Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

India's leading lab-grown diamond brand Solitario has raised USD 3.6 Million in a pre-IPO funding round. This funding attracted notable investors like Neeraj Gupta (Founder of Meru Cabs), Mauritius-based FPI Investi Global, Vicco Group, and Seema Manish Nuwal (Promoter, Solar Industries). Other investors include ultra HNI's like Amit Agarwal, Rajesh Singla, Garima Theti, and Sandeep Singh, as the company press release communicated.

Dilution & Purpose Of Raising Funds

This round was valued at 150 crores and Solitario plans to dilute 6% of its equity. Actor and co-founder Vivek Oberoi stated, "The newly raised capital will be used to expand Solitario's retail network both domestically and internationally, enter new geographical markets, enhance branding and marketing initiatives, broaden its product portfolio, and strengthen its manufacturing capabilities."

"This investment validates our vision of creating beautiful, sustainable jewellery that doesn't compromise our planet's future.” Ricky Vasandani, The CEO of Solitario said.

Indian Lab-Grown Diamond Industry Facts

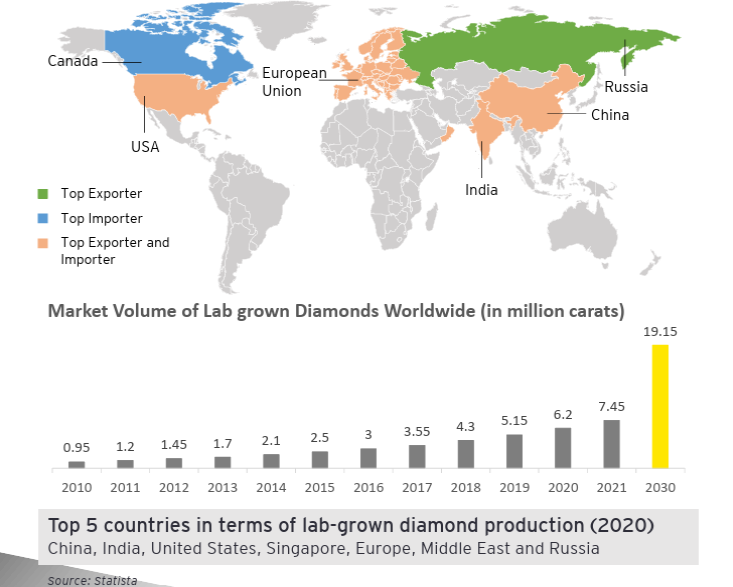

The global Lab Grown Diamond market size was valued at USD 23,898.6 million in 2022 and is expected to expand at a CAGR of 8.64% during the forecast period, reaching USD 39,301.2 million by 2028.

As per the Ministry of Commerce and Industry, the nation already produces around three million lab-grown diamonds a year, accounting for 15% of global production. The India lab-grown diamond jewellery market was valued at USD 264.5 million in 2022. Over the next ten years, lab-grown diamond jewellery sales will rise at 14.8% CAGR. The total market size is set to increase from USD 299.9 million in 2023 to 1,192.3 million by 2033.

Additional Government Incentives

- DGFT gave a separate HSN Code for Lab Grown Diamonds.

- 100% FDI allowed through automatic route.

- Custom duty made 0% on import of diamond seeds.

- GST rate was also reduced to 5% from 18%.

Solitario Products & Business Expansion

Solitario's lab-grown diamonds possess the same physical, chemical and optical properties as mined diamonds, but have an advantage of 40-50 per cent lesser cost and environmentally sustainable. Their collection ranges from everyday collections to high-end luxury pieces.

Solitario has a manufacturing facility spanning 30,000 Acres in Surat, employing over 300 people. They have also collaborated with PNG to launch stores in 7+ cities.

Financial Overview

| Particulars | FY 2024(In Rs Lacs) | FY 2023 ( In Rs Lacs) | FY 2022 ( In Rs Lacs) |

| Total Income | 5,202.50 | 2,430.14 | 16.95 |

| Total Expenses | 4,341.18 | 2,262.48 | 25.48 |

| EBITDA | 861.32 | 167.66 | (8.53) |

| Depreciation & Amortisation | 36.39 | 5.64 | - |

| EBIT | 824.93 | 162.01 | (8.53) |

| Interest Expenses | 6.30 | 0.20 | 0.43 |

| EBT (Earnings Before Tax) | 818.64 | 161.82 | (8.96) |

| Tax Expense | 305.99 | 53.86 | - |

| PAT (Profit After Tax) | 512.65 | 107.96 | (8.96) |

Solitario's total income grew from 16.95 lakhs in FY 22 to a whopping 5,000 lacs (50 crores) in FY 2024 which is a 300X growth in 3 years. This upsurge in operations reflects the increased demand for Solitario's jewellery products.

Moreover, the increase in PAT from a loss of Rs 9 lacs to a profit of Rs 512 lakhs in 3 years justifies the 150 crore valuation of the lab diamonds company. Exciting time for investors to keep track of this pre-IPO company.