Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

Polymatech Electronics Private Limited posted a strong set of numbers in FY25, underlining its shift from an early-stage, loss-making phase to consistent profitability and balance-sheet improvement. The latest financials, now updated on the company’s page, point to sustained revenue growth, steady operating margins, and a clear pickup in cash generation as semiconductor manufacturing volumes scale up.

Business Overview

Founded in 2007, Polymatech Electronics operates a semiconductor manufacturing facility at the SIPCOT Hi-Tech SEZ in Kancheepuram, Tamil Nadu. The company manufactures LED semiconductor chips and also produces microcontrollers, wireless chips, logic chips, and memory chips. Its operations place it squarely within India’s domestic electronics manufacturing push, a segment expected to see long-term demand driven by localisation and supply-chain diversification.

Financial Performance Snapshot

FY25 marked another year of strong execution, with growth across key income statement metrics.

Metric | FY23 | FY24 | FY25 |

Revenue | 649.7 | 1,237.6 | 1,912.1 |

EBITDA | 186.1 | 320.3 | 496.3 |

EBITDA Margin | 28.6% | 25.9% | 26% |

Profit Before Tax | 166.8 | 270 | 445.1 |

Profit After Tax | 166.8 | 240.1 | 375.6 |

Net Margin | 25.7% | 19.5% | 19.9% |

Revenue rose 54.5 % year on year in FY25, following an already sharp increase in FY24. Operating margins held steady at around 26 %, indicating that expansion has been supported by cost control and scale benefits. Net profit increased to Rs. 375.6 crore, reflecting improved operating leverage and higher capacity utilisation.

Balance Sheet Position

The balance sheet expanded meaningfully during the year. Total assets increased to Rs. 3,081.5 crore in FY25 from Rs. 1,616.0 crore in FY24, led by growth in current assets and continued investment in plant and equipment.

Equity strengthened to Rs. 1,172.1 crore, supported by rising reserves, which stood at Rs. 1,092.4 crore at year-end. This reflects the cumulative effect of several years of profit generation. At the same time, the debt-to-equity ratio of 1.60 highlights the capital-intensive nature of semiconductor manufacturing, making leverage an important factor to monitor as the company expands.

Cash Flow Performance

Cash flow trends in FY25 show a clear improvement in earnings quality and liquidity.

Category | FY23 (Rs. crore) | FY24 (Rs. crore) | FY25 (Rs. crore) |

Operating activities | 44.3 | 253.8 | 439.2 |

Investing activities | -80.4 | -477.2 | -102.2 |

Financing activities | 77.3 | 204.1 | 33.1 |

Net Cash Flow | 41.3 | -19.3 | 370.2 |

Cash and Equivalent | 41.3 | 22 | 392.3 |

Cash generated from operations rose sharply to Rs. 439.2 crore, supported by higher profits and better working capital management. Investment outflows point to ongoing capacity expansion, while financing inflows moderated, suggesting lower dependence on fresh borrowings. As a result, cash and cash equivalents increased to Rs. 392.3 crore, strengthening the company’s liquidity position.

Shareholding Structure

The shareholding remains promoter-driven. Eswara Rao Nandam holds 46.1% of the company, while Uma Nandam owns 42.2%. The remaining 8.7% is distributed among individual and institutional shareholders.

How has Polymatech Share Price performed recently?

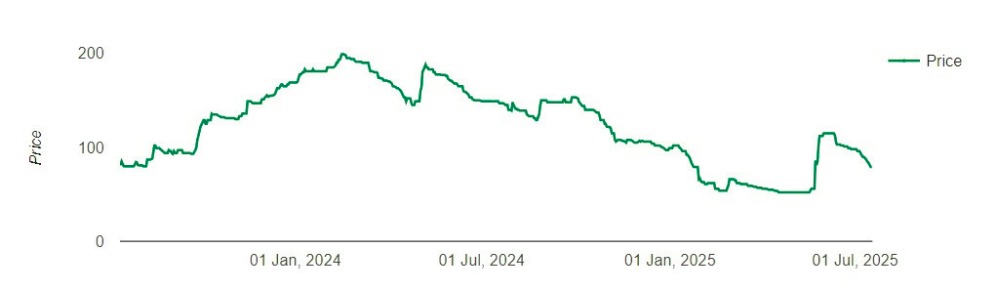

On May 24, polymatech share price rose to Rs 188 per share, but this bull run did not continue for long. In the next 6 months, share began declining and reached Rs 100 by December 24. This is possible due to regulatory concerns after Auditor SS Kothari Mehta & Co. resigned. This raised red flags around financial transparency and compliance. Also, PAT Margins dropped from 26% in FY 23 to 20% in FY 24.

Post FY 25

The MD of Polymatech announced some new projects and the possibility of an IPO talk in FY 25-26. This raised the Polymatech Electronics unlisted share price from Rs 52 per share to Rs 113 per share. This development coincides with the improved financial performance for FY 24-25.

Currently, Polymatech's unlisted share price is trading at Rs 64 per share.

Valuation Snapshot

At the current unlisted share price of Rs. 64, Polymatech trades at a price-to-earnings multiple of 7.8 and a price-to-book multiple of 2.4. The market capitalisation stands at approximately Rs. 2,803 crore. These levels reflect recent earnings growth while also factoring in execution risks, leverage, and regulatory developments, including the rejection of its draft offer document.

Future Of Polymatech

FY25 confirms Polymatech’s progress as a profitable and cash-generating semiconductor manufacturer. Revenue growth, stable margins, rising cash balances, and stronger reserves have improved the company’s financial footing. While leverage levels and listing clarity remain key areas to track, the updated financials offer a clearer view of operational scale and financial resilience for participants in the unlisted market.