Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

Vikram Solar has filed its draft red herring prospectus (DRHP) with SEBI to raise funds through an IPO. Vikram Solar IPO aims to raise ₹2,000 crore. This includes ₹1500 crore in fresh issues and 17.45 million shares by its promoter group.

Let’s explore various aspects of Vikram Solar IPO from an investor’s point of view:

Vikram Solar IPO Details

Vikram Solar IPO Price Band: Vikram Solar IPO is a book-built issue which expected to be announced near the IPO date. When the IPO opens, interested investors can choose the price given within the price band to apply for an IPO.

Vikram Solar IPO Listing Date: Vikram's IPO is expected is yet to be announced. As of now, the open date and close date are not yet finalized.

Vikram Solar IPO Issue Size: Vikram Solar aims to raise ₹2,000 crores. This includes ₹1500 crore in fresh issues and a 17.45 million Offer for Sales shares by promoters.

OFS comprises selling up to 3.62 million shares by Anil Chaudhary, up to 2.58 lakh shares by Girish Kumar Madhogaria, up to 1.27 lakh by Pushpa Madhogaria, up to 1 million shares by Vikram India Ltd.

Objectives Of Vikram Solar IPO

The freshly generated funds will be used in the following ways:

A)New Manufacturing Facility: Rs 793.36 crores will be used for capital expenditure to invest in a wholly owned subsidiary, VSL Green Power Pvt Ltd. for establishing a 3000 MW solar cell and module manufacturing facility.

B) Expansion of Existing Manufacturing Facility: Rs 602.9 crores will be utilized for expanding the solar module manufacturing capacity from 3000 MW to 6000 MW.

C) Other general corporate purposes.

About Vikram Solar

Vikram Solar Limited (formerly known as Vikram Solar Pvt. Ltd.) is India’s largest domestic PV module manufacturer and integrated solar energy solutions provider with a presence in solar photovoltaic (“PV”) modules, engineering, procurement, and construction (“EPC”) services, and operations and maintenance (“O&M”) service. With an international presence across 6 continents, they are an active contributor to shaping the solar revolution.

Here are some key achievements by Vikram Solar:

A) Expanded manufacturing capacity to 3.5 GW in FY 2023-24, targeting 4.5 GW by FY 2024-25 and 10.5 GW by FY 2025-26.

B)1,400 MW of EPC Projects in the portfolio -commissioned

C)700 MW+ O&M projects in the portfolio -ongoing

D)Eligible for key subsidies, including PLI for our 2.4 GW solar facility, and TNGO, bolstering our growth and innovation prospects.

E)Top Performer in PVEL’s PV module reliability scorecard for the sixth consecutive year and the seventh time in the last eight years.

