunities for diversification and enhanced returns that transcend conventional asset classes, exploring realms such as private equity, hedge funds, and real estate.

The mutual fund offering will complement their current solutions. Sunil Rohokale & Managing Director of ASK Asset & Wealth Management Group, stated, "We have received an in-principle approval for entering the mutual fund business. India’s investment landscape is evolving rapidly, and we see a tremendous opportunity to bring our research-driven, client-centric investment approach to a wider audience. We are confident that with ASK’s deep-rooted expertise and commitment to long-term wealth creation, and with our legacy of trust and performance, we will be able to offer differentiated products that cater to the diverse needs of investors. We look forward to establishing our AMC to meet SEBI’s final approval requirements"

About Ask Investment Managers & Philosophy

ASK Investment Managers is the flagship company of ASK Asset and Wealth Management Group. They focus on pure-play discretionary listed equity management.

The firm has introduced many industry-first initiatives, like being one of the first companies to secure a portfolio license in India. Also, AIF is the first company to set up operations in GIFT City for overseas investors. Their time-tested investment philosophy makes them the core of capital preservation and growth-focused portfolios.

Financial Overview Of Ask Investment

Amount(In Rs Crores) | FY 21-22 | FY 22-23 | FY 23-24 |

Revenue | 945.8 | 966 | 1120.7 |

EBITDA | 427.7 | 458.3 | 528.3 |

Profit After Tax | 314.4 | 335.8 | 402.6 |

Earning Per Share | 41.3 | 40.1 | 48.0 |

A) Revenue Growth in 3-year

Ask IM’s revenue has grown from Rs 945 crores in FY 21-22 to Rs 1120 crores in FY 23-24.This clearly reflects the growth of operations for Ask Investment Managers Ltd share price.

B) EBITDA

Ask IM’s EBITDA was Rs 427.7 crores in FY 21-22, which increased to 458.3 crores in FY 22-23. This further jumped in FY 23-24 to Rs 528.3 crores, growing in profitability.

C) Profit after Tax

Ask’s profit grew from 314 crores in FY22 to 335 crores in FY23. This recovered in FY24 to Rs 402.6 crores. Thus reflecting a strong prospect for growth in Ask Investment Managers Unlisted Shares.

D) Earnings Per Share

Ask gave an earnings of Rs 41 per share in FY22. This dipped in FY 23 to Rs 40. However, Ask IM made a comeback in FY 24 with 48 per share. Earnings per share and P/E Ratio effects affect the Ask Investment Managers unlisted share price.

Thus, based on the above financial observations, Ask Investment Managers unlisted sharescan give significant investment growth to investors.

Ask Investment Managers Ltd Share Price Analysis

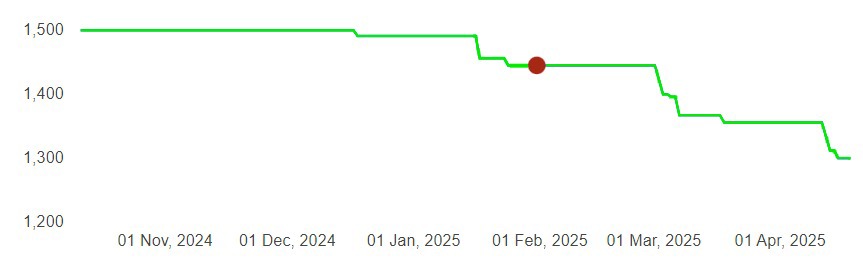

In October 2024, Ask Investment Managers Ltd share price was trading at Rs 1,499 per share. By March 25, the share price had gone down to Rs 1,355 per share. Currently, the Ask Investment Managers unlisted shares are trading at Rs 1470 per share.

Check Ask Investment Managers Ltd Share Price Today At Stockify

At Stockify, you get updated prices of Ask Investment Managers unlisted shares. Keeping oneself updated with the costs of unlisted shares makes buying and selling easy. Our experts possess a tremendous knowledge of the grey market, they update the prices whenever they change.

Join our Whatsapp Investor Community for regular Pre-IPO stock updates.