Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

The food delivery market in India has seen some major changes in the last year. From average order value (AOV) to the market dominance by some major companies, almost everything has gone through changes. Now, TinyOwl and Foodpanda are no longer popular names in food delivery services. Moreover, the landscape of online food ordering has become a duopoly, with Swiggy and Zomato taking the leading role.

Swiggy, however, has left Zomato behind in becoming a profitable business in the food delivery industry. Let us take a closer look at the revenue breakup of Swiggy and its profit margins and losses over the years. Moreover, we will also analyse how Swiggy has been performing in losses, although its revenue has been climbing upward in the graph. A year-wise comparison of its financials will explain how Swiggy has fared in the long run. However, Swiggy’s tale of inception is mandatory before we dive into the in-depth analysis.

Inception

Before Swiggy existed, the co-founders Nandan Reddy and Sriharsha Majety established Bundl. Bundl was an e-commerce platform to provide courier service and shipping in India. However, the co-founders decided to halt all services of Bundl in 2014. Sriharsha Majety later explained why they decided to shut down Bundl. At that time, Flipkart and eBay had already established their dominance in the logistics and delivery sector.

However, food delivery was an emerging sector in India in 2014. TinyOwl and Foodpanda were quickly spreading, and the trend of online food ordering was expected to increase. Therefore, the co-founders remodelled the company into a food delivery service, and that’s how Swiggy was established. Swiggy, therefore, started delivering food in Bangalore and spread to several cities and towns across India over time.

Expansion

From 2014 to 2023, Swiggy expanded to 500 plus cities in India and several market domains. Initially, it focussed on growing in Bangalore, and after making a substantial presence in Bangalore, it moved on to other locations.

In 2017, Swiggy established a cloud kitchen service, The Bowl Company, and a kitchen incubator unit, Swiggy Access. Swiggy Access boosted the openings of new kitchens, and in two years, more than 1000 Swiggy Access kitchens were established and functioning in India. Moreover, in 2019, Swiggy Go and Swiggy Stores came into the picture; Swiggy Go was later changed to Swiggy Genie. While Swiggy Go allowed users to send and receive parcels, Swiggy stores supplied available products from local stores.

Swiggy invested largely in the grocery delivery business, Instamart and shut down the stores in 2020. The Bowl Kitchen was later closed off, and Swiggy Access was sold off to Kitchen@. After a phase of extensive expansion, Swiggy has been closing off the less profitable verticals in the past years. This has not been much different from Zomato, which discontinued its services in more than 225 Indian cities.

Fundraisings

The expansion wouldn’t have been possible without the several rounds of funding. Over 60 major investors and financial institutions have contributed to Swiggy’s growth. Accel (2015), Invesco (2022), Norwest Venture Partners (2015), and Bessemer Venture Partners (2016) are some important names among Swiggy’s investors. Other investors include Samsung Venture Investment, SoftBank Vision Fund, and Prosus are some other notable investors.

In total, Swiggy has organised more than 15 fundraising rounds and collected an amount of USD 3.57 billion. In the latest fundraising round, Series K, Swiggy generated an investment of USD 700 million from 23 companies that included Prosus and Invesco.

A Year-Wise Analysis Of Swiggy Financials

Swiggy was established in 2014 on the ruins of an e-commerce logistics company, Bundl. The food delivery business expanded rapidly with a vision of delivering restaurant-cooked food door-to-door. Initially, when the food delivery market wasn’t saturated, and the industry was growing quickly, Swiggy invested in several initiatives. It set out dark shops, ghost kitchens, and established units like cloud kitchen and Instamart. Moreover, Swiggy hired a dedicated delivery fleet and extensively hired its employees and support staff.

How Does Swiggy Generate Its Revenue?

When venture capitalists, banks, or peer-to-peer investors decide to invest in a company, they assess its business model. A company’s business model elaborates on how the company makes money or will do so in future.

Swiggy’s business model has evolved extensively over the years. Initially, its income sources were limited to food sales and commissions from partner restaurants. However, as Swiggy expanded, it invested in several units like Instamart and Swiggy Access and partnered with FMCG brands and restaurants. Now Swiggy generates income from varied sources like grocery and food sales, subscriptions, advertisements, and revenue from partner restaurants and grocery markets. Although Swiggy continued to generate substantial amounts from its cloud kitchen units, it significantly reduced its expenses on cloud kitchens and sold them in 2023.

The scope for online food delivery hasn’t decreased, but the growth has been slow and inconsistent. Moreover, the food delivery business hasn’t been very profitable if you take a look at the top dogs like Zomato and Swiggy. FY21 saw a contraction in revenue for Swiggy. Swiggy has consistently recorded growing revenue over the last two years. However, with increasing revenue, the losses have also continued to grow, and the company has been performing in the loss.

The below table depicts the accurate picture of the operative revenue, net profit, and expenses of Swiggy.

