Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

Nayara Energy, India's largest private fuel retailer, has announced a buyback offer to its minority shareholders. The company aims to purchase 25.9 million outstanding shares at ₹731 per share. This move is intended to provide an exit opportunity for shareholders who have been holding onto their stakes since the company's delisting.

Background of the Buyback Offer

- In 2017, a consortium led by Russia's Rosneft and partners acquired Nayara Energy, formerly Essar Oil, for nearly $13 billion.

- Before this acquisition, the company's shares were delisted from Indian stock exchanges in 2016. Despite the delisting and subsequent exit offers, over 2 lakh minority shareholders continued to hold shares in the company

- These shareholders have faced challenges in liquidating or monetizing their holdings since the shares are not listed on the exchange.

- Recognizing this issue, Nayara Energy's Board of Directors decided on March 3, 2025, to initiate a buyback program.

- The offer price of ₹731 per share was determined based on a valuation exercise conducted by an independent registered valuer.

- The Company will shortly be finalizing the schedule for the buyback program and issuing the Letter of Offer to its Minority shareholders.

Implications For Minority Shareholders

For the minority shareholders who have been holding onto their shares since the delisting, this buyback offer presents a valuable opportunity to liquidate their investments at a fair price.The offer price of ₹731 per share reflects the company's current valuation and provides an exit route for these investors.

About Nayara Energy

Nayara Energy is a prominent player in India's oil-refining and marketing sector. The company operates the Vadinar refinery in Gujarat, which is India's second-largest single-site refinery, with a capacity of 20 million metric tonnes per annum (MMTPA).

This complex facility is capable of processing a diverse range of crude oils, from sweet to sour and light to heavy, into Euro-grade petroleum products.

In addition to refining, Nayara Energy has established a vast retail network, operating over 6,500 fuel stations across India. This extensive presence underscores the company's commitment to meeting the nation's growing energy demands and contributing significantly to India's energy security.

