Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

The IT industry is a significant part of India’s GDP and the largest contributor to the revenue generated from exports. After the pandemic, the IT industry continued its general trend of expansion and growth albeit the current slowdown. Moreover, aggressive hiring was followed by margin shocks in the financial quarters. It is because although the revenues and profits increased consistently, the salary and expenditures grew many folds, and net profit saw a major downfall. This harmed the company’s financial reports and share prices.

However, careful measures by the major IT industries in Asia, Europe, and North America have greatly improved the picture today. With the lowering attrition rates and cost-cutting strategies, we can expect the profits to surge significantly. This will bring positive development to the stock prices and Nifty IT Index. Now, as the share prices of IT companies are comparatively low and have promising chances to rise, retail investors are showing an interest in IT shares. Moreover, stock traders are showing an increased willingness to buy high-performing unlisted stocks as these are emerging companies with high return potential.

In that light, let’s explore some of the top-grossing unlisted tech companies in terms of revenue and share performances.

Top Performing Unlisted Shares Of IT Companies

IT shares hold a special place in the business world, given their fast-paced development and a future favouring cutting-edge technology. Since these companies have a considerable client base in America and Europe, the increasing value of the dollar in terms of rupees means higher revenue for these IT companies. In fact, exports to America make up 60 percent of the income of these IT companies.

Therefore, if you want to make large-return investments, unlisted IT stocks are a good choice. Here are the best IT companies that are active in the grey market.

Hexaware Technologies

Hexaware Technologies Ltd is a leading provider of IT and BPO services to the world. It is one of the best IT companies in India. It has a worldwide reputation for its services in over twenty subdomains, including application, cloud, business process, cyber security, and more.

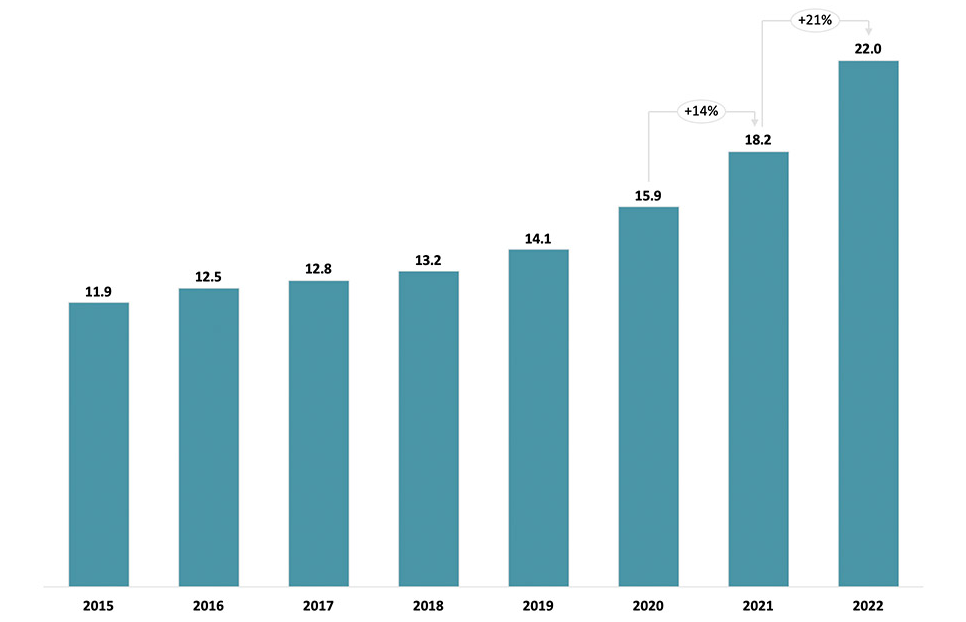

The above figure depicts how Hexaware Technologies showed an impeccable performance in the Bombay Stock Exchange. Currently, the company stocks are not traded on NSE or BSE.

The experts predict that Hexaware revenues are bound to grow at a rate of 12-14 percent. With an incredible performance, Hexaware Technologies Ltd's unlisted shares are a must-buy for stock traders wishing to capitalise on the immense return opportunities in the IT industry.

