Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

The stock market is rapidly growing as most people started investing to create a second revenue stream and earn high returns. One of the most popular and national-level stock exchanges is the Metropolitan Stock Exchange of India (MSEI) which operates in currency, equity derivatives, debt and more. The stock exchange platform MSEI is currently not listed; you should buy its unlisted shares from the grey market for investment-related stuff. Investing in the Metropolitan Stock Exchange of India (MSEI) unlisted shares can offer you great returns. Still, before investing, you should know the company's predicted growth in the next few years.

Considering the growth rate of a company and its prospects is essential to making a sound investment decision and knowing its offerings. The trading platform Metropolitan Stock Exchange of India provides a digital platform to investors simplifying the hassles involved with investments. The MSEI’s future growth depends on the number of traders preferring the platform for investment.

An Overview of the Metropolitan Stock Exchange of India

MSEI is a national-level stock exchange platform that helps intermediates like stockbrokers, corporates, banks, and investors with a hi-tech electronic platform for transparent trading. The top shareholders of MSEI include individuals like Siddharth Balachandran and Radhakishan S Damani, as well as popular banks, including State Bank Of India, Bank Of Baroda, and Union Bank Of India. Considering the top stakeholders in MSEI, the company is expected to outperform as big names are associated.

Metropolitan Stock Exchange of India (MSEI) Unlisted Shares Details

The current price of Metropolitan Stock Exchange of India (MSEI) unlisted shares is Rs 7.56 per equity share, and it is expected to surge in the future due to its in-demand business model. Here is a glance at unlisted shares of the Metropolitan Stock Exchange of India.

| Market cap | ₹ 4162.5 crores |

| Current unlisted share price | ₹ 7.56 per equity share |

| Lot size | 10,000 shares |

| 52 W high | ₹ 13 per equity share |

| 52 W low | ₹ 1.1 per equity share |

| P/B Ratio | 21.6 |

| Face value | 1 |

| Debt to equity | 0.3 |

| Stock P/E | -86.6 |

| Demat Account | Both |

| ISIN | INE312K01010 |

| Retail discount | Bulk deal (5%) |

Predictions For the Metropolitan Stock Exchange of India (MSEI) in the Next Five Years

As the trading giant grows, the per-equity share price of the Metropolitan Stock Exchange of India is expected to surge. Furthermore, let's look at the last five-year financials of the platform to know its plan:

| Particulars (in lakhs) | 2019-20 | 2020-21 | 2021-22 | 2022-23 | 2023-24 |

| Total revenue | 3,701 | 3,245 | 2,506 | 5,470 | 2100 |

| Profit/Loss Before Tax (PBT) | -4,501 | -3,067 | -3,126 | -1,990 | -4760 |

| Profit/Loss After Tax (PAT) | -4,577 | -3,108 | -3,167 | -1,870 | -4880 |

| Earnings per share (EPS) | -0.10 | -0.06 | -0.06 | -0.04 | -0.1 |

The last five-year financials of the MSEI clearly show that the company's net losses are continuously decreasing(except FY 23-24). As the number of traders increases, the use of the electronic platform of the Metropolitan Stock Exchange of India will grow; it will increase the popularity of the stock broking platforms and users; thus, the share prices and net revenue will rise in the future.

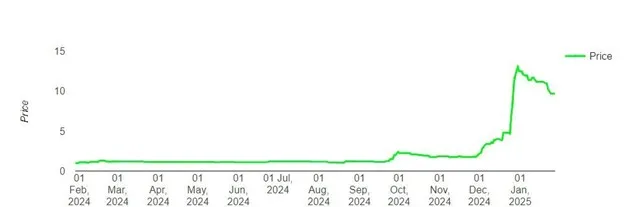

In Sept 24,msei unlisted share pricewas trading around Rs 1.2 per share. By Jan 25, this price reached to Rs 12.5 per share. This sudden jump has attracted a lot of investor attention looking to capitalize on such a growth opportunity.

MSEI raised funds worth Rs 238 crores on December 24, the second half. They did a private placement involving investors like Billionbrains Garage Ventures (Groww’s promoter) & Rainmatter Investments (Kamath Brothers Of Zerodha) Securicorp Securities India, and Share India Securities.

MSEI Board approved the issuance of up to 119 crore Equity shares of face value of ₹1 per share at a premium of ₹1 per share. Hence amounting to Rs 238 crores.

Should You Invest In the Metropolitan Stock Exchange Of India Pre-IPO Shares?

Stock exchange platforms like MSEI play a vital role in boosting the Indian economy, and investing in its shares is the best way of leveraging the company’s growth. Investing in unlisted shares is considered the best way of diversifying investment risks and boosting your portfolio. Unlisted shares of top-performing companies have the potential to offer you multi-bagger returns over a period. But how can you invest in unlisted shares?

To invest in Metropolitan Stock Exchange of India (MSEI) pre-IPO shares or any top-performing pre-IPO company, you can rely on Stockify, an ideal platform to sell or buy unlisted shares. With Stockify, you can check the company's current unlisted share price and financial reports and know top-performing pre-IPO shares before their listing on NSE and BSE. What are you waiting for? Connect with our experts now!

FAQs

Q1 - Which is the best platform to sell or buy Metropolitan Stock Exchange of India (MSEI) unlisted shares in India?

Ans - In India, Stockify is the best online brokerage platform for buying and selling the Metropolitan Stock Exchange of India unlisted shares. The expert traders are always available to guide you through the investment process and share the financial details to make a sound investment decision.

Q2 - What is the lock-in period for unlisted shares of the Metropolitan Stock Exchange of India (MSEI)?

Ans - For Venture Capital Funds, Foreign Venture Capital Investors, and other investors like Retail, HNIs, and Body Corporates, the lock-in period for the Metropolitan Stock Exchange of India unlisted shares is six months. For AIF-II, there is no lock-in period.

Q3 - What is the current price of Metropolitan Stock Exchange of India (MSEI) unlisted shares?

Ans - The Metropolitan Stock Exchange of India unlisted shares are priced at Rs 7.56 per equity share. You can instantly check the updated Metropolitan Stock Exchange of India (MSEI) unlisted share price using Stockify. Our in-house team of expert brokers constantly track unlisted shares' latest prices and immediately updates them on the portal.

Q4 - Is trading in the Metropolitan Stock Exchange of India unlisted shares legal in India?

Ans - Buying and selling Metropolitan Stock Exchange (MSEI) unlisted shares are 100% legal in India. You can count on Stockify to invest in top-performing pre-IPO companies and have a safe and hassle-free investment experience.

Q5 - How can I buy or sell unlisted shares of the Metropolitan Stock Exchange of India (MSEI)?

Ans - You can rely on Stockify for buying and selling the Metropolitan Stock Exchange of India unlisted shares. It is a leading Indian trading platform ideal for buying and selling unlisted shares of top-performing companies. Connect with our experts.