Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

Tata Capital sold its 2 subsidiaries, Tata Capital Forex Limited (foreign exchange) and TC Travel and Services Limited (travel services), to Thomas Cook India in 2017. Thomas Cook purchased these subsidiaries to strengthen its market share in travel services, a provider of foreign exchange services in India.

About the deal

In 2017, Thomas Cook faced multiple challenges due to the growing number of Indian startups in the sector, with companies like Yatra.com and Makemytrip quickly taking a huge share of the market.

To combat the pressure, it acquired Tata Capital’s two subsidiaries:

Tata Capital Forex Limited dealt with foreign exchange services

Tata Capital Travel and Services Limited used to provide travel-related services

The deal went through in December, but no financial details were shared.

Here’s what Mr. Madhavan Menon, Chairman & Managing Director, Thomas Cook (India) Limited said, “Our acquisition of Tata Capital’s Forex and Travel companies serves to further strengthen the Thomas Cook India Group’s leadership position in the Travel & Foreign Exchange sector in the country. This also allows us to continue to serve the strong corporate portfolio of both Tata Capital Forex Limited and TC Travel Services Limited – large corporate houses including flagship Tata Group companies; as well as a set of new retail customers. The acquisition creates clear opportunities, including a significant increase in scale and network reach, volume/ buying advantages as well as technology gains, all resulting in stronger customer service and stakeholder value.”

What happened to Thomas Cook post-acquisition of Tata’s travel and Forex segments?

After this deal, Thoma Cook Group, the British global travel company, faced financial difficulties and liquidated in September 2019. Since then, various assets of Thomas Cook have been acquired by different companies. However, Fairfax Financial Holdings Limited, through its wholly-owned subsidiary, Fairbridge Capital (Mauritius) Limited, and its controlled affiliates, holds 67.7% of Thomas Cook.

If we talk about India, then India’s travel sector scene has been fully changed, with Indian companies like Yatra and MakeMyTrip taking the lead. MMT holds a substantial 56.9 percent market share, with Cleartrip and EaseMyTrip trailing at 13.7 percent and 13.4 percent, respectively. Yatra.com captures 9.4 percent of the market, while ixigo accounts for 3.2 percent. So, Thomas Cook vanished completely from this Indian scene.

However, in forex services, Thomas Cook still appears to be among the top five companies, including Cox & Kings, BookMyForex, and FXKart.

What is the state of Tata Capital now?