Capgemini Technology Services India

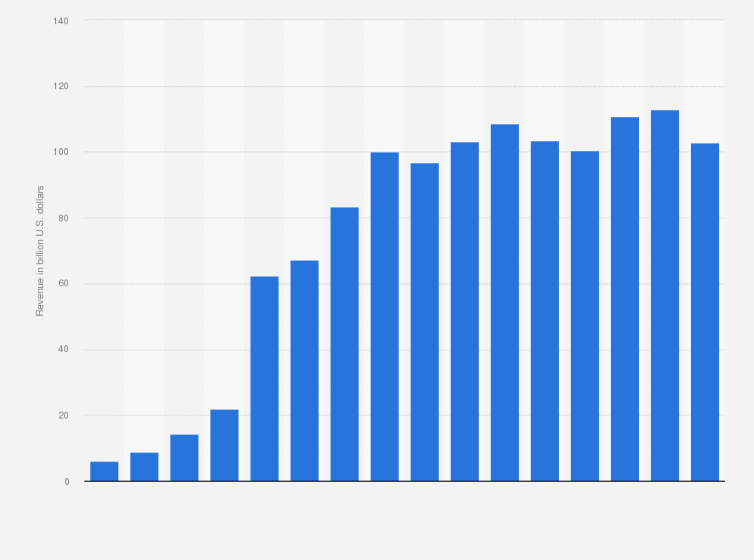

Capgemini is a revolutionary IT company that provides business tech solutions to its clients. It is the best of its kind, and its services range from cloud, data and artificial intelligence, cyber security, enterprise management, and more. By the end of the financial year 2022-2023, Capgemini delivered another record performance that registered a growth of 21.1% in revenue, 16.6% in constant currency growth, and 13% in operating margin.

The figure above demonstrates the rising global revenue of Capgemini over the years.

Capgemini Technology Services India Limited is the Indian branch of the tech giant and is actively traded in the unlisted market. Given Capgemini’s expertise in navigating market changes and helping clients with the same, the company is expected to have an excellent performance in the upcoming years. Therefore, Capgemini Technology Services India Limited unlisted shares are one of the best investment choices for a stock trader.

Tata Technologies

Tata Technologies is another IT branch of the Tata conglomerate besides Tata Consultancy Services and a subsidiary of Tata Motors. Tata is investing mainly in futuristic products to capitalise on opportunities in IT, sustainable energy, electric vehicles, etc. Tata Technologies holds expertise in digital enterprise, engineering research & development, and software products.

Take a look at the revenue of the Tata group in different years. Tata Technologies is one of the group's main focuses before its IPO. Recently, Tata Technologies announced significant associations with the state governments of India for shaping the future together by leveraging the technology. The emerging nature of the company makes it one of the top investment choices in the IT industry.

PharmEasy

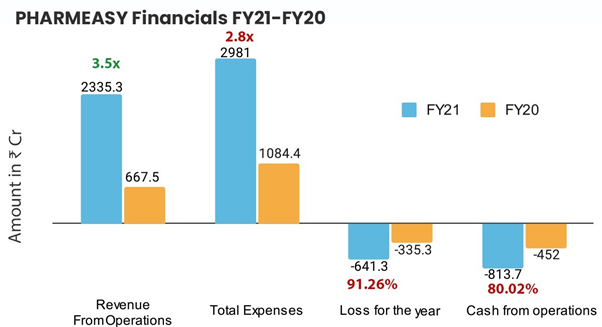

This health tech giant needs no introduction. Since its inception, PharmEasy has brought a revolution to the Indian medicine and healthcare market. The response was an expanding size and unprecedented growth of the company’s popularity. PharmEasy acquired significant players in healthcare and treatment, such as Medlife and Thyrocare. The company is looking forward to extensively expanding its outpatient services in 2023. With that in mind, PharmEasy launched Surgicare to provide consultation and hospital recommendations for patients who need surgeries. When the company is bullish about expanding, the investors and stockholders reply with increased faith in the company’s shares.

A looming IPO ahead of Pharmeasy makes it a prerequisite that the company corrects its share performance. Retail investors know that PharmEasy is the right investment option as the share prices are low currently, and they will surge as the company takes corrective steps before going public with the IPO.

Before You Invest!

We have covered some of the high-performing IT companies in the grey market. These stocks are currently in high demand thanks to reasons like dangling IPO, companies’ incredible performance, and the growth trend in the IT sector. Similar reasons make investing in IT stocks a recommended move for stock traders. Moreover, the share prices are comparably low, giving way to significant returns in the future.When you start trading, it is imperative to diversify your portfolio with stocks from various companies in different industries. Therefore explore Pre-IPO stocks from many sectors such as healthcare, automobiles, smartphones and accessories, information technology, etc. A diverse portfolio will keep you prepared for market adversities. Stockify provides trending stocks, key indicators, and real-time guidance to make trading a breeze. Connect with our professionals and make promising investments now!