Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

PharmEasy, the e-pharmacy unicorn from Mumbai, achieved a revenue milestone by crossing INR 6,000 crores in the fiscal year ending 2023.

But this doesn't mean that the company is still profitable. The company has reported a loss of Rs. 2290 Cr. for FY 23. These losses are 16% down from the past year

Why have these losses built up?

The increased losses and depressed margins are mostly because of the expensive acquisitions made by the company in the past. They acquired companies like Thyroocare, Aknamed, Medlife, and MargERP to grow and stay on top of the competition in FY 21.

This helped PharmEasy to maintain its market leadership in the pharmaceutical space. However, the acquisitions were expensive and built up a lot of debt.

Due to this, in 2022, API Holdings, the parent company of PharmEasy, faced challenges, delaying its initial public offering (IPO) and seeking funds at a 90% reduced valuation.

The fiscal year 2021 was tough for the Mumbai-based company, with

- Losses soared fourfold to Rs 2,731 crore from Rs 641 crore in FY21.

- Operating cash outflows also rose significantly to Rs 2,589 crore.

This meant that PharmEasy had to spend Rs 1.48 to earn every rupee that year.

How did these losses affect the current scenario?

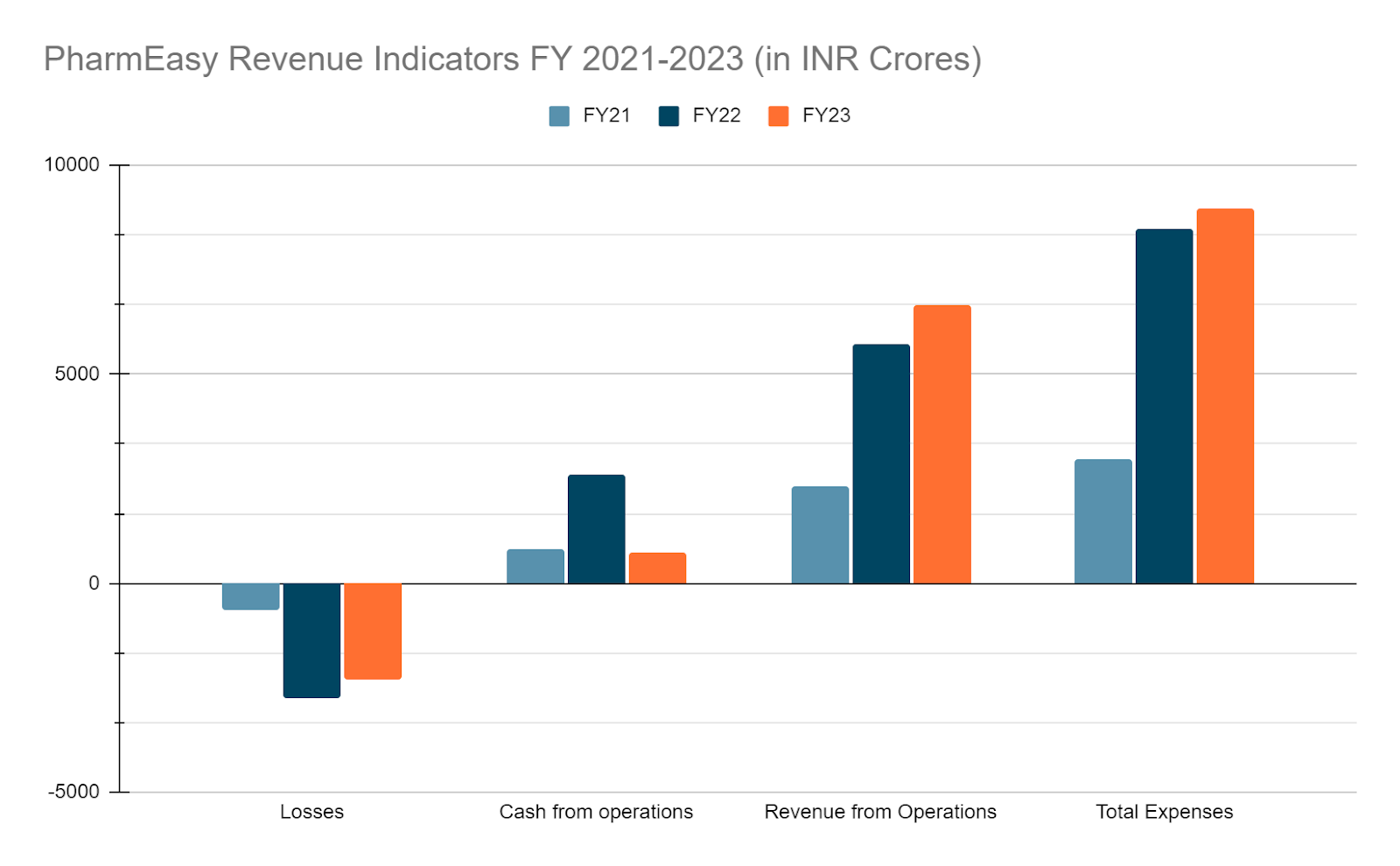

| Indicator | FY21 | FY22 | FY23 |

| Losses | INR 641 Crore | INR 2,731 Crore | INR 2,290 Crore |

| Cash from operations | INR 814 Crore | INR 2,589 Crore | INR 744 Crore |

| Revenue from Operations | INR 2,335 Crore | INR 5,729 Crore | INR 6,644 Crore |

| Total Expenses | INR 2,981 Crore | INR 8,491 Crore | INR 8,974 Crore |

Due to the acquisitions and expansions in 2020-21, PharmEasy could see rapid growth in revenue for the next two years.

But, in FY23, the growth slowed down. This doesn’t hint at a bad signal. The year saw the company reduce its losses by 16% and also a revenue growth of almost Rs. 1000 cr.

The gross merchandise value (GMV) was also reported at Rs 14,351 crore in FY23.

When we look at these indicators carefully, we understand that:

- Despite a reduction in losses from FY22, API Holdings faced continued financial challenges in FY23, signifying ongoing efforts to address profitability.

- While FY22 saw a substantial increase in cash flow from operations, FY23 saw a dip of around 72%. This can hint at a change in operational dynamics, as a way to cut down costs. Whatever they did to reduce the Cash outflows, seems to have worked as it gave them such a substantial amount of cost reduction.

