Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

The Metropolitan Stock Exchange of India (MSEI) is a national-level stock exchange having a licence to operate in currency derivatives, equity derivatives, debt, and more. An interesting thing to note about this stock exchange is that it is not listed on the stock exchange yet.

In this blog, we have drafted an analysis of the MSEI unlisted share price growth rate, and it will help you make the right investment decision.

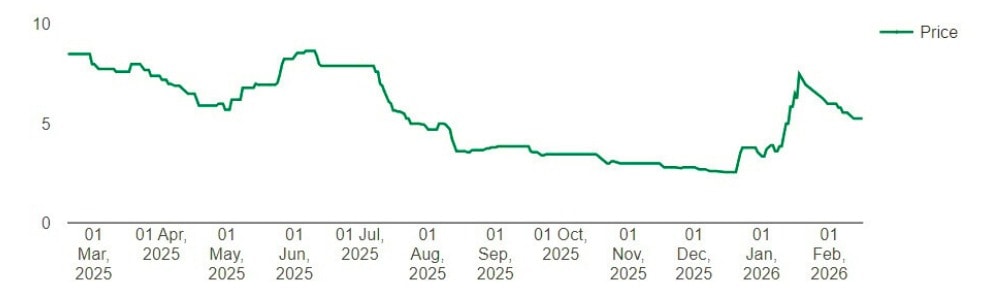

The Metropolitan Stock Exchange of India (MSEI) unlisted shares are trading in the grey market. The MSEI Share Price has grown almost 2X from September 25 to January 26

In Sept 25, msei unlisted share price was trading around Rs 3.85 per share. By Jan 26, this price reached Rs 7.5 per share. This sudden jump has attracted a lot of investor attention looking to capitalise on such a growth opportunity.

After trading resumed, a natural correction had happened, and currently, MSEI Unlisted Share is trading around Rs. 5-6 per share.

If you plan to buy unlisted shares of MSEI, one thing you must consider is its future growth rate. Since the Metropolitan Stock Exchange of India provides an electronic trading platform to investors, its future growth also depends on the number of successful trades. Let’s discuss the reason behind this sudden growth.

Real Reason Behind Msei Share Price 2X Jump In Just 5 Months

MSEI raised funds worth Rs 238 crores on December 24, the second half. They did a private placement involving investors like Billionbrains Garage Ventures (Groww’s promoter) & Rainmatter Investments (Kamath Brothers Of Zerodha), Securicorp Securities India, and Share India Securities.

MSEI Board approved the issuance of up to 119,00,00,000 Equity shares of face value of ₹1 per share at a premium of ₹1 per share. Hence, amounting to Rs 238 crores.

In the second round of raising capital, MSEI secured Rs. 1000 cr as announced on 26 Aug,2025. The major investors involved are Peak XV Partners (via Peak XV Venture Partners Investments VII), Jainam Broking Limited, Monarch Networth Capital Limited, Trust Investment Advisors and many more.

In this round, the board had approved the issuance of 500 crore equity shares. Shares were issued at a price of Rs.2 per share (where a Rs. 1 is the face value and a premium of Rs 1 per share).

The possible reason behind this growth can be the implementation of funding plans by MSEI. The exchange was earlier planning to resume its trading with around 130 stocks. And now it officially launched on 27Jan, 2026. Thus showing increased investor interest in this exchange.

Also Read: MSEI Officially Resumes Stock Trading: Is It The Right Direction?

Along with the relaunch, SEBI approved MSEI’s Liquidity Enhancement Scheme (LES). It improves daily trading activity, reduces the risk of the exchange looking inactive and makes participation smoother for brokers and investors.

Metropolitan Stock Exchange of India (MSEI) Unlisted Share Price: Current Status

Before we predict the future growth of the Metropolitan Stock Exchange of India (MSEI) unlisted shares, have a look at the current status of MSEI in the market. Here is a glance at the status of Metropolitan Stock Exchange of India (MSEI) Pre-IPO shares:

Particulars | Details |

Face Value | Rs 1 per equity |

Market Cap | Rs 3,084.50 Crores |

Current Unlisted Share Price | Rs 5.33 per share |

The predicted equity per price of the Metropolitan Stock Exchange of India (MSEI) might increase with its growth rate. Let’s take a look at the updated financials of the Metropolitan Stock Exchange of India (MSEI):

