Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

Overview of Tata Motors Q3 Financial Performance.

The two exciting tales from the national leading motor brand mention the two contrasting realities. One states that Jaguar Land Rover earned its number for the demand of robust Range Rover and Defender.

Not just this, the passenger vehicle division also accounted for impressive sales. Then what brought the humongous losses? It is the commercial vehicle segment that reported the net loss.

TATA Motors: Story of Q3 Results 2026

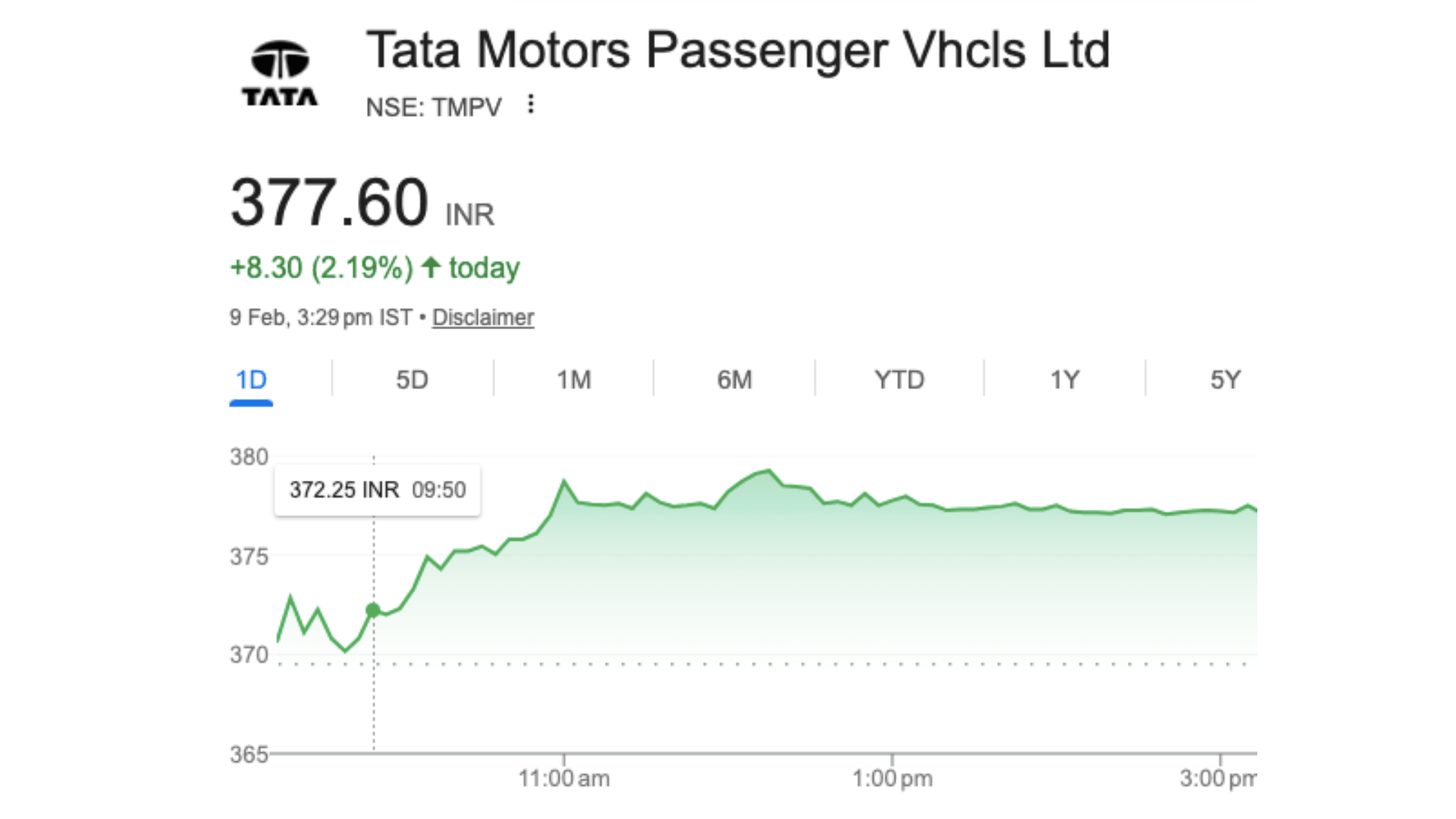

The segment for the passenger vehicle division announced its Q3 results for the financial year on February 5,26. Though the reports show decline, the company positively looks towards pulling it up in Quarter 4.

The PV division reported a massive loss of ₹3,486-crore against last financial year profit of ₹5,406 crore.

Ahead of December 2025, the Tata Motors Share Price for the passenger vehicle segment slipped 3%.

Source: Tata Motors

What made the profit decline looks like a reeling impact of Jaguar Land Rover (JLR). Or is it just the strategic financial clean up by the company.

What is in it lets us evaluate the blog, but before that let us eye on the some financial metrics.

Tata Motors Q3 Results 2026 Preview-Key Financials:

Here are the financials for the motor brands:

Particulars | Performance |

Revenue Volume | Growth of 22% YoY |

Profit After Tax (PAT) | Projection to rise ~48% YoY |

EBITDA | Decline ~11% |

This is not the only picture for the age-old motor brand.

Let us now study the probable reasons that have impacted the Tata Motors Q3 Results for FY26.

Key Factors to Watch for Tata Motors Q3 Result FY 26.

Following could be the reasons why the company reported a decline in their financials:

1. Jaguar Land Rover Impact:

The cyberattack on JLR significantly impacted the Q3 results consolidating a net loss of ₹3,486-crore. The attack crippled the manufacturing units in Slovakia and United Kingdom.The incident caused a 5 week production halt with over ₹3200 exceptional cost that dragged down the earnings, reversing the profit from previous years. Also, the net debt of JLR rose to £3.3 billion by the end of Q3 FY26.

2. Demerger Effect:

The recent demerger has changed the perspective of how analysts change the earnings. There is a limited standalone data that confines the approach to focus on absolute numbers rather than trend comparisons. This limits earning announcements considering how sensitive the market is.

The post demerger effects, demand in the key markets, and the production disruptions have altered the performance and the profitability trends.

3. Margin and Operating Efficiency:

Fall in EBITDA and control in operating margins amid the competitive atmosphere also seem to have pulled down the profits for Tata Motors.

4. Commercial Vehicle and Passenger Vehicle Division:

This is the pressure point for the motor brand. The CV segment faced margin pressures due to competitive pricing and elevated input costs. The growth was not high which limited its impact on the profitability of the company.

For the passenger vehicle the growth is steady but not enough.

5. Launch Costs:

One estimated reason could be the period when the vehicles are launched. Sales mix and model launches could have temporarily affected the profitability.

Final Thoughts

Tata Motors concentrated on growing its sales in the commercial vehicle segment and expanding electric vehicle adoption to push profitability and margins.

The investors are yet to evaluate how Tata Motors look at considering cost controlling which further will impact the stocks stabilising. They are hopeful on how the profitability rolls out in the next quarter.

For you to know more about unlisted shares consider reading more on Stockify.

FAQs

Why did Tata Motors PV segment Q3 results fall sharply?

The share price fell and the profit margins dipped because of the JLR cyberattack that impacted the earnings for the company.

What caused JLR’s 39.4% revenue fall?

The drop is highly influenced by supply chain disruptions, global market slowdown, and reduced demand in key markets.

What is Tata Motor’s future outlook?

The company strongly focuses on EV expansion, cost control, and improving operational efficiency.