- The revenue growth of 16% shows the company's resilience amid challenges.

When we analyze the financial reports further, we find that:

| Indicator | FY21 | FY22 | FY23 |

| EBITDA Margin | -22.61% | -39.66% | -20.38% |

| Return on Capital Employed (ROCE) | -14.42% | -32.11% | -27.12% |

| Cost per Rupee of Operating Revenue | INR 1.28 | INR 1.48 | INR 1.35 |

The improvement in EBITDA margin from -39.66% in FY22 to -20.38%, and the cost per rupee revenue from 1.48 to 1.35 in FY23 suggests a positive shift in the company's ability to generate earnings before interest, taxes, depreciation, and amortization relative to its revenue.

This means that the loans, and the debt that reduced PharmeEasy’s profitability for the past few years, are finally getting under their control.

And on the ROCE front, we can see an improvement of 5%.

For investors and stakeholders, achieving a positive ROCE is a key metric, as it highlights the company's efficiency in using capital to its fullest to earn more profits. That’s why Prosus must have said in their recent interview that they were confident about PharmEasy’s financial strength.

The Future

Looking forward, PharmEasy seems set for an exciting future, branching out into different sectors. Right now, a significant chunk, around 90%, of its earnings comes from selling pharmaceutical and cosmetic goods, showing its strong position in the healthcare industry.

Expanding beyond its main offerings, the ePharmacy company is now into diagnostic services, internet portals, teleconsulting, and software services through its acquisitions. This means they're adapting to new trends and meeting changing healthcare and tech needs.

API Holdings is also working on additional revenue streams. Other than PharmEasy, they also make money by leasing out software and hardware, managing warehouses, and getting commissions by connecting customers with labs for diagnostic tests. This kind of variety not only helps revenue but also puts the company in a good spot in the healthcare and tech industries.

This can really make things interesting for PharmEasy share price in the unlisted market in the future.

If you're curious about investing in PharmEasy shares and need help figuring things out, consider Stockify. It is India’s one of the most trusted portals for investing in unlisted shares of Indian companies.