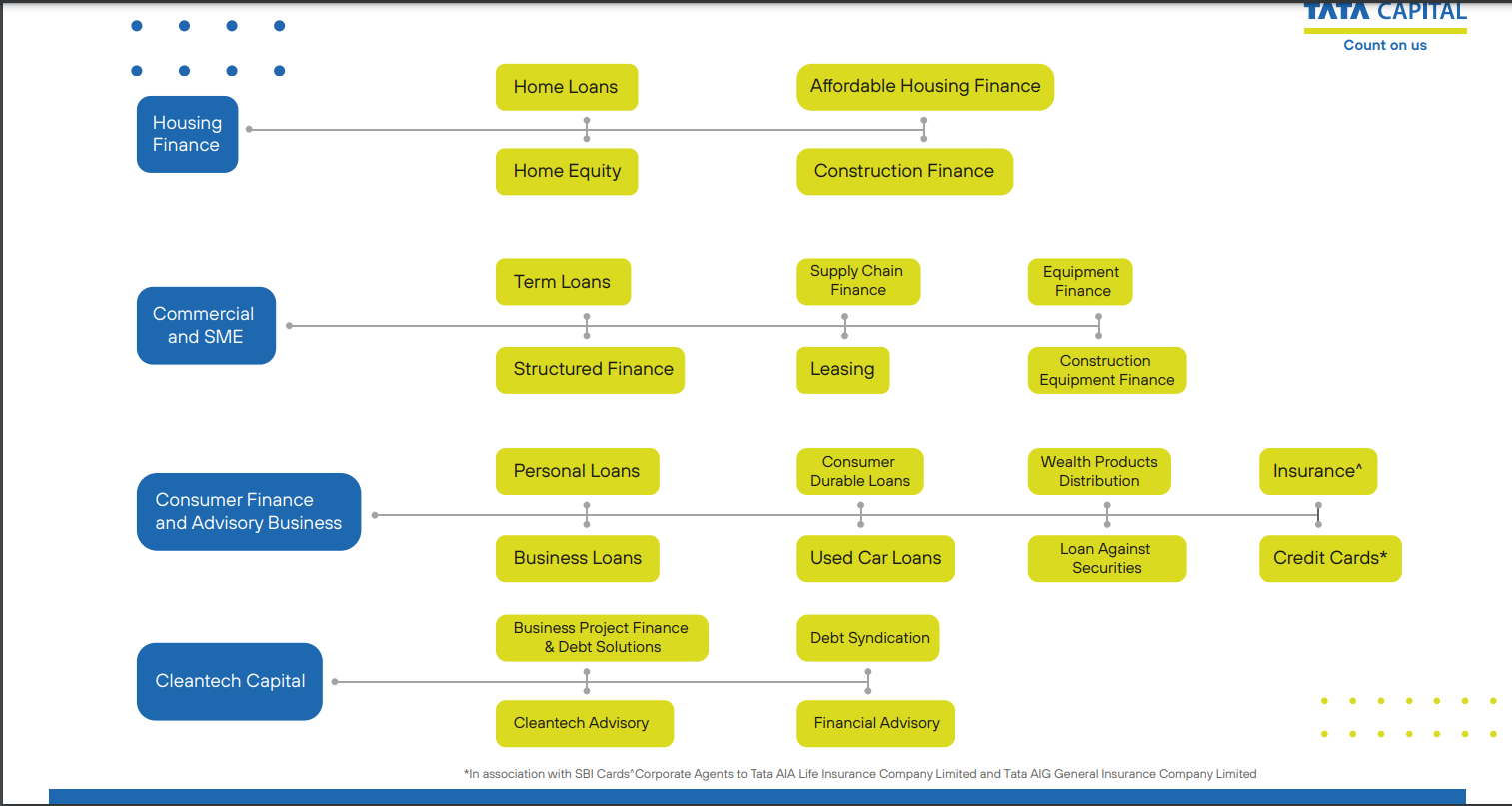

By selling its subsidiaries, Tata Capital solely focused on its finance business. Currently, its activities are focused on Commercial and SME, and Consumer finance and advisory business.

Source: Tata Capital Presentation

In India, Tata Capital ranks 11 on the ELETS top 100 NBFCs in India. Not just that, it has grown it has been the catalyst of change for the digitization of Indian traditional banking system.

Along with that, Tata Capital has also increased its branches from 175 to 700 in the last 2 years. It aims to add 300 more branches this year.

This shows that Tata Capital’s growth shows no signs of stopping.

After these deals with Thomas Cook, Tata Capital currently has only two subsidiaries, namely:

Tata Capital Housing Finance Limited

Tata Securities Limited

But, when we look at the partners of Tata Capital, and the startups that it ventured into, the portfolio is nothing short of amazing.

You can check these out here: https://www.tatacapital.com/partners.html

This shows that sometimes businesses have to cut off that extra segment which might be dear to them, but are just not working out.

What’s the future for Tata Capital?

Tata Capital is currently rumored to be filing an IPO this year. Tata Sons owns about 95% of Tata Capital's equity. If the IPO were to come out soon, then Tata Capital should see a huge spike in interest from people all around the world.

Tata’s Debt-to-Equity Ratio stands at 6.453, which is average by industry standards. This suggests that Tata Capital is currently in a very strong position if it gets listed.

So, to earn out of this prospective listing, you should consider investing in the current Tata Capital stock price from an unlisted market. Looking at Tata Capital share price now,it has a high prospect of giving you a value investment opportunity.

You can explore Stockify, one of India's most trusted dealers specializing in unlisted shares. Our team’s expertise and market insights can guide you through the process and help you make informed investment decisions. Check out Stockify now!