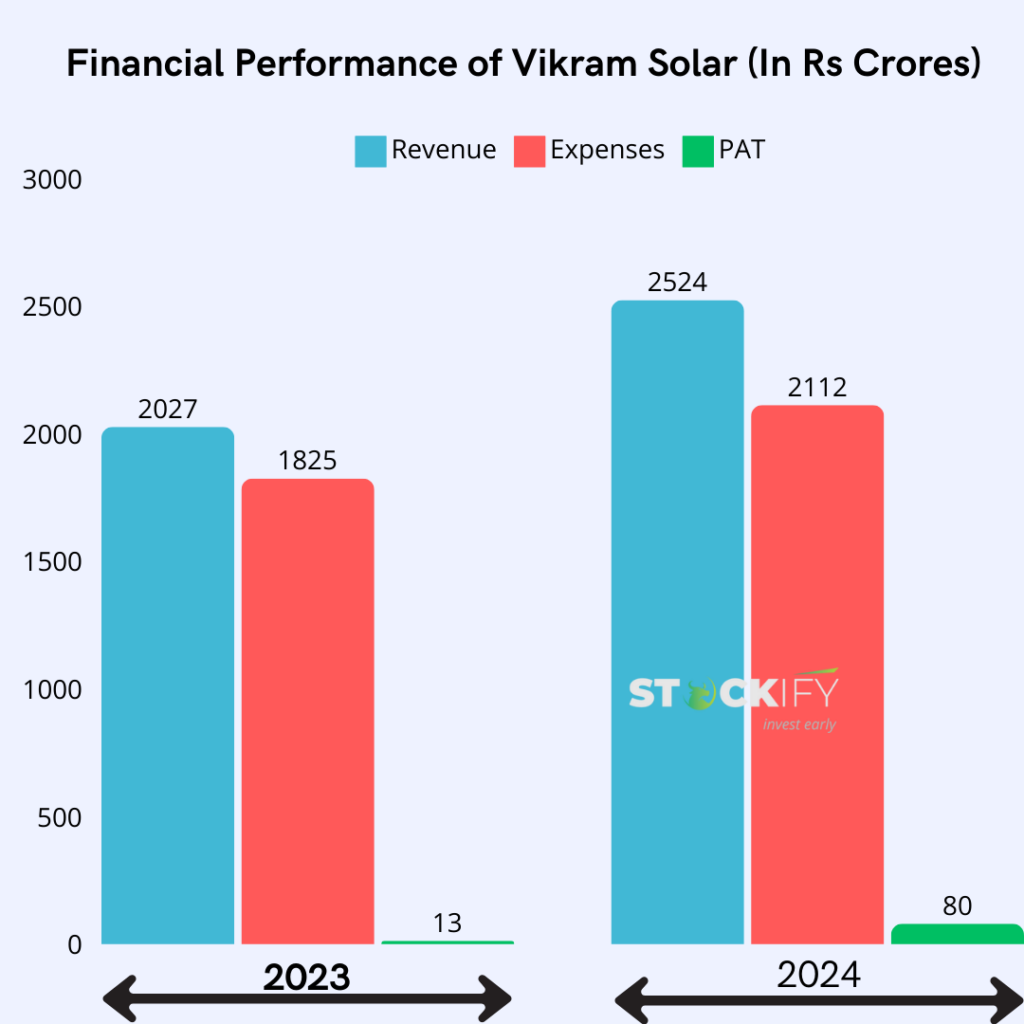

Vikram Solar Financial Performance

Revenue grew by 21.11 percent to Rs 2,510.99 crore and it recorded over 450 per cent jump in its post-tax profit.

EBITDA: INR 398 Cr.

PAT (Profit After Tax): INR 79 Cr.

Share of Exports in Revenue: 61.58%.

A Quick Look At Vikram Solar IPO’s Risk & Strengths

Risk Factors

Their future performance depends on cost-effectively building scalability and manufacturing facilities.

Global pandemics like the current one and unfavorable economic conditions can lower the company’s profit potential.

The company’s sustainability depends mainly on the continuation of favorable government policies.

Strengths

One of India’s largest solar module manufacturers with a strong order book.

Robust financial performance, backed by strong brand recognition and a proven track record.

Diversified business, ability to provide EPC and O&M service as an additional value add-on.

Possible To Buy Vikram Solar Shares before IPO?

Currently, Vikram Solar is not listed in the stock market. However, investors can buy pre-IPO shares and own Vikram Solar shares before they get traded in the listed market.

Interested Investors can buy Vikram Solar Unlisted Shares by clickinghere. Investors can check the details of other pre-IPO shares at Stockify.

Vikram Solar IPO FAQs

Q1:Is Vikram Solar public?

Currently, Vikram Solar is not yet listed on any stock exchange, so it is not public.

Q2:Is it good to invest in Vikram Solar?

Vikram Solar is one of the most actively traded shares in the unlisted market. You can invest in Vikram Solar Unlisted Shares.

Q3:Is it legal to buy unlisted shares of Vikram Solar in India?

Yes, this is 100% legal and safe to buy unlisted shares of Vikram Solar Ltd. However, this is applicable when you buy Vikram Solar Ltd unlisted shares from reliable and known unlisted share dealers. You can request a quote or trade online at Stockify, we are ready to assist you.