Table of Contents

Buy/Sell Your Unlisted Shares

Submit the details below to share a quote.

India's largest Stock Exchange NSE is gearing up for IPO by 2025. Last week, the exchange announced its Q2 2025 results, giving a clear growth picture of the NSE 2025 1st Half. Let's uncover the key aspects of NSE's Financial Performance:

A) 36% Jump in Revenue from Operations.

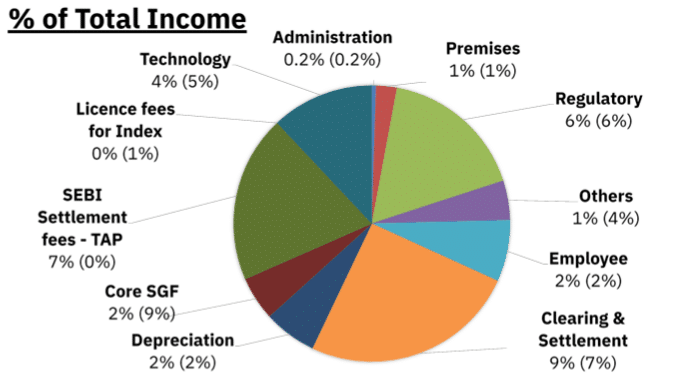

NSE's revenue from operations jumped by 36% to Rs 9,020 crores as compared to Rs 6,639 crores in the same period last year. The total income grew by 35% to Rs 9,974 crores, from Rs 7,380 crores last year. Here's a snapshot of NSE's Total Income Break Up:

Source: NSE Website

This strong growth can be attributed to factors like an increase in trading volumes in capital markets & equity derivatives.

B) Total Expenses Increased by 60%.

Although Revenue increased substantially, the expense also increased by 24%. In H1 FY 2024, Expenses before Contribution to the Core Settlement Guarantee Fund (SGF) was Rs 1,665 crores.

In H1 FY 2025, the total expenses grew by 60% to Rs 2,672 crores. This heavy jump is due to the Settlement of Rs Rs 642 crores made on Sept 24 to settle the pending TAP case with SEBI.

C) Contribution To Core SGF Affecting Short-Term Health

The contribution to Core SGF has significantly decreased from Rs 610 crores in H1 FY 2024 to only Rs 160 in H1 FY 2025.

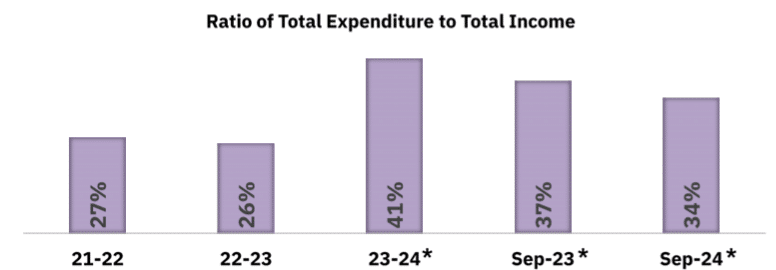

While such settlements & contributions can impact short-term financial health, if we break over this expense in the accruing period, the percentage of Total Expenditure to Total Income has reduced. Check the chart below:

Note: This chart is rationalized to Core SGF & SEBI Settlement Fees over the last 3 comparison periods.

D) 41% Growth in Profitability (EBITDA)

NSE's operating EBITDA rose 41% from Rs 4,573 crores in H1 FY 2024 to Rs 6,450 crores in H1 FY 2025. The Profit After Tax (PAT) also grew from Rs 3,843 crores to Rs 5,704 crores in the same period, a 48% annual increase. This growth indicates strong operational performance of the NSE Share price.

E) Almost 50% Jump in Earnings Per Share(EPS)

NSE's Earnings Per Share(EPS) for H1 FY 2024 was Rs 15.52 per share, which increased by 48% in H1 FY 2025 to Rs 23.05 per share. This positively contributes to the growth of the NSE stock price.

Also read: NSE Unlisted shares FY24 Results In-depth analysis

F)Tracking NSE Unlisted Share Price Chart

The NSE Share Price has doubled in the last 7 months. On March 24, the unlisted share was trading at around Rs 1,000 per share. On November 24, NSE is trading at around Rs 2,000 per share. Based on its recent returns and positive news indicators, this can be the right time to buy.

If you buy NSE unlisted shares, count on Stockify. We are one of India’s trusted online stock trading platforms where you can buy and sell unlisted shares in India from the comfort of your home.

Connect with our team to know more.

FAQ:

Q1. What is the current price of NSE Unlisted shares in India?

The current price of NSE unlisted shares in India is Rs. 2000 per share (post bonus)

Q2. Where can I buy NSE unlisted shares in India?

The best platform to buy NSE unlisted shares in India is Stockify . You can get recent updates and news regarding trends in the unlisted share market.

Q3. How is the NSE unlisted share price determined?

Multiple factors, directly and indirectly, affect the NSE unlisted share price, including supply, demand, and valuation in the funding rounds.

Q4. Is it safe to buy and buy NSE unlisted shares in India?

Even though there is little risk associated with buying and selling unlisted shares, trusting a credible site to buy and sell unlisted shares can reduce the risk. Stockify is one such platform that you can consider.

Q5. How to keep track of NSE unlisted share price?

Keeping track of the unlisted share is easy with Stockify. The site regularly updates the price of unlisted shares based on market trends. You can connect with the professionals for more information.