Particulars (in Rs cr.) | FY 2025 | FY 2024 | FY 2023 |

Total Equity | 396.7 | 192.83 | 246.69 |

Total Assets | 443.9 | 249.21 | 299.46 |

Total Income | 17.4 | 21.04 | 54.66 |

Profit Before Tax (PBT) | -34.9 | -47.6 | -19.93 |

Profit After Tax (PAT) | -34.2 | -48.75 | -18.66 |

Earning Per Share (EPS) | -0.06 | -0.10 | -0.04 |

The company’s financial status, shown in the table above, gives an overview of its growth rate. In addition, the financial report of this exchange for the last three years indicates a positive growth rate over the past years. As we can see from the above table, the growth of the Metropolitan Stock Exchange of India (MSEI) was slow, which was unexpected. Its total income jumped and decreased over the years, which directly impacted its profit.

In addition, the earnings per share (EPS) of Metropolitan Stock Exchange of India (MSEI) unlisted continued to remain negative over the period, declining from (-0.06) to (-0.10) before marginally improving again. This trend indicates sustained pressure on shareholder value.

If we see the Metropolitan Stock Exchange of India’s unlisted share price, it is currently traded at Rs 5.33 per share.

Predicted Future Growth Rate Of The Metropolitan Stock Exchange Of India (MSEI)

Undoubtedly, the growth rate of India’s Metropolitan Stock Exchange was not that impressive, but with significant investments from Grow and Kamath Brothers, MSEI has built hype for some significant growth in the coming years.

Various factors, like the number of daily derivatives trades, also play an important role in the growth of MSEI. Since this stock exchange is not listed yet, many expectations from the Metropolitan Stock Exchange of India (MSEI) IPO will significantly improve its growth rate.

Over the years, the number of trades in the Metropolitan Stock Exchange of India (MSEI) increased, which makes it the fastest-growing stock exchange after BSE and NSE.

It also recorded new investors who registered here and started trading in financial securities. The demand for Metropolitan Stock Exchange of India (MSEI) unlisted shares led to a 10X jump in its share price in Dec 24, which is a positive sign for investors. You should be optimistic about the future of MSEI as its growth rate is predicted to remain positive in the coming years. Thus, investors can keep a positive metropolitan stock exchange share price target 2025.

Also Read: MSEI Share Price Doubles In 1 Week: What’s Happening?

Invest In Metropolitan Stock Exchange Of India (MSEI) Pre-IPO Shares With Stockify

Stock Exchanges in India play a significant role in the growth of the Indian economy, and it is essential to invest in these to leverage their fast growth rate. One such is MSEI, which is unlisted and provides an e-trading facility to investors. You can buy the Metropolitan Stock Exchange of India (MSEI) unlisted shares with the help of Stockify. Its unlisted shares have performed well despite the slow growth of the stock exchange.

As per predicted data, the Metropolitan Stock Exchange of India (MSEI) share price will grow and remain positive. With the help of Stockify, India’s best platform to buy unlisted shares, you can check the company’s current unlisted share price and financial reports. Here, you will get access to top-performing Pre-IPO shares before their listing on NSE and BSE. Become a part of the future growth of MSEI; start investing in unlisted shares now!

FAQs

1- What Predicted Metropolitan Stock Exchange Of India (MSEI) Share Price Will Be In The Next 5 Years?

Predicting the exact Metropolitan Stock Exchange (MSEI) share price for the next five years is difficult, and the share price will depend on the company’s performance and other factors.

2- Is Investing in the Metropolitan Stock Exchange of India (MSEI) Unlisted Shares Beneficial?

Metropolitan Stock Exchange of India (MSEI) Pre-IPO shares have the best-prevailing rates in the unlisted market. Its unlisted shares might offer good returns in the future.

3- When Can We Expect the Metropolitan Stock Exchange Of India (MSEI) IPO?

As per the sources, an IPO of the Metropolitan Stock Exchange of India (MSEI) might launch next year.

4- What Is The Tax Rate On Metropolitan Stock Exchange Of India (MSEI) Unlisted Shares?

The tax rate on the Metropolitan Stock Exchange of India (MSEI) Pre-IPO shares is 10-20%.

5- What Is The Process Of Buying Unlisted Shares Of the Metropolitan Stock Exchange Of India (MSEI)?

You can buy the Metropolitan Stock Exchange of India (MSEI) unlisted shares using Stockify. The process of buying unlisted shares is simple and convenient here.

6- What is the metropolitan stock exchange share price today available in unlisted market?

Currently Metropolitan stock exchange share price today is Rs 9.74. To know its trading availability, you can check with Stockify.