Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

On 13th Feb 2026, NCDEX announced a long-term technology partnership with Tata Consultancy Services (TCS). Until now, a SEBI-regulated exchange, NCDEX, has been dealing in commodity derivatives. But now the exchange isofficially expanding into equities with Tata Consultancy Services (TCS) to strengthen its technology infrastructure.

Let's discuss the details of the NCDEX-TCS partnership and the growth of the NCDEX Unlisted Share

What Is This Partnership All About?

As announced by the Chief Technology Officer of NCDEX, Mr Balkrishna Shankwalker, ”Guided by our ‘Bharat First’ philosophy, as we prepare to enter the equity and equity derivatives segment, our priority is to build a strong technology architecture capable of catering to the diverse market and regulatory needs of the Indian Financial ecosystem.

The NCDEX entered into a long-term strategic technology partnership with Tata Consultancy Services (TCS) for 10 years.

Under the 10-year partnership, TCS will develop, implement and maintain NCDEX's main platform for equity trading and surveillance. This includes the framework that technology provides, essential to manage governance, trading, monitoring, and regulatory compliance on a large scale.

Simply, TCS will be the driving force behind NCDEX's equity goals by creating an enterprise-grade, high-performance platform that can accommodate high volumes, low-latency trading, and changing market demands while adhering to Indian regulations.

The Significance of NCDEX's Entering into the Equity Market

As a major player in India's agricultural and commodity markets, NCDEX has long been recognised mainly as a commodity derivatives exchange.

Its planned entry into the equity derivatives shows an important shift in its long-term approach, expanding its focus beyond commodities into the mainstream capital markets.

This action indicates NCDEX is planning to diversify its business strategy and get more involved in India's developing equity market.

In addition, the expansion is in line with the primary objective of "Equity for Bharat," which is to build a market infrastructure that is easily accessible, inclusive and technology-driven.

Role of TCS in Building NCDEX’s Equity Platform

Using its well-proven BaNCS and Quartz technology, Tata Consultancy Services (TCS) is going to be crucial in developing and maintaining NCDEX's new equity and equity derivatives platform.

TCS is trusted by exchanges all over the world because of its expertise in managing critical market infrastructure, where accuracy and dependability are essential.

For NCDEX, this involves having access to technology designed to handle large volumes, low latency and smooth scalability, which are necessary in today's trading environments.

How the New Platform Strengthens Market Infrastructure

The goal of the suggested platform is to make market operations more structurally stable. In order to ensure seamless trade execution even during periods of high volume, speed and system reliability are important areas of focus.

Additionally, inbuilt compliance and surveillance features are designed to promote transparent and structured marketplaces. Also, the architecture was created with future readiness in mind, allowing NCDEX to launch new features and products in response to changing market demands.

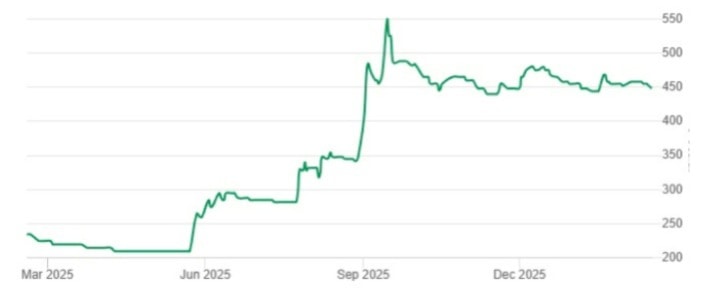

NCDEX Unlisted Share Grew 91% in 1year

The price of NCDEX Unlisted shares grew by 91% in the last one year. From February 25 to February 26, the price went up from Rs. 235-Rs. 449.

EBITDA was negative at Rs. -48.9 crore during this time, suggesting ongoing pressure on core operating performance, while NCDEX's revenue dropped from Rs. 136 crore in FY24 to Rs. 122.1 crore in FY25.

However, non-operating and exceptional items, such as stake sales, were primarily responsible for FY25's net profit of Rs. 236 crore rather than core exchange earnings. NCDEX's market capitalisation is approximately Rs. 2,300-2,400 crore at the current price of Rs. 449, and the stock is trading close to 3x book value.

Strategic developments like the launch of a mutual fund transaction platform and the proposed international expansion into Sri Lanka might be one of the reasons for price appreciation.

Additionally, a formal entry into equity and equity derivatives is now announced.

Overall, despite inconsistent operating metrics, recent price movements appear to reflect structural and strategic developments.

Also Read: NCDEX Shows Steady Balance Sheet Despite Low Agri-Trade Activity

This NCDEX-TCS partnership will add to NCDEX's emphasis on building operational infrastructure and compliance. making it possible to build its equity and equity derivative platform.