Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

After 2 years of pulling back its IPO, Pharmeasy is in talks to relaunch its IPO. According to the Economic Times, this is part of Pharmeasy's renewed strategy aims to sustain financially by merging with its listed subsidiary, Thyrocare.

Will PharmEasy go for IPO?

According to a source quoted by ET, Pharmeasy will present its IPO strategy in February next month. A noteworthy development is that the company plans to do a reverse merger with its listed subsidiary Thyrocare. The intention is to streamline operations & appeal to public market investors.

Not just Pharmeasy, but many Indian start-ups like Oyo & Boat have followed the trend of re-starting IPO discussions after delaying due to market uncertainties. Leadership changes have led to a change in the company's direction.

Pharmeasy Co founders Resign

Co-founders, Dhaval Shah, Dharmil Sheth, and Hardik Dedhia have stepped back as founders of Pharmeasy but remain on board for API Holdings and Thyrocare. Siddharth Shah continues to be the CEO of Pharmeasy.

Pharmeasy's financials and valuations have also been a concern.

Pharmeasy Made Significant Financial Adjustments

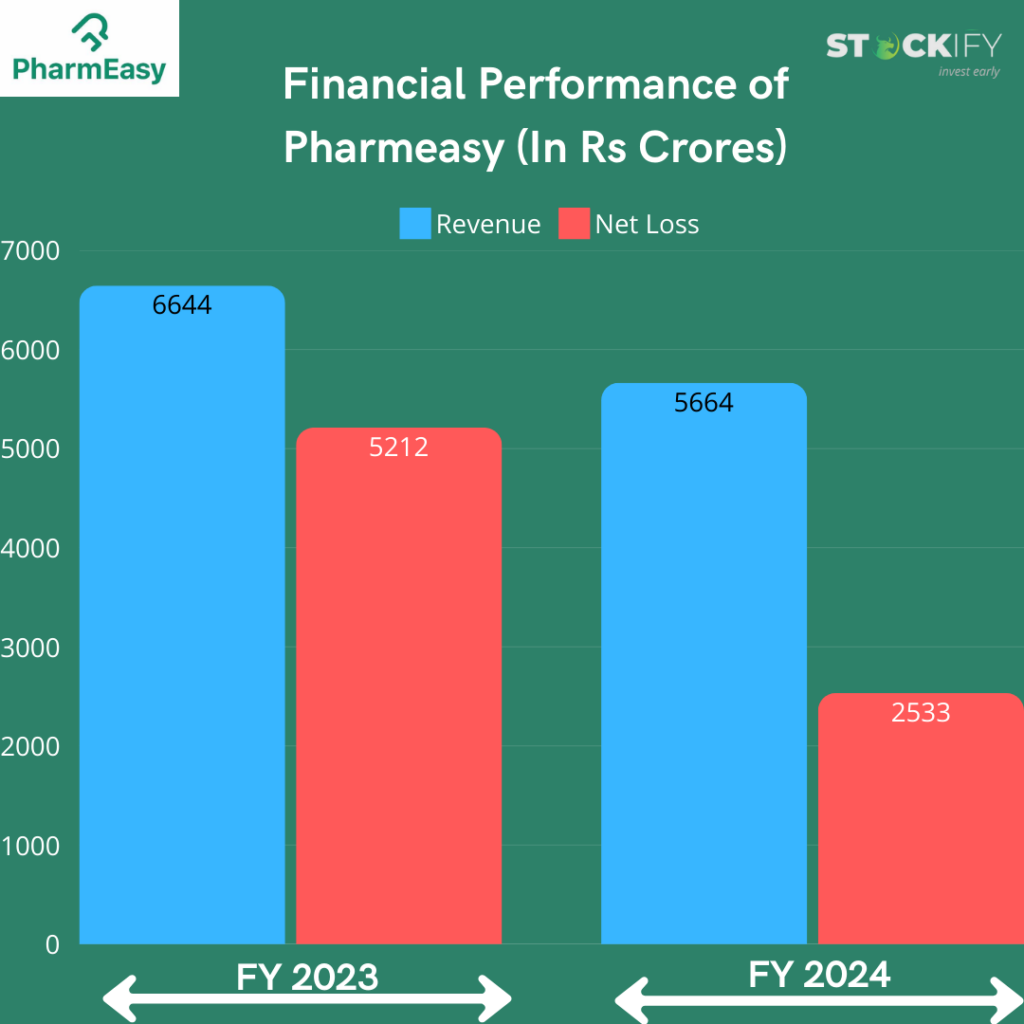

- PharmEasy’s Revenue declined by 14.7% to Rs 5,664 crore in FY 24 from Rs 6,644 crore in FY23. This decline can be concerning.

- Their primary revenue driver was medical sales contributing to Rs 5,008 crore, while lab testing and other services contributed to Rs 652 crore.

- At the same time, the net loss was reduced by 50% from ₹5,212 crore in FY 23 to ₹2,533 crore in FY 24. This was due to operational cost-cutting measures and a reduction in goodwill impairment.

- Pharm easy's total expenses also reduced from Rs 8,974 crore in FY23 to Rs 7,255 crore in FY24, signaling a tighter control over expenses.

Their financial performance can significantly impact pharmeasy pre ipo shares valuation.

Challenging Road Ahead For Pharmeasy

Pharmeasy did a recapitalization in 2023 issuing the right shares. Investors like Manipal Group’s Ranjan Pai, alongside Prosus Ventures and Temasek, participated in this round. The company’s valuation plummeted by a staggering 92% and dropped from a peak of $4.8 billion to $458 million. These funds were primarily used for debt restructuring, laying the groundwork for Pharmeasy IPO.

Pharmeasy may have a challenging road ahead as competitors like Tata 1mg, and Apollo 24 X 7 are leading the game. Ecom giant Flipkart has also entered this market. The recent strategic change is a significant effort to lead the Online Pharmacy sector facing high competition.