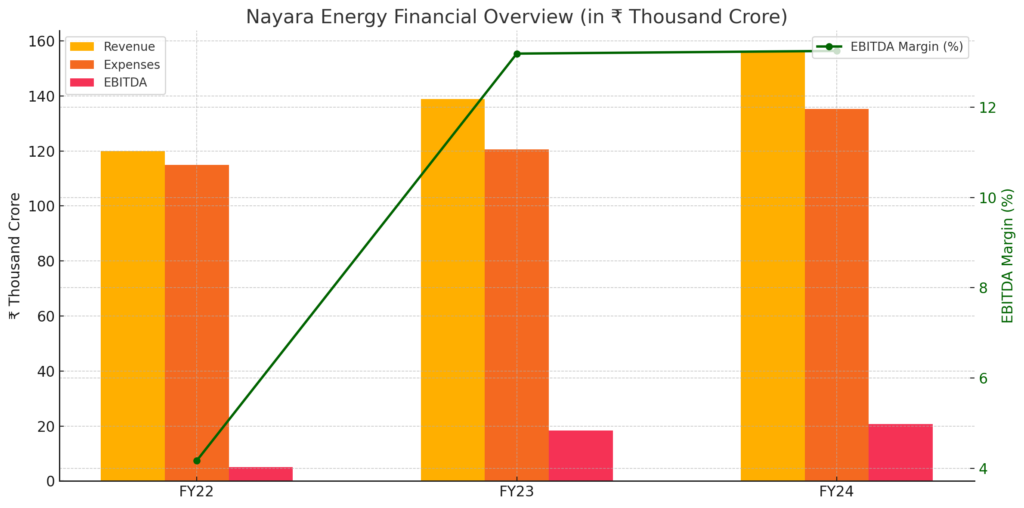

Financial Analysis of Nayara Energy

| Particulars | 2022 (in Rs crore) | 2023 (in Rs crore) | 2024 (in Rs crore) |

| Revenue | 120,005 | 138,866 | 156,030 |

| Expenses | 115,003 | 120,554 | 135,361 |

| EBITDA | 5,002 | 18,313 | 20,670 |

| EBITDA Margin | 4.17% | 13.19% | 13.25% |

| PAT | 921 | 9,426 | 12,321 |

| EPS( Per share) | 6.2 | 63.2 | 82.7 |

Source: Nayara Energy

A) Revenue Growth

In FY 22, Nayara Energy reported a consolidated revenue of ₹1,20,005 Cr. which grew to ₹1,38,866 Cr. in FY 23 and further to ₹1,56,030 Cr. in FY 24 — reflecting a 15.7% growth in FY 23 and 12.4% in FY 24, signaling strong top-line momentum driven by robust demand and pricing.

B) Expenses

Total expenses increased from ₹1,15,003 Cr. in FY 22 to ₹1,20,554 Cr. in FY 23, and further to ₹1,35,361 Cr. in FY 24. The rise was proportional to revenue in FY 24, but the margins remained intact. The increase likely reflects higher operational activity, crude input costs, and inflation-linked logistics.

C)Profit After Tax

PAT saw a remarkable surge of 923% YoY in FY 23, rising from ₹921 Cr. in FY 22 to ₹9,426 Cr. in FY 23. This was followed by another 30.7% increase to ₹12,321 Cr. in FY 24, underlining a sustained improvement in bottom-line profitability.

D) EBITDA & Margin

EBITDA jumped from ₹5,002 Cr. in FY 22 to ₹18,313 Cr. in FY 23 — a 266% rise, and then to ₹20,670 Cr. in FY 24. Correspondingly, EBITDA margins improved from 4.17% in FY 22 to 13.19% in FY 23, and remained stable at 13.25% in FY 24, indicating strong operational efficiency and cost management.

E) Earnings Per Share

EPS followed the PAT trend, rising from ₹6.2 in FY 22 to ₹63.2 in FY 23 — a 919% growth, and further to ₹82.7 in FY 24, reflecting a 30.8% YoY increase. This consistency in EPS growth highlights the company’s ability to translate profits into per-share value without dilution.

The above financial factors make it worth it for you to buy Nayara Unlisted shares and get high returns on your investment, as the company has been performing well in all aspects.

Nayara Energy Limited Unlisted Shares: Evaluation Of Important Values

Nayara Energy Limited is an unlisted company showcasing strong key market indicators.

Currently, the face value per share stands at Rs. 10.0, and the book value per share is at an impressive Rs. 280.2. The company’s price-to-earnings (PE) ratio is 22.2, indicating its favourable valuation in the market. Nayara Energy Limited unlisted share price today is INR 1,365 per share.

Considering the company’s potential for growth, the price-to-sales ratio is just 1.8, which signifies that the stock is relatively undervalued compared to its revenue-generating capabilities. Additionally, the price-to-book ratio is 6.6, showing that the stock is currently trading much above its book value.

Nayara Energy Limited holds a significant position in the market. The company’s market capitalization is an impressive Rs. 2,852,535 million, further highlighting its strong industry presence.

FAQS

- Is Nayara Energy listed in the stock market?

Nayara Energy Limited is not listed in either NSE or BSE, but its unlisted shares are available to buy online.

- Can I sell Nayara Energy shares?

An investor can sell or transfer Nayara Energy (Formerly Essar Oil) Limited Unlisted Shares from their Demat account to any other Demat account using a delivery instruction slip.

- Who acquired Nayara Energy Ltd?

Two years after Russia and Rosneft first encountered Western-imposed sanctions for the invasion of Crimea, a partnership led by Rosneft, they purchased Nayara for $12.9 billion in 2016.

- Is Nayara Energy a Russian company?

The Vadinar refinery, which has a capacity of 20 MMTPA and is the second largest in India, is owned and operated by Nayara Energy, an Indo-Russian oil refining and marketing corporation.

- From where can you buy Nayara Energy’s unlisted shares?

Stockify offers a reliable platform for purchasing unlisted stocks, including Nayara Energy Limited. You canbuy unlisted sharesfrom Stockify.