Financial Year | Operating Revenue (In Rs. Crore) | Expenses (In Rs. Crore) | Net Profit |

2021-22 | 5,705 | 9574 | -3629 |

2020-21 | 2547 | 4139 | -1617 |

2019-20 | 3468 | 7595 | -3920 |

A year-wise analysis shows that although the revenue increased, so did the total expenses. This is because Swiggy had been spending hugely on the procurement of resources in an inflation-ridden market.

A Breakdown Of Expenses

The flip side of numerous sources of income is that Swiggy had to spend a lot on them. Moreover, it was lossful when these business initiatives didn’t continue to grow and bring significant returns on investments. Swiggy spends around 25 percent of its total cost on outsourcing support. It spends a similar amount on employee benefit expenses. Other significant costs include material costs and advertising and promotional expenses. The minor expenses like communication technology and loss on cancellation of orders also add more than Rs. 100 crores individually.

Moreover, countless small expenses are clubbed in other expense categories that add to several hundred crores in the case of Swiggy. Due to the huge expenses, Swiggy has constantly been playing in the loss for the past few years.

The Good News For Food & Grocery Delivery Businesses

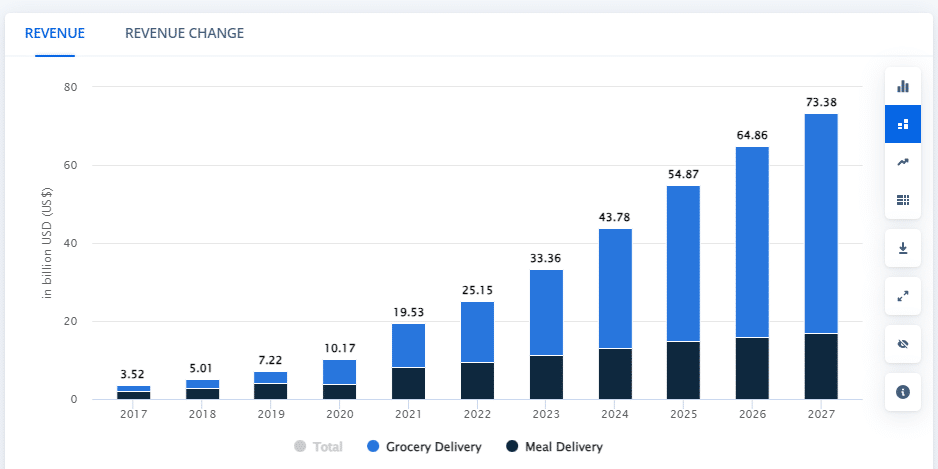

There is a reason that Swiggy continued to persevere through the phases of losses. It is because the Indian food and grocery delivery market is growing at a rapid rate. The total revenue of the food delivery market in India is expected to grow at a CAGR of 21.78% from 2023 to 2027. Moreover, the grocery delivery market is expected to grow at a rate of 38.2% in 2024.

Source: Statista

The bottom line is that online food delivery businesses are going to continue to flourish in India.

Buy Unlisted Shares

Swiggy took corrective measures to reduce its expenses in the financial year 2022-23. The company closed many business verticals and focussed on food and grocery delivery. As a result, Swiggy decreased its monthly cash burn from USD 45-50 in 2021 to USD 20 in 2023. Moreover, the company’s co-founder and CEO, Sriharsha Majety, disclosed that Swiggy became profitable in March 2023. In this revolutionary milestone, Swiggy has become one of the few companies in the food delivery industry to become profitable.

Swiggy’s consistent performance in these years has been attracting retail investors. Swiggy is an unlisted company that has yet to go public through an IPO. However, Swiggy pre-IPO shares are actively purchased in the grey market. Therefore, if you want to bag a significant return, Swiggy unlisted shares are the best investment choice.

Frequently Asked Questions About Swiggy Unlisted Shares

Is Swiggy listed or unlisted?

Swiggy is not listed in the national stock exchanges like NSE or BSE. Therefore, it is an unlisted company whose shares are only available in the grey market.

Can I invest in Swiggy pre-IPO shares?

While Swiggy shares are not available on the listed stock broking platforms, Swiggy pre-IPO shares are heavily traded in unlisted markets. Therefore, you can invest in Swiggy unlisted shares.

What is the price of the Swiggy IPO?

The Swiggy IPO issue and date are not confirmed yet. Swiggy is planning for an IPO, however, there has been no disclosure about the IPO timeline and issue size

Who owns Swiggy unlisted shares?

Swiggy is a private limited company, and its shares are not listed on the stock exchanges. However, Swiggy unlisted shares are actively traded in the secondary market, and retail investors are allowed to buy unlisted shares.

Is Swiggy more profitable than Zomato?

Swiggy became profitable in March 2023 and has left Zomato behind. In this revolutionary milestone, Swiggy has become one of the few companies in the food delivery industry